MetLife 2013 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

14. Junior Subordinated Debt Securities (continued)

Rate Exchangeable Surplus Trust Securities, MetLife Capital Trust X’s 9.250% Fixed-to-Floating Rate Exchangeable Surplus Trust Securities and the

10.750% JSDs. MetLife, Inc. also entered into a replacement capital obligation which will commence during the six month period prior to the scheduled

redemption date of each of the securities described above and under which MetLife, Inc. must use reasonable commercial efforts to raise replacement

capital to permit repayment of the securities through the issuance of certain qualifying capital securities.

Interest expense on outstanding junior subordinated debt securities was $258 million for each of the years ended December 31, 2013, 2012 and

2011.

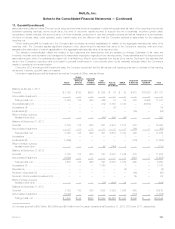

15. Common Equity Units

Acquisition of ALICO

In connection with the financing of the ALICO Acquisition in November 2010, MetLife, Inc. issued to AM Holdings 40.0 million common equity units

with an aggregate stated amount at issuance of $3.0 billion and an estimated fair value of $3.2 billion. Each common equity unit has an initial stated

amount of $75 per unit and initially consists of: (i) three purchase contracts (the “Series C Purchase Contracts,” the “Series D Purchase Contracts” and

the “Series E Purchase Contracts” and, together, the “Purchase Contracts”), obligating the holder to purchase, on a subsequent settlement date, a

variable number of shares of MetLife, Inc. common stock, par value $0.01 per share, for a purchase price of $25 ($75 in the aggregate); and (ii) a 1/40

undivided beneficial ownership interest in each of three series of Debt Securities issued by MetLife, Inc., each series of Debt Securities having an

aggregate principal amount of $1.0 billion. Distributions on the common equity units will be made quarterly, and will consist of contract payments on the

Purchase Contracts and interest payments on the Debt Securities, at an aggregate annual rate of 5.00% of the stated amount at any time. The excess

of the estimated fair value of the common equity units over the estimated fair value of the Debt Securities (see Note 12), after accounting for the present

value of future contract payments recorded in other liabilities, resulted in a net decrease to additional paid-in capital of $69 million, representing the fair

value of the Purchase Contracts discussed below. On March 8, 2011, AM Holdings sold, in a public offering, all the common equity units it received as

consideration from MetLife in connection with the ALICO Acquisition. The common equity units are listed on the New York Stock Exchange (“NYSE”).

Purchase Contracts

Settlement of the Purchase Contracts of each series occurs upon the successful remarketing of the related series of Debt Securities, or upon a

final failed remarketing of the related series, as described below under “—Debt Securities.” On each settlement date subsequent to a successful

remarketing, the holder will pay $25 per common equity unit and MetLife, Inc. will issue to such holder a variable number of shares of its common

stock in settlement of the applicable Purchase Contract. The number of shares to be issued will depend on the average of the daily volume-weighted

average prices of MetLife, Inc.’s common stock during the 20 trading day periods ending on, and including, the third day prior to the initial scheduled

settlement date for each series of Purchase Contracts. The Series C Purchase Contracts and Series D Purchase Contracts have been settled as

described in “—Remarketing of Debt Securities and Settlement of Purchase Contracts.” The initially-scheduled settlement date for the remaining Series

E Purchase Contracts is October 8, 2014. If the average value of MetLife, Inc.’s common stock as calculated pursuant to the stock purchase

agreement dated as of March 7, 2010, as amended, by and among MetLife, Inc., AIG and AM Holdings (the “Stock Purchase Agreement”) during the

applicable 20 trading day period is less than or equal to $35.15, as such amount may be adjusted (the “Reference Price”), the number of shares to be

issued in settlement of the Series E Purchase Contract will equal $25 divided by the Reference Price, as calculated pursuant to the Stock Purchase

Agreement (the “Maximum Settlement Rate”). If the market value of MetLife, Inc.’s common stock is greater than or equal to $43.93, as such amount

may be adjusted (the “Threshold Appreciation Price”), the number of shares to be issued in settlement of the Series E Purchase Contract will equal $25

divided by the Threshold Appreciation Price, as so calculated (the “Minimum Settlement Rate”). If the market value of MetLife, Inc.’s common stock is

greater than the Reference Price and less than the Threshold Appreciation Price, the number of shares to be issued will equal $25 divided by the

applicable market value, as so calculated. In the event of an unsuccessful remarketing of any series of Debt Securities and the postponement of

settlement to a later date, the average market value used to calculate the settlement rate for a particular series will not be recalculated, although certain

corporate events may require adjustments to the settlement rate. After settlement of the remaining Series E Purchase Contracts, MetLife, Inc. will

receive proceeds of $1.0 billion and issue between 22.8 million and 28.5 million shares of its common stock, subject to certain adjustments, in

addition to the proceeds received and shares issued upon settlement of the Series C Purchase Contracts in October 2012 and Series D Purchase

Contracts in September 2013. The holder of a common equity unit may, at its option, settle the related Series E Purchase Contracts before the

applicable settlement date. However, upon early settlement, the holder will receive the Minimum Settlement Rate.

Distributions on the Purchase Contracts will be made quarterly at an average annual rate of 3.02%. The value of all Purchase Contracts at issuance

of $247 million was calculated as the present value of the future contract payments and was recorded in other liabilities with an offsetting decrease in

additional paid-in capital. The other liabilities balance will be reduced as contract payments are made. Contract payments of $48 million and

$84 million were made for the years ended December 31, 2013 and 2012, respectively.

Debt Securities

The Debt Securities are senior, unsecured notes of MetLife, Inc. which, in the aggregate, pay quarterly distributions at an initial average annual rate

of 1.98% and are included in long-term debt (see Note 12 for further discussion of terms). The Debt Securities are pledged as collateral to secure the

obligations of each common equity unit holder under the related Purchase Contracts. Each series of the Debt Securities will be subject to a

remarketing and sold on behalf of participating holders to investors. The proceeds of a remarketing, net of any related fees, will be applied on behalf of

participating holders who so elect to settle any obligation of the holder to pay cash under the related Purchase Contract on the applicable settlement

dates. The Series C Purchase Contracts and Series D Purchase Contracts have been settled as described in “— Remarketing of Debt Securities and

Settlement of Purchase Contracts.” The initially-scheduled settlement date for the remaining contracts is October 8, 2014 for the Series E Debt

Securities, subject to delay if there are one or more unsuccessful remarketings. If the initial attempted remarketing of the series is unsuccessful, up to

two additional remarketing attempts will occur. At the remarketing date, the remarketing agent may reset the interest rate on the Debt Securities,

subject to a reset cap for each of the first two attempted remarketings of each series. If a remarketing is successful, the reset rate will apply to all

outstanding Debt Securities of the applicable tranche of the remarketed series, whether or not the holder participated in the remarketing and will

become effective on the settlement date of such remarketing. If the first remarketing attempt with respect to a series is unsuccessful, the Series E

176 MetLife, Inc.