MetLife 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

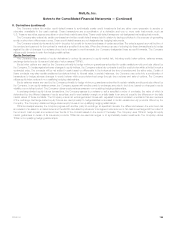

9. Derivatives (continued)

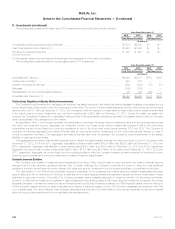

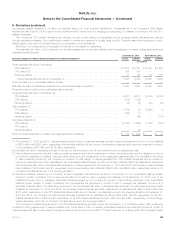

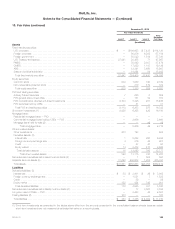

Net Derivative Gains (Losses)

The components of net derivative gains (losses) were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Derivatives and hedging gains (losses) (1) ............................................................. $(8,343) $(3,158) $ 6,108

Embedded derivatives ............................................................................ 5,104 1,239 (1,284)

Total net derivative gains (losses) .................................................................. $(3,239) $(1,919) $ 4,824

(1) Includes foreign currency transaction gains (losses) on hedged items in cash flow and non-qualifying hedging relationships, which are not presented

elsewhere in this note.

The following table presents earned income on derivatives:

Years Ended December 31,

2013 2012 2011

(In millions)

Qualifying hedges:

Net investment income ............................................................................... $135 $111 $ 98

Interest credited to policyholder account balances .......................................................... 150 164 214

Other expenses .................................................................................... (6) (5) (4)

Non-qualifying hedges: ................................................................................

Net investment income ............................................................................... (6) (6) (8)

Other revenues ..................................................................................... — 47 75

Net derivative gains (losses) ........................................................................... 328 476 411

Policyholder benefits and claims ....................................................................... (292) (120) 17

Total ........................................................................................... $309 $667 $803

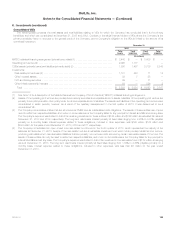

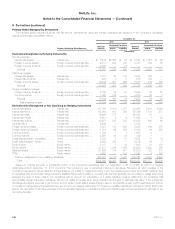

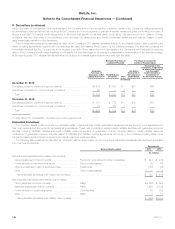

Non-Qualifying Derivatives and Derivatives for Purposes Other Than Hedging

The following table presents the amount and location of gains (losses) recognized in income for derivatives that were not designated or qualifying as

hedging instruments:

Net

Derivative

Gains (Losses)

Net

Investment

Income (1)

Policyholder

Benefits and

Claims (2) Other

Revenues (3)

(In millions)

Year Ended December 31, 2013:

Interest rate derivatives ....................................................... $(3,458) $ — $ (27) $ —

Foreign currency exchange rate derivatives ........................................ (1,716) — — —

Credit derivatives — purchased ................................................ (21) (14) —

Credit derivatives — written .................................................... 130 1 — —

Equity derivatives ............................................................ (3,663) (25) (727) —

Total .................................................................... $(8,728) $(38) $(754) $ —

Year Ended December 31, 2012:

Interest rate derivatives ....................................................... $ (296) $ — $ — $ 28

Foreign currency exchange rate derivatives ........................................ (660) — — —

Credit derivatives — purchased ................................................ (298) (14) — —

Credit derivatives — written .................................................... 150 — — —

Equity derivatives ............................................................ (2,556) (9) (419) —

Total .................................................................... $(3,660) $(23) $(419) $ 28

Year Ended December 31, 2011:

Interest rate derivatives ....................................................... $3,940 $ (1) $ — $236

Foreign currency exchange rate derivatives ........................................ 343 (9) — —

Credit derivatives — purchased ................................................ 250 6 — —

Credit derivatives — written .................................................... (75) (1) — —

Equity derivatives ............................................................ 1,178 (35) (87) —

Total .................................................................... $5,636 $(40) $ (87) $236

MetLife, Inc. 141