MetLife 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

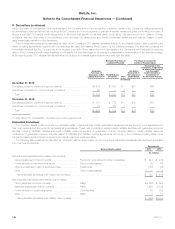

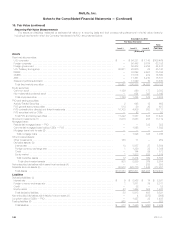

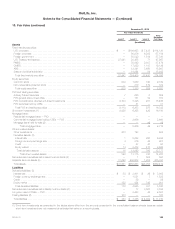

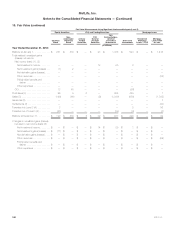

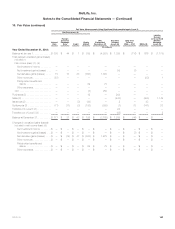

10. Fair Value (continued)

The Company issues certain variable annuity products with guaranteed minimum benefits. GMWBs, GMABs and GMIBs contain embedded

derivatives, which are measured at estimated fair value separately from the host variable annuity contract, with changes in estimated fair value reported

in net derivative gains (losses). These embedded derivatives are classified within PABs in the consolidated balance sheets.

The fair value of these embedded derivatives, estimated as the present value of projected future benefits minus the present value of projected

future fees using actuarial and capital market assumptions including expectations concerning policyholder behavior, is calculated by the Company’s

actuarial department. The calculation is based on in-force business, and is performed using standard actuarial valuation software which projects future

cash flows from the embedded derivative over multiple risk neutral stochastic scenarios using observable risk free rates.

Capital market assumptions, such as risk free rates and implied volatilities, are based on market prices for publicly traded instruments to the extent

that prices for such instruments are observable. Implied volatilities beyond the observable period are extrapolated based on observable implied

volatilities and historical volatilities. Actuarial assumptions, including mortality, lapse, withdrawal and utilization, are unobservable and are reviewed at

least annually based on actuarial studies of historical experience.

The valuation of these guarantee liabilities includes nonperformance risk adjustments and adjustments for a risk margin related to non-capital

market inputs. The nonperformance adjustment is determined by taking into consideration publicly available information relating to spreads in the

secondary market for MetLife, Inc.’s debt, including related credit default swaps. These observable spreads are then adjusted, as necessary, to reflect

the priority of these liabilities and the claims paying ability of the issuing insurance subsidiaries compared to MetLife, Inc.

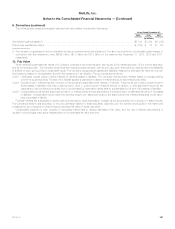

Risk margins are established to capture the non-capital market risks of the instrument which represent the additional compensation a market

participant would require to assume the risks related to the uncertainties of such actuarial assumptions as annuitization, premium persistency, partial

withdrawal and surrenders. The establishment of risk margins requires the use of significant management judgment, including assumptions of the

amount and cost of capital needed to cover the guarantees. These guarantees may be more costly than expected in volatile or declining equity

markets. Market conditions including, but not limited to, changes in interest rates, equity indices, market volatility and foreign currency exchange rates;

changes in nonperformance risk; and variations in actuarial assumptions regarding policyholder behavior, mortality and risk margins related to non-

capital market inputs, may result in significant fluctuations in the estimated fair value of the guarantees that could materially affect net income.

The Company ceded the risk associated with certain of the GMIBs previously described. These reinsurance agreements contain embedded

derivatives which are included within premiums, reinsurance and other receivables in the consolidated balance sheets with changes in estimated fair

value reported in net derivative gains (losses) or policyholder benefits and claims depending on the statement of operations classification of the direct

risk. The value of the embedded derivatives on the ceded risk is determined using a methodology consistent with that described previously for the

guarantees directly written by the Company with the exception of the input for nonperformance risk that reflects the credit of the reinsurer.

The estimated fair value of the embedded derivatives within funds withheld related to certain ceded reinsurance is determined based on the change

in estimated fair value of the underlying assets held by the Company in a reference portfolio backing the funds withheld liability. The estimated fair value

of the underlying assets is determined as previously described in “— Investments — Securities, Short-term Investments, Other Investments, Long-term

Debt of CSEs — FVO and Trading Liabilities.” The estimated fair value of these embedded derivatives is included, along with their funds withheld hosts,

in other liabilities in the consolidated balance sheets with changes in estimated fair value recorded in net derivative gains (losses). Changes in the credit

spreads on the underlying assets, interest rates and market volatility may result in significant fluctuations in the estimated fair value of these embedded

derivatives that could materially affect net income.

The estimated fair value of the embedded equity and bond indexed derivatives contained in certain funding agreements is determined using market

standard swap valuation models and observable market inputs, including a nonperformance risk adjustment. The estimated fair value of these

embedded derivatives are included, along with their funding agreements host, within PABs with changes in estimated fair value recorded in net

derivative gains (losses). Changes in equity and bond indices, interest rates and the Company’s credit standing may result in significant fluctuations in

the estimated fair value of these embedded derivatives that could materially affect net income.

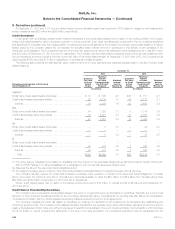

Embedded Derivatives Within Asset and Liability Host Contracts

Level 3 Valuation Techniques and Key Inputs:

Direct and assumed guaranteed minimum benefits

These embedded derivatives are principally valued using the income approach. Valuations are based on option pricing techniques, which utilize

significant inputs that may include swap yield curve, currency exchange rates and implied volatilities. These embedded derivatives result in Level 3

classification because one or more of the significant inputs are not observable in the market or cannot be derived principally from, or corroborated

by, observable market data. Significant unobservable inputs generally include: the extrapolation beyond observable limits of the swap yield curve

and implied volatilities, actuarial assumptions for policyholder behavior and mortality and the potential variability in policyholder behavior and

mortality, nonperformance risk and cost of capital for purposes of calculating the risk margin.

Reinsurance ceded on certain guaranteed minimum benefits

These embedded derivatives are principally valued using the income approach. The valuation techniques and significant market standard

unobservable inputs used in their valuation are similar to those described above in “— Direct and Assumed Guaranteed Minimum Benefits” and

also include counterparty credit spreads.

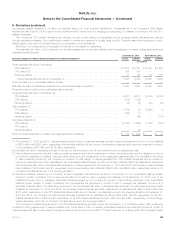

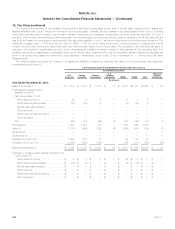

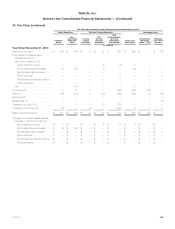

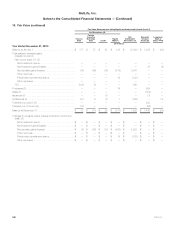

Transfers between Levels

Overall, transfers between levels occur when there are changes in the observability of inputs and market activity. Transfers into or out of any level

are assumed to occur at the beginning of the period.

Transfers between Levels 1 and 2:

For assets and liabilities measured at estimated fair value and still held at December 31, 2013, transfers between Levels 1 and 2 were $101

million. For assets and liabilities measured at estimated fair value and still held at December 31, 2012, transfers between Levels 1 and 2 were not

significant.

154 MetLife, Inc.