MetLife 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

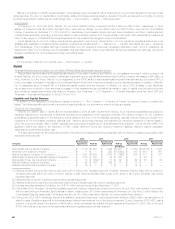

(7) During October 2013, Metropolitan Tower Life Insurance Company (“MTL”) distributed shares of an affiliate to MetLife, Inc. as an in-kind dividendof

$32 million. Also during October 2013, MTL paid a dividend to MetLife, Inc. in the amount of $77 million in cash, which represented its dividend

capacity without regulatory approval at December 31, 2013. Regulatory approval for these dividends was obtained due to the amount and timing of

the payments.

In addition to the amounts presented in the table above, for the years ended December 31, 2013, 2012 and 2011, cash dividends in the

aggregate amount of $0, $150 million and $139 million, respectively, were paid to MetLife, Inc. by certain of its other subsidiaries. Additionally, for the

years ended December 31, 2013, 2012 and 2011, MetLife, Inc. received cash of $267 million, $9 million and $771 million, respectively, representing

returns of capital from certain subsidiaries.

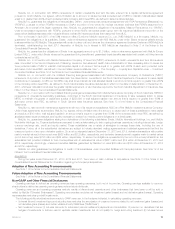

The dividend capacity of our non-U.S. operations is subject to similar restrictions established by the local regulators. The non-U.S. regulatory

regimes also commonly limit the dividend payments to the parent to a portion of the prior year’s statutory income, as determined by the local

accounting principles. The regulators of our non-U.S. operations, including Japan’s Financial Services Agency, may also limit or not permit profit

repatriations or other transfers of funds to the U.S. if such transfers are deemed to be detrimental to the solvency or financial strength of the non-

U.S. operations, or for other reasons. Most of the non-U.S. subsidiaries are second tier subsidiaries which are owned by various non-U.S. holding

companies. The capital and rating considerations applicable to the first tier subsidiaries may also impact the dividend flow into MetLife, Inc.

In the second quarter of 2013, MetLife, Inc. announced its plans for the Mergers. As a result, the aggregate amount of dividends permitted to be

paid without insurance regulatory approval may be impacted. See “— Executive Summary” for further information on the Mergers.

We actively manage target and excess capital levels and dividend flows on a proactive basis and forecast local capital positions as part of the

financial planning cycle. The dividend capacity of certain U.S. and non-U.S. subsidiaries is also subject to business targets in excess of the minimum

capital necessary to maintain the desired rating or level of financial strength in the relevant market. We cannot provide assurance that MetLife, Inc.’s

subsidiaries will have statutory earnings to support payment of dividends to MetLife, Inc. in an amount sufficient to fund its cash requirements and pay

cash dividends and that the applicable regulators will not disapprove any dividends that such subsidiaries must submit for approval. See “Risk Factors

— Capital-Related Risks — As a Holding Company, MetLife, Inc. Depends on the Ability of Its Subsidiaries to Transfer Funds to It to Meet Its

Obligations and Pay Dividends” in the 2013 Form 10-K and Note 16 of the Notes to the Consolidated Financial Statements elsewhere herein.

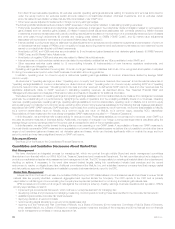

Short-term Debt

MetLife, Inc. maintains a commercial paper program, the proceeds of which can be used to finance the general liquidity needs of MetLife, Inc. and

its subsidiaries. MetLife, Inc. had no short-term debt outstanding at both December 31, 2013 and 2012.

Debt Issuances and Other Borrowings

For information on MetLife, Inc.’s debt issuances and other borrowings, see “— The Company — Liquidity and Capital Sources — Debt

Issuances and Other Borrowings.”

Collateral Financing Arrangements and Junior Subordinated Debt Securities

For information on MetLife, Inc.’s collateral financing arrangements and junior subordinated debt securities, see Notes 13 and 14 of the Notes to

the Consolidated Financial Statements, respectively.

Credit and Committed Facilities

At December 31, 2013, MetLife, Inc., along with MetLife Funding, maintained $4.0 billion in unsecured credit facilities, the proceeds of which are

available for general corporate purposes, to support our commercial paper programs and for the issuance of letters of credit. At December 31, 2013,

MetLife, Inc. had outstanding $192 million in letters of credit and no drawdowns against these facilities. Remaining availability was $3.8 billion at

December 31, 2013. See “— The Company — Liquidity and Capital Sources — Credit and Committed Facilities.”

MetLife, Inc. maintains committed facilities with a capacity of $300 million. At December 31, 2013, MetLife, Inc. had outstanding $300 million in

letters of credit and no drawdowns against these facilities. There was no remaining availability at December 31, 2013. In addition, MetLife, Inc. is a

party to committed facilities of certain of its subsidiaries, which aggregated $12.1 billion at December 31, 2013. The committed facilities are used as

collateral for certain of the Company’s affiliated reinsurance liabilities.

See Note 12 of the Notes to the Consolidated Financial Statements for further discussion of these facilities.

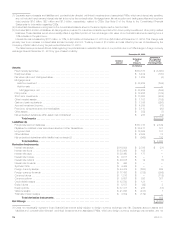

Long-term Debt Outstanding

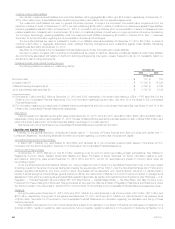

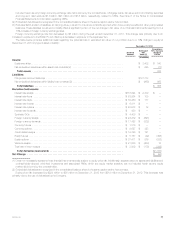

The following table summarizes the outstanding long-term debt of MetLife, Inc. at:

December 31,

2013 2012

(In millions)

Long-term debt — unaffiliated ............................................................. $15,938 $15,669

Long-term debt — affiliated (1), (2), (3), (4) .................................................... $ 3,600 $ 3,250

Collateral financing arrangements ........................................................... $ 2,797 $ 2,797

Junior subordinated debt securities ......................................................... $ 1,748 $ 1,748

(1) In December 2013, MetLife, Inc. issued a $350 million senior note to MetLife Reinsurance Company of Delaware (“MRD”) due December 2033. The

senior note bears interest at a fixed rate of 5.10%, payable semi-annually. MRD issued a $350 million surplus note to MetLife, Inc. in exchange for

the senior note.

(2) In December 2012, $1.25 billion of senior notes issued by Exeter, a subsidiary, payable to affiliates and comprised of three notes, were reassigned

to MetLife, Inc. MetLife, Inc. received $1.25 billion of preferred stock of Exeter in exchange for the assumption of this affiliated debt. A $250 million

senior note matures on September 30, 2016 and bears interest at a fixed rate of 7.44%, payable semi-annually. A $500 million senior note matures

on July 15, 2021 and bears interest at a fixed rate of 5.64%, payable semi-annually. A $500 million senior note matures on December 16, 2021 and

bears interest at a fixed rate of 5.86%, payable semi-annually.

(3) In December 2012, MetLife, Inc. issued a $750 million senior note to MRD due September 30, 2032. The senior note bears interest at a fixed rate

of 4.21%, payable semi-annually. MRD issued a $750 million surplus note to MetLife, Inc. in exchange for the senior note.

(4) In September 2012, $750 million of senior notes issued by Exeter payable to MLIC, were reassigned to MetLife, Inc. MetLife, Inc. received

$750 million of preferred stock of Exeter in exchange for the assumption of this affiliated debt. On September 30, 2012, $250 million of the

MetLife, Inc. 69