MetLife 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

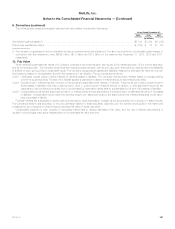

9. Derivatives (continued)

counterparty against payables to the same counterparty arising out of all included transactions. Substantially all of the Company’s ISDA Master

Agreements also include Credit Support Annex provisions which require both the pledging and accepting of collateral in connection with its OTC-

bilateral derivatives.

The Company’s OTC-cleared derivatives are effected through central clearing counterparties and its exchange-traded derivatives are effected

through regulated exchanges. Such positions are marked to market and margined on a daily basis, and the Company has minimal exposure to credit-

related losses in the event of nonperformance by counterparties to such derivatives.

See Note 10 for a description of the impact of credit risk on the valuation of derivatives.

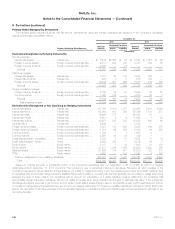

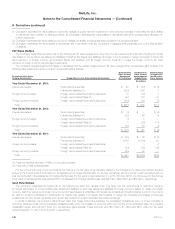

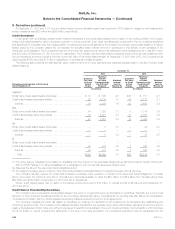

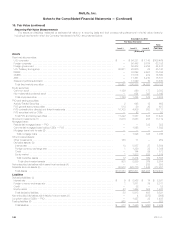

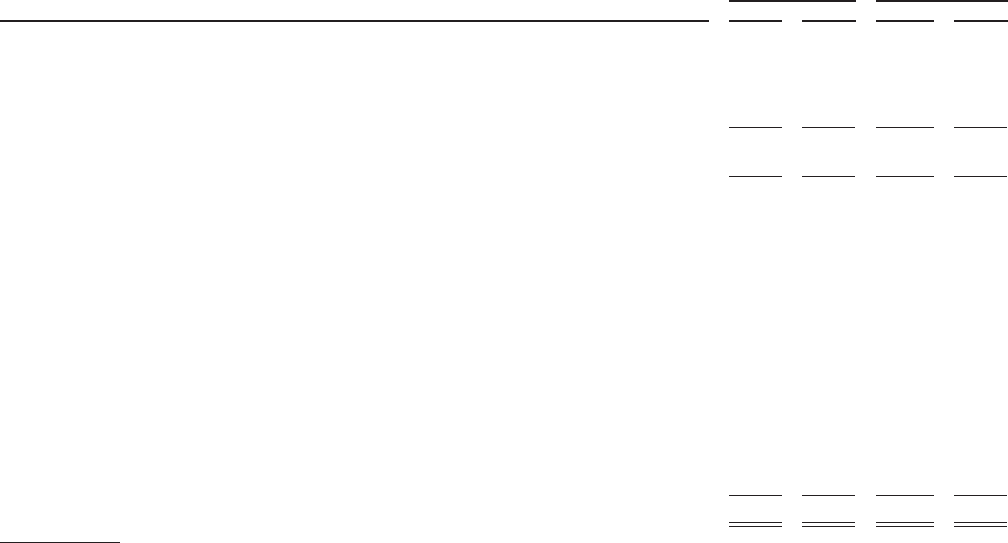

The estimated fair value of the Company’s net derivative assets and net derivative liabilities after the application of master netting agreements and

collateral was as follows at:

December 31, 2013 December 31, 2012

Derivatives Subject to a Master Netting Arrangement or a Similar Arrangement Assets Liabilities Assets Liabilities

(In millions)

Gross estimated fair value of derivatives:

OTC-bilateral (1) ..................................................................... $8,537 $ 6,367 $14,048 $ 5,480

OTC-cleared (1) ..................................................................... 302 129 — —

Exchange-traded .................................................................... 11 53 19 170

Total gross estimated fair value of derivatives (1) .......................................... 8,850 6,549 14,067 5,650

Amounts offset in the consolidated balance sheets ............................................ — — — —

Estimated fair value of derivatives presented in the consolidated balance sheets (1) ................... 8,850 6,549 14,067 5,650

Gross amounts not offset in the consolidated balance sheets:

Gross estimated fair value of derivatives: (2)

OTC-bilateral ........................................................................ (4,631) (4,631) (4,562) (4,562)

OTC-cleared ........................................................................ (122) (122) — —

Exchange-traded .................................................................... (5) (5) (19) (19)

Cash collateral: (3)

OTC-bilateral ........................................................................ (1,679) (3) (5,960) (1)

OTC-cleared ........................................................................ (169) (7) — —

Exchange-traded .................................................................... — (44) — (151)

Securities collateral: (4)

OTC-bilateral ........................................................................ (2,105) (1,464) (3,526) (875)

OTC-cleared ........................................................................ — — — —

Exchange-traded .................................................................... — (4) — —

Net amount after application of master netting agreements and collateral ........................... $ 139 $ 269 $ — $ 42

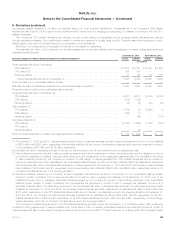

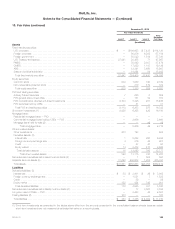

(1) At December 31, 2013 and 2012, derivative assets include income or expense accruals reported in accrued investment income or in other liabilities

of $255 million and $290 million, respectively, and derivative liabilities include income or expense accruals reported in accrued investment incomeor

in other liabilities of $28 million and $114 million, respectively.

(2) Estimated fair value of derivatives is limited to the amount that is subject to set-off and includes income or expense accruals.

(3) Cash collateral received is included in cash and cash equivalents, short-term investments or in fixed maturity securities, and the obligation to return it

is included in payables for collateral under securities loaned and other transactions in the consolidated balance sheets. The receivable for the return

of cash collateral provided by the Company is inclusive of initial margin on exchange-traded and OTC-cleared derivatives and is included in

premiums, reinsurance and other receivables in the consolidated balance sheets. The amount of cash collateral offset in the table above is limited to

the net estimated fair value of derivatives after application of netting agreements. At December 31, 2013 and 2012, the Company received excess

cash collateral of $104 million and $0, respectively, and provided excess cash collateral of $236 million and $290 million, respectively, which is not

included in the table above due to the foregoing limitation.

(4) Securities collateral received by the Company is held in separate custodial accounts and is not recorded on the consolidated balance sheets.

Subject to certain constraints, the Company is permitted by contract to sell or repledge this collateral, but at December 31, 2013 none of the

collateral had been sold or repledged. Securities collateral pledged by the Company is reported in fixed maturity securities in the consolidated

balance sheets. Subject to certain constraints, the counterparties are permitted by contract to sell or repledge this collateral. The amount of

securities collateral offset in the table above is limited to the net estimated fair value of derivatives after application of netting agreements and cash

collateral. At December 31, 2013 and 2012, the Company received excess securities collateral with an estimated fair value of $238 million and

$161 million, respectively, for its OTC-bilateral derivatives which are not included in the table above due to the foregoing limitation. At December 31,

2013 and 2012, the Company provided excess securities collateral with an estimated fair value of $66 million and $0, respectively, for its OTC-

bilateral derivatives, $141 million and $0, respectively, for its OTC-cleared derivatives, and $81 million and $40 million, respectively, for its exchange-

traded derivatives, which are not included in the table above due to the foregoing limitation.

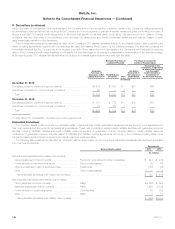

The Company’s collateral arrangements for its OTC-bilateral derivatives generally require the counterparty in a net liability position, after considering

the effect of netting agreements, to pledge collateral when the fair value of that counterparty’s derivatives reaches a pre-determined threshold. Certain of

these arrangements also include credit-contingent provisions that provide for a reduction of these thresholds (on a sliding scale that converges toward

MetLife, Inc. 145