MetLife 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

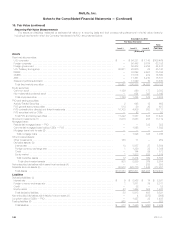

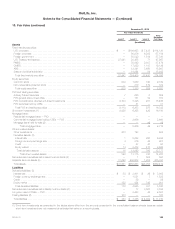

10. Fair Value (continued)

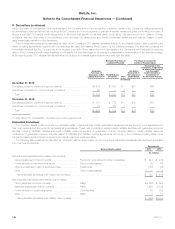

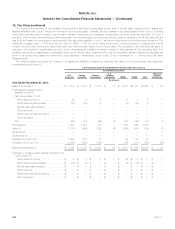

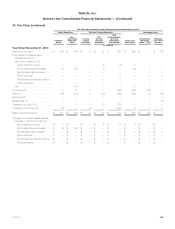

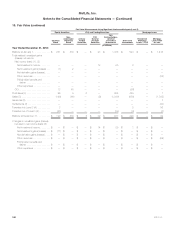

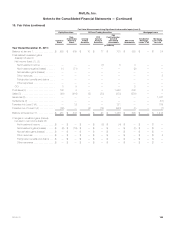

Assets and Liabilities Measured at Fair Value Using Significant Unobservable Inputs (Level 3)

The following table presents certain quantitative information about the significant unobservable inputs used in the fair value measurement, and the

sensitivity of the estimated fair value to changes in those inputs, for the more significant asset and liability classes measured at fair value on a recurring

basis using significant unobservable inputs (Level 3) at:

December 31, 2013 December 31, 2012 Impact of

Increase in Input

on Estimated

Fair Value (2)Valuation Techniques Significant Unobservable Inputs Range Weighted

Average (1) Range Weighted

Average (1)

Fixed maturity

securities: (3)

U.S. corporate and

foreign corporate • Matrix pricing • Delta spread adjustments (4) (10) — 240 46 (50) — 500 90 Decrease

• Illiquidity premium (4) 30 — 30 30 30 — 30 30 Decrease

• Credit spreads (4) (1,489) — 876 174 (1,416) — 876 272 Decrease

• Offered quotes (5) 4 — 145 100 — — 348 115 Increase

• Consensus pricing • Offered quotes (5) 33 — 145 95 — — 555 92 Increase

Foreign government • Matrix pricing • Credit spreads (4) 4 — 72 32 (58) — 150 72 Decrease

• Market pricing • Quoted prices (5) 64 — 156 100 77 — 146 99 Increase

• Consensus pricing • Offered quotes (5) 84 — 156 107 82 — 200 117 Increase

RMBS • Matrix pricing and

discounted cash

flow • Credit spreads (4) (136) — 3,609 288 9 — 2,980 521 Decrease (6)

• Market pricing • Quoted prices (5) 10 — 109 98 13 — 109 100 Increase (6)

• Consensus pricing • Offered quotes (5) 69 — 101 93 28 — 100 75 Increase (6)

CMBS • Matrix pricing and

discounted cash

flow • Credit spreads (4) 215 — 2,025 409 1 — 9,164 374 Decrease (6)

• Market pricing • Quoted prices (5) 70 — 104 97 1 — 106 99 Increase (6)

• Consensus pricing • Offered quotes (5) 90 — 101 95 Increase (6)

ABS • Matrix pricing and

discounted cash

flow • Credit spreads (4) 30 — 1,878 145 — — 1,829 109 Decrease (6)

• Market pricing • Quoted prices (5) — — 110 101 40 — 105 100 Increase (6)

• Consensus pricing • Offered quotes (5) 56 — 106 98 — — 111 97 Increase (6)

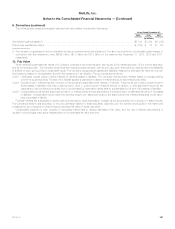

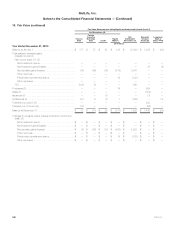

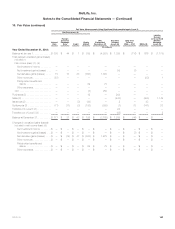

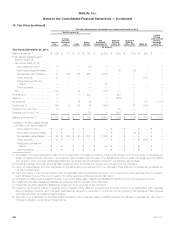

Derivatives:

Interest rate • Present value

techniques • Swap yield (7) 248 — 450 186 — 353 Increase (12)

Foreign currency

exchange rate • Present value

techniques

• Swap yield (7) 97 — 767 228 — 795

• Correlation (8) 38% — 47% 43% — 57% Increase (12)

Credit • Present value

techniques • Credit spreads (9) 98 — 101 100 — 100 Decrease (9)

• Consensus pricing • Offered quotes (10)

Equity market • Present value

techniques or

option pricing

models

• Volatility (11) 13% — 28% 13% — 32% Increase (12)

• Correlation (8) 60% — 60% 65% — 65%

Embedded

derivatives:

Direct and assumed

guaranteed

minimum benefits • Option pricing

techniques

• Mortality rates:

Ages 0 - 40 0% — 0.14% 0% — 0.14% Decrease (13)

Ages 41 - 60 0.04% — 0.88% 0.05% — 0.88% Decrease (13)

Ages 61 - 115 0.26% — 100% 0.26% — 100% Decrease (13)

• Lapse rates:

Durations 1 - 10 0.50% — 100% 0.50% — 100% Decrease (14)

Durations 11 - 20 2% — 100% 2% — 100% Decrease (14)

Durations 21 - 116 2% — 100% 2% — 100% Decrease (14)

• Utilization rates 20% — 50% 20% — 50% Increase (15)

• Withdrawal rates 0% — 40% 0.07% — 20% (16)

• Long-term equity volatilities 9.14% — 40% 15.18% — 40% Increase (17)

• Nonperformance risk spread (1.08)% — 0.83% 0.10% — 1.72% Decrease (18)

156 MetLife, Inc.