MetLife 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

9. Derivatives (continued)

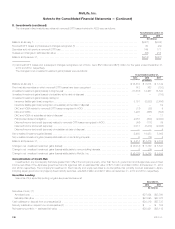

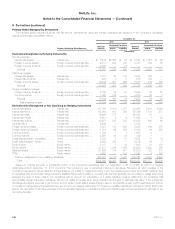

Primary Risks Managed by Derivatives

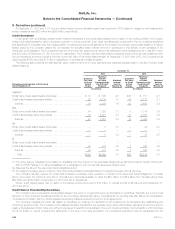

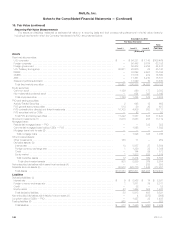

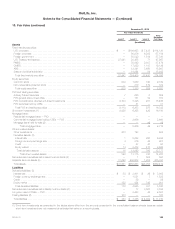

The following table presents the gross notional amount, estimated fair value and primary underlying risk exposure of the Company’s derivatives,

excluding embedded derivatives, held at:

Primary Underlying Risk Exposure

December 31,

2013 2012

Notional

Amount

Estimated Fair Value Notional

Amount

Estimated Fair Value

Assets Liabilities Assets Liabilities

(In millions)

Derivatives Designated as Hedging Instruments

Fair value hedges:

Interest rate swaps ................ Interest rate ................... $ 6,419 $1,282 $ 78 $ 5,397 $ 1,921 $ 90

Foreign currency swaps ............ Foreign currency exchange rate . . . 2,713 252 135 3,187 332 85

Foreign currency forwards .......... Foreign currency exchange rate . . . 2,935 — 77 — — —

Subtotal ..................................................... 12,067 1,534 290 8,584 2,253 175

Cash flow hedges:

Interest rate swaps ................ Interest rate ................... 3,121 83 141 3,642 705 —

Interest rate forwards .............. Interest rate ................... 450 7 7 675 139 —

Foreign currency swaps ............ Foreign currency exchange rate . . . 12,452 401 660 9,038 219 355

Subtotal ..................................................... 16,023 491 808 13,355 1,063 355

Foreign operations hedges:

Foreign currency forwards .......... Foreign currency exchange rate . . . 3,182 82 47 2,552 43 61

Currency options ................. Foreign currency exchange rate . . . 7,362 318 — 4,375 43 3

Subtotal ..................................................... 10,544 400 47 6,927 86 64

Total qualifying hedges ........................................ 38,634 2,425 1,145 28,866 3,402 594

Derivatives Not Designated or Not Qualifying as Hedging Instruments

Interest rate swaps .................. Interest rate ................... 107,354 3,330 1,767 83,250 5,201 2,043

Interest rate floors ................... Interest rate ................... 63,064 451 346 56,246 1,174 837

Interest rate caps ................... Interest rate ................... 39,460 177 — 49,465 74 —

Interest rate futures .................. Interest rate ................... 6,011 9 9 11,684 1 38

Interest rate options ................. Interest rate ................... 40,978 255 243 16,328 640 60

Synthetic GICs ..................... Interest rate ................... 4,409 — — 4,162 — —

Foreign currency swaps .............. Foreign currency exchange rate . . . 9,307 133 684 8,208 199 736

Foreign currency forwards ............ Foreign currency exchange rate . . . 11,311 69 359 9,202 26 288

Currency futures .................... Foreign currency exchange rate . . . 1,316 1 1 1,408 4 —

Currency options ................... Foreign currency exchange rate . . . 2,265 53 48 129 1 —

Credit default swaps—purchased ...... Credit ....................... 3,725 7 51 3,674 11 34

Credit default swaps—written ......... Credit ....................... 9,055 166 1 8,879 79 5

Equity futures ...................... Equity market ................. 5,157 1 43 7,008 14 132

Equity options ...................... Equity market ................. 37,411 1,344 1,068 22,920 2,825 356

Variance swaps .................... Equity market ................. 21,636 174 577 19,830 122 310

TRRs ............................ Equity market ................. 3,802 — 179 3,092 4 103

Total non-designated or non-qualifying derivatives ....................... 366,261 6,170 5,376 305,485 10,375 4,942

Total ........................................................ $404,895 $8,595 $6,521 $334,351 $13,777 $5,536

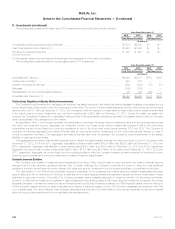

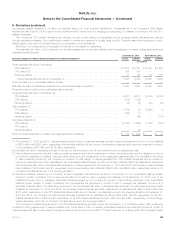

Based on notional amounts, a substantial portion of the Company’s derivatives was not designated or did not qualify as part of a hedging

relationship at both December 31, 2013 and 2012. The Company’s use of derivatives includes (i) derivatives that serve as macro hedges of the

Company’s exposure to various risks and that generally do not qualify for hedge accounting due to the criteria required under the portfolio hedging rules;

(ii) derivatives that economically hedge insurance liabilities that contain mortality or morbidity risk and that generally do not qualify for hedge accounting

because the lack of these risks in the derivatives cannot support an expectation of a highly effective hedging relationship; (iii) derivatives that

economically hedge embedded derivatives that do not qualify for hedge accounting because the changes in estimated fair value of the embedded

derivatives are already recorded in net income; and (iv) written credit default swaps that are used to synthetically create credit investments and that do

not qualify for hedge accounting because they do not involve a hedging relationship. For these non-qualified derivatives, changes in market factors can

lead to the recognition of fair value changes in the consolidated statement of operations without an offsetting gain or loss recognized in earnings for the

item being hedged.

140 MetLife, Inc.