MetLife 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc., in connection with MRD’s reinsurance of certain universal life and term life risks, entered into a capital maintenance agreement

pursuant to which MetLife, Inc. agreed, without limitation as to amount, to cause the initial protected cell of MRD to maintain total adjusted capital

equal to or greater than 200% of such protected cell’s company action level RBC, as defined in state insurance statutes.

MetLife, Inc. guarantees the obligations of its subsidiary, DelAm, under a stop loss reinsurance agreement with RGA Reinsurance (Barbados) Inc.

(“RGARe”), pursuant to which RGARe retrocedes to DelAm a portion of the whole life medical insurance business that RGARe assumed from

American Life on behalf of its Japan operations. Also, MetLife, Inc. guarantees the obligations of its subsidiary, Missouri Reinsurance, Inc. (“MoRe”),

under a retrocession agreement with RGARe, pursuant to which MoRe retrocedes certain group term life insurance liabilities and a portion of the

closed block liabilities associated with industrial life and ordinary life insurance policies that it assumed from MLIC.

Prior to the sale in April 2011 of its 50% interest in Mitsui Sumitomo MetLife Insurance Co., Ltd. (“MSI MetLife”) to a third party, MetLife, Inc.

guaranteed the obligations of its subsidiary, Exeter, under a reinsurance agreement with MSI MetLife, under which Exeter reinsures variable annuity

business written by MSI MetLife. This guarantee will remain in place until such time as the reinsurance agreement between Exeter and MSI MetLife is

terminated, notwithstanding the April 2011 disposition of MetLife, Inc.’s interest in MSI MetLife as described in Note 3 of the Notes to the

Consolidated Financial Statements.

MetLife, Inc. guarantees the obligations of Exeter in an aggregate amount up to $1.0 billion, under a reinsurance agreement with MetLife Europe

Limited (“MEL”), under which Exeter reinsures the guaranteed living benefits and guaranteed death benefits associated with certain unit-linked annuity

contracts issued by MEL.

MetLife, Inc., in connection with MetLife Reinsurance Company of Vermont’s (“MRV”) reinsurance of certain universal life and term life insurance

risks, committed to the Vermont Department of Banking, Insurance, Securities and Health Care Administration to take necessary action to cause the

three protected cells of MRV to maintain total adjusted capital in an amount that is equal to or greater than 200% of each such protected cell’s

authorized control level RBC, as defined in Vermont state insurance statutes. See “— The Company — Liquidity and Capital Sources — Credit and

Committed Facilities” and Note 12 of the Notes to the Consolidated Financial Statements.

MetLife, Inc., in connection with the collateral financing arrangement associated with MetLife Reinsurance Company of Charleston’s (“MRC”)

reinsurance of a portion of the liabilities associated with the closed block, committed to the South Carolina Department of Insurance to make capital

contributions, if necessary, to MRC so that MRC may at all times maintain its total adjusted capital in an amount that is equal to or greater than 200%

of the company action level RBC, as defined in South Carolina state insurance statutes as in effect on the date of determination or December 31,

2007, whichever calculation produces the greater capital requirement, or as otherwise required by the South Carolina Department of Insurance. See

Note 13 of the Notes to the Consolidated Financial Statements.

MetLife, Inc., in connection with the collateral financing arrangement associated with MetLife Reinsurance Company of South Carolina’s (“MRSC”)

reinsurance of universal life secondary guarantees, committed to the South Carolina Department of Insurance to take necessary action to cause

MRSC to maintain the greater of capital and surplus of $250,000 or total adjusted capital in an amount that is equal to or greater than 100% of

authorized control level RBC, as defined in South Carolina state insurance statutes. See Note 13 of the Notes to the Consolidated Financial

Statements.

MetLife, Inc. has net worth maintenance agreements with two of its insurance subsidiaries, MLIIC and First MetLife Investors Insurance Company.

Under these agreements, as amended, MetLife, Inc. agreed, without limitation as to the amount, to cause each of these subsidiaries to have capital

and surplus of $10 million, total adjusted capital in an amount that is equal to or greater than 150% of the company action level RBC, as defined by

applicable state insurance statutes, and liquidity necessary to enable it to meet its current obligations on a timely basis.

MetLife, Inc. guarantees obligations arising from derivatives of the following subsidiaries: Exeter, MetLife International Holdings, Inc. and MetLife

Worldwide Holdings, Inc. These subsidiaries are exposed to various risks relating to their ongoing business operations, including interest rate, foreign

currency exchange rate, credit and equity market. These subsidiaries use a variety of strategies to manage these risks, including the use of

derivatives. Further, all of the subsidiaries’ derivatives are subject to industry standard netting agreements and collateral agreements that limit the

unsecured portion of any open derivative position. On a net counterparty basis at December 31, 2013 and 2012, derivative transactions with positive

mark-to-market values (in-the-money) were $568 million and $3.2 billion, respectively, and derivative transactions with negative mark-to-market values

(out-of-the-money) were $734 million and $22 million, respectively. To secure the obligations represented by the out of-the-money transactions, the

subsidiaries had provided collateral to their counterparties with an estimated fair value of $651 million and $12 million at December 31, 2013 and

2012, respectively. Accordingly, unsecured derivative liabilities guaranteed by MetLife, Inc. were $83 million and $10 million at December 31, 2013

and 2012, respectively.

MetLife, Inc. also guarantees the obligations of certain of its subsidiaries under committed facilities with third-party banks. See Note 12 of the

Notes to the Consolidated Financial Statements.

Acquisitions

During the years ended December 31, 2013, 2012 and 2011, there were no cash outflows for acquisitions. See Note 3 of the Notes to the

Consolidated Financial Statements for information regarding the Company’s acquisitions.

Adoption of New Accounting Pronouncements

See Note 1 of the Notes to the Consolidated Financial Statements.

Future Adoption of New Accounting Pronouncements

See Note 1 of the Notes to the Consolidated Financial Statements.

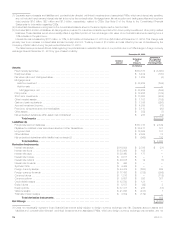

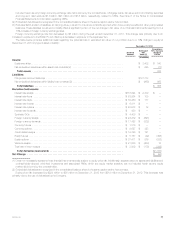

Non-GAAP and Other Financial Disclosures

Operating earnings is defined as operating revenues less operating expenses, both net of income tax. Operating earnings available to common

shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or

exited by MetLife (“Divested Businesses”). Operating revenues also excludes net investment gains (losses) and net derivative gains (losses). Operating

expenses also excludes goodwill impairments.

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

‰Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to net investment gains (losses) and

net derivative gains (losses) and certain variable annuity GMIB fees (“GMIB Fees”);

‰Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are

hedges of investments or that are used to replicate certain investments, but do not qualify for hedge accounting treatment, (ii) includes income

MetLife, Inc. 71