MetLife 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

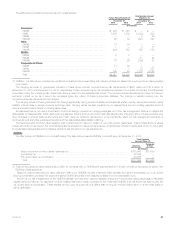

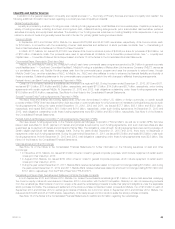

Living Benefit Guarantees

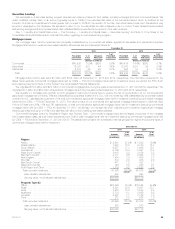

The table below presents our living benefit guarantees based on total contract account values at December 31, 2013:

Total Contract

Account Value (1)

Americas Corporate

& Other

(In millions)

GMIB ............................................................................... $ 99,140 $ —

GMWB - non-life contingent .............................................................. 7,329 3,831

GMWB - life-contingent ................................................................. 20,040 9,894

GMAB .............................................................................. 369 1,935

$126,878 $15,660

(1) Total contract account value above excludes $53.3 billion for contracts with no living benefit guarantees and approximately $9.1 billion of total

contract account value in the EMEA and Asia segments.

In terms of total contract account value, GMIBs are our most significant living benefit guarantee. Our primary risk management strategy for our GMIB

products is our derivatives hedging program as discussed below. Additionally, we have engaged in certain reinsurance agreements covering some of

our GMIB business. As part of our overall risk management approach for living benefit guarantees, we continually monitor the reinsurance markets for

the right opportunity to purchase additional coverage for our GMIB business.

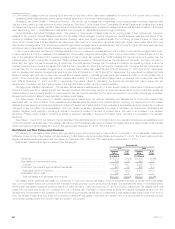

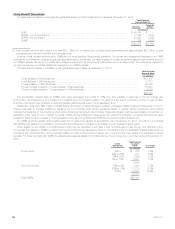

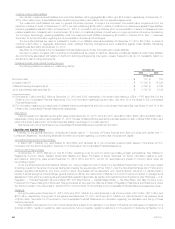

The table below presents our GMIBs, by their guaranteed payout basis, at December 31, 2013:

Total Contract

Account Value

(In millions)

7-year setback, 2.5% interest rate .................................................................. $37,569

7-year setback, 1.5% interest rate .................................................................. 6,177

10-year setback, 1.5% interest rate ................................................................. 20,382

10-year mortality projection, 10-year setback, 1.0% interest rate .......................................... 30,500

10-year mortality projection, 10-year setback, 0.5% interest rate .......................................... 4,512

$99,140

The annuitization interest rates on GMIBs have been decreased from 2.5% to 0.5% over time, partially in response to the low interest rate

environment, accompanied by an increase in the setback period from seven years to 10 years and the recent introduction of the 10-year mortality

projection. We expect new contracts to have comparable guarantee features for the foreseeable future.

Additionally, 30% of the $99.1 billion of GMIB total contract account value has been invested in managed volatility funds as of December 31, 2013.

These funds seek to manage volatility by adjusting the fund holdings within certain guidelines based on capital market movements. Such activity

reduces the overall risk of the underlying funds while maintaining their growth opportunities. These risk mitigation techniques translate to a reduction or

elimination of the need for us to manage the funds’ volatility through hedging or reinsurance. We expect the proportion of total contract account value

invested in these funds to increase for the foreseeable future, as new contracts with GMIB are required to invest in these funds.

Our GMIB products typically have a waiting period of 10 years to be eligible for annuitization. As of December 31, 2013, only 7% of our contracts

with GMIBs were eligible for annuitization. The remaining contracts are not eligible for annuitization for an average of seven years.

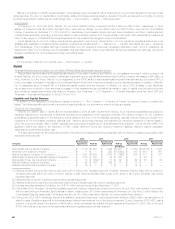

Once eligible for annuitization, contractholders would only be expected to annuitize if their contracts were in-the-money. We calculate in-the-

moneyness with respect to GMIBs consistent with net amount at risk as discussed in Note 4 of the Notes to the Consolidated Financial Statements, by

comparing the contractholders’ income benefits based on total contract account values and current annuity rates versus the guaranteed income

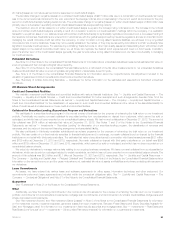

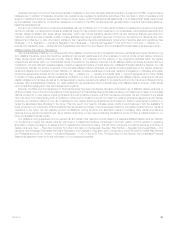

benefits. For those contracts with GMIB, the table below presents details of contracts that are in-the-money and out-of-the money at December 31,

2013:

In-the-

Moneyness

Total Contract

Account

Value % of Total

(In millions)

In-the-money 30% + $ 722 0.8%

20% to 30% 611 0.6%

10% to 20% 1,326 1.3%

0% to 10% 3,281 3.3%

5,940

Out-of-the-money -10% to 0% 7,098 7.2%

-20% to 10% 11,819 11.9%

-20% + 74,283 74.9%

93,200

Total GMIBs $99,140

58 MetLife, Inc.