MetLife 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

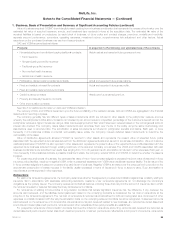

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

and other receivables (future policy benefits). Such amounts are amortized through earned premiums over the remaining contract period in proportion

to the amount of insurance protection provided. For retroactive reinsurance of short-duration contracts that meet the criteria of reinsurance accounting,

amounts paid (received) in excess of the related insurance liabilities ceded (assumed) are recognized immediately as a loss and are reported in the

appropriate line item within the statement of operations. Any gain on such retroactive agreement is deferred and is amortized as part of DAC, primarily

using the recovery method.

Amounts currently recoverable under reinsurance agreements are included in premiums, reinsurance and other receivables and amounts currently

payable are included in other liabilities. Assets and liabilities relating to reinsurance agreements with the same reinsurer may be recorded net on the

balance sheet, if a right of offset exists within the reinsurance agreement. In the event that reinsurers do not meet their obligations to the Company

under the terms of the reinsurance agreements, reinsurance recoverable balances could become uncollectible. In such instances, reinsurance

recoverable balances are stated net of allowances for uncollectible reinsurance.

Premiums, fees and policyholder benefits and claims include amounts assumed under reinsurance agreements and are net of reinsurance ceded.

Amounts received from reinsurers for policy administration are reported in other revenues. With respect to GMIBs, a portion of the directly written GMIBs

are accounted for as insurance liabilities, but the associated reinsurance agreements contain embedded derivatives. These embedded derivatives are

included in premiums, reinsurance and other receivables with changes in estimated fair value reported in policyholder benefits and claims.

If the Company determines that a reinsurance agreement does not expose the reinsurer to a reasonable possibility of a significant loss from

insurance risk, the Company records the agreement using the deposit method of accounting. Deposits received are included in other liabilities and

deposits made are included within premiums, reinsurance and other receivables. As amounts are paid or received, consistent with the underlying

contracts, the deposit assets or liabilities are adjusted. Interest on such deposits is recorded as other revenues or other expenses, as appropriate.

Periodically, the Company evaluates the adequacy of the expected payments or recoveries and adjusts the deposit asset or liability through other

revenues or other expenses, as appropriate.

Investments

Net Investment Income and Net Investment Gains (Losses)

Income on investments is reported within net investment income, unless otherwise stated herein. Gains and losses on sales of investments,

impairment losses and changes in valuation allowances are reported within net investment gains (losses), unless otherwise stated herein.

Fixed Maturity and Equity Securities

The majority of the Company’s fixed maturity and equity securities are classified as available-for-sale (“AFS”) and are reported at their estimated fair

value. Unrealized investment gains and losses on these securities are recorded as a separate component of other comprehensive

income (loss) (“OCI”), net of policyholder-related amounts and deferred income taxes. All security transactions are recorded on a trade date basis.

Investment gains and losses on sales are determined on a specific identification basis.

Interest income on fixed maturity securities is recognized when earned using an effective yield method giving effect to amortization of premiums

and accretion of discounts. Prepayment fees are recognized when earned. Dividends on equity securities are recognized when declared.

The Company periodically evaluates fixed maturity and equity securities for impairment. The assessment of whether impairments have occurred is based

on management’s case-by-case evaluation of the underlying reasons for the decline in estimated fair value, as well as an analysis of the gross unrealized

losses by severity and/or age as described in Note 8 “— Evaluation of AFS Securities for OTTI and Evaluating Temporarily Impaired AFS Securities.”

For fixed maturity securities in an unrealized loss position, an other-than-temporary impairment (“OTTI”) is recognized in earnings when it is

anticipated that the amortized cost will not be recovered. When either: (i) the Company has the intent to sell the security; or (ii) it is more likely than not

that the Company will be required to sell the security before recovery, the OTTI recognized in earnings is the entire difference between the security’s

amortized cost and estimated fair value. If neither of these conditions exist, the difference between the amortized cost of the security and the present

value of projected future cash flows expected to be collected is recognized as an OTTI in earnings (“credit loss”). If the estimated fair value is less than

the present value of projected future cash flows expected to be collected, this portion of OTTI related to other-than-credit factors (“noncredit loss”) is

recorded in OCI.

With respect to equity securities, the Company considers in its OTTI analysis its intent and ability to hold a particular equity security for a period of

time sufficient to allow for the recovery of its estimated fair value to an amount equal to or greater than cost. If a sale decision is made for an equity

security and recovery to an amount at least equal to cost prior to the sale is not expected, the security will be deemed to be other-than-temporarily

impaired in the period that the sale decision was made and an OTTI loss will be recorded in earnings. The OTTI loss recognized is the entire

difference between the security’s cost and its estimated fair value.

FVO and Trading Securities

FVO and trading securities are stated at estimated fair value and include investments for which the FVO has been elected (“FVO Securities”) and

investments that are actively purchased and sold (“Actively Traded Securities”). FVO Securities include:

‰fixed maturity and equity securities held-for-investment by the general account to support asset and liability management strategies for certain

insurance products and investments in certain separate accounts (“FVO general account securities”);

‰contractholder-directed investments supporting unit-linked variable annuity type liabilities which do not qualify for presentation and reporting as

separate account summary total assets and liabilities. These investments are primarily mutual funds and, to a lesser extent, fixed maturity and

equity securities, short-term investments and cash and cash equivalents. The investment returns on these investments inure to contractholders

and are offset by a corresponding change in PABs through interest credited to policyholder account balances (“FVO contractholder-directed unit-

linked investments”); and

‰securities held by consolidated securitization entities (“CSEs”) (“FVO securities held by CSEs”).

Actively Traded Securities principally include fixed maturity securities and short sale agreement liabilities, which are included in other liabilities.

Changes in estimated fair value of these securities are included in net investment income, except for certain securities included in FVO Securities

where changes are included in net investment gains (losses).

94 MetLife, Inc.