MetLife 2013 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

21. Contingencies, Commitments and Guarantees (continued)

Life had given timely notice of its claim for indemnification but, because it found that Sun Life had not yet incurred an indemnifiable loss, granted

MLIC’s motion for summary judgment. Both parties appealed but subsequently agreed to withdraw the appeal and consider the indemnity claim

through arbitration. In September 2010, Sun Life notified MLIC that a purported class action lawsuit was filed against Sun Life in Toronto, Fehr v. Sun

Life Assurance Co. (Super. Ct., Ontario, September 2010), alleging sales practices claims regarding the same individual policies sold by MLIC and

transferred to Sun Life. An amended class action complaint in that case was served on Sun Life, again without naming MLIC as a party. On August 30,

2011, Sun Life notified MLIC that a purported class action lawsuit was filed against Sun Life in Vancouver, Alamwala v. Sun Life Assurance Co. (Sup.

Ct., British Columbia, August 2011), alleging sales practices claims regarding certain of the same policies sold by MLIC and transferred to Sun Life.

Sun Life contends that MLIC is obligated to indemnify Sun Life for some or all of the claims in these lawsuits. These sales practices cases against Sun

Life are ongoing and the Company is unable to estimate the reasonably possible loss or range of loss arising from this litigation.

C-Mart, Inc. v. Metropolitan Life Ins. Co., et al. (S.D. Fla., January 10, 2013). Cadenasso v. Metropolitan Life Insurance Co., et al. (N.D. Cal.,

November 26, 2013).

Plaintiffs filed these lawsuits against defendants, including MLIC and a former MetLife financial services representative, alleging that the defendants

sent unsolicited fax advertisements to plaintiff and others in violation of the Telephone Consumer Protection Act, as amended by the Junk Fax

Prevention Act, 47 U.S.C. § 227 (“TCPA”). In the C-Mart case, the court granted plaintiff’s motion to certify a class of approximately 36,000 persons in

Missouri who, during the period of August 7, 2012 through September 6, 2012, were allegedly sent an unsolicited fax in violation of the TCPA. Trial is

set for April 2014. In the Cadenasso case, plaintiff seeks certification of a nationwide class of persons (except for Missouri residents) who were

allegedly sent millions of unsolicited faxes in violation of the TCPA. In both cases, plaintiffs seek an award of statutory damages under the TCPA in the

amount of $500 for each violation and to have such damages trebled.

Sales Practices Claims

Over the past several years, the Company has faced numerous claims, including class action lawsuits, alleging improper marketing or sales of individual

life insurance policies, annuities, mutual funds or other products. Some of the current cases seek substantial damages, including punitive and treble

damages and attorneys’ fees. The Company continues to vigorously defend against the claims in these matters. The Company believes adequate

provision has been made in its consolidated financial statements for all probable and reasonably estimable losses for sales practices matters.

Summary

Putative or certified class action litigation and other litigation and claims and assessments against the Company, in addition to those discussed

previously and those otherwise provided for in the Company’s consolidated financial statements, have arisen in the course of the Company’s business,

including, but not limited to, in connection with its activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer.

Further, state insurance regulatory authorities and other federal and state authorities regularly make inquiries and conduct investigations concerning the

Company’s compliance with applicable insurance and other laws and regulations.

It is not possible to predict the ultimate outcome of all pending investigations and legal proceedings. In some of the matters referred to previously,

very large and/or indeterminate amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possiblethat

an adverse outcome in certain cases could have a material effect upon the Company’s financial position, based on information currently known by the

Company’s management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect.

However, given the large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that

an adverse outcome in certain matters could, from time to time, have a material effect on the Company’s consolidated net income or cash flows in

particular quarterly or annual periods.

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require insurers doing business within the jurisdiction to participate

in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or failed

insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the proportionate

share of the premiums written by member insurers in the lines of business in which the impaired, insolvent or failed insurer engaged. Some states

permit member insurers to recover assessments paid through full or partial premium tax offsets. In addition, Japan has established the Life Insurance

Policyholders Protection Corporation of Japan as a contingency to protect policyholders against the insolvency of life insurance companies in Japan

through assessments to companies licensed to provide life insurance.

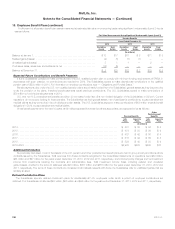

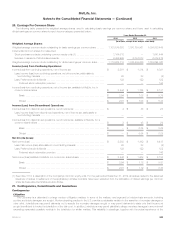

Assets and liabilities held for insolvency assessments were as follows:

December 31,

2013 2012

(In millions)

Other Assets:

Premium tax offset for future undiscounted assessments ............................................................ $ 60 $114

Premium tax offsets currently available for paid assessments ......................................................... 69 14

Receivable for reimbursement of paid assessments (1) ............................................................. 5 6

$134 $134

Other Liabilities:

Insolvency assessments ..................................................................................... $ 93 $205

(1) The Company holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement.

208 MetLife, Inc.