MetLife 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

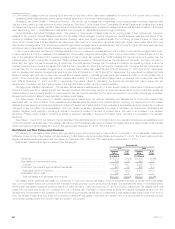

Other than the commitments disclosed in Note 21 of the Notes to the Consolidated Financial Statements, there are no other material obligations or

liabilities arising from the commitments to fund partnership investments, mortgage loans, bank credit facilities, bridge loans, and private corporate bond

investments. For further information on commitments to fund partnership investments, mortgage loans, bank credit facilities, bridge loans and private

corporate bond investments. See “— Liquidity and Capital Resources — The Company — Contractual Obligations.”

In addition, see “Primary Risks Managed by Derivatives and Non-Derivatives” in Note 9 of the Notes to the Consolidated Financial Statements for

further information on interest rate lock commitments.

Insolvency Assessments

See Note 21 of the Notes to the Consolidated Financial Statements.

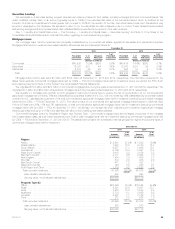

Policyholder Liabilities

We establish, and carry as liabilities, actuarially determined amounts that are calculated to meet policy obligations or to provide for future annuity

payments. Amounts for actuarial liabilities are computed and reported in the consolidated financial statements in conformity with GAAP. For more details

on Policyholder Liabilities, see “— Summary of Critical Accounting Estimates.”

Due to the nature of the underlying risks and the high degree of uncertainty associated with the determination of actuarial liabilities, we cannot

precisely determine the amounts that will ultimately be paid with respect to these actuarial liabilities, and the ultimate amounts may vary from the

estimated amounts, particularly when payments may not occur until well into the future.

We periodically review our estimates of actuarial liabilities for future benefits and compare them with our actual experience. We revise estimates, to

the extent permitted or required under GAAP, if we determine that future expected experience differs from assumptions used in the development of

actuarial liabilities. We charge or credit changes in our liabilities to expenses in the period the liabilities are established or re-estimated. If the liabilities

originally established for future benefit payments prove inadequate, we must increase them. Such an increase could adversely affect our earnings and

have a material adverse effect on our business, results of operations and financial condition.

Insurance regulators in many of the non-U.S. countries in which we operate require certain MetLife entities to prepare a sufficiency analysis of the

reserves presented in the locally required regulatory financial statements, and to submit that analysis to the regulatory authorities. See “Business —

International Regulation” in the 2013 Form 10-K.

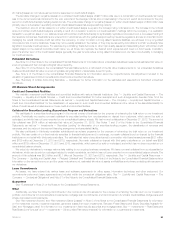

We have experienced, and will likely in the future experience, catastrophe losses and possibly acts of terrorism, as well as turbulent financial markets

that may have an adverse impact on our business, results of operations, and financial condition. Due to their nature, we cannot predict the incidence,

timing, severity or amount of losses from catastrophes and acts of terrorism, but we make broad use of catastrophic and non-catastrophic reinsurance

to manage risk from these perils.

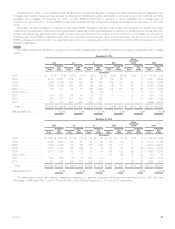

Future Policy Benefits

We establish liabilities for amounts payable under insurance policies. See Notes 1 and 4 of the Notes to the Consolidated Financial Statements for

additional information. See also “— Industry Trends — Impact of a Sustained Low Interest Rate Environment — Interest Rate Stress Scenario” and “— Variable

Annuity Guarantees.” A discussion of future policy benefits by segment follows.

Retail

For the Retail Life & Other business, future policy benefits are comprised mainly of liabilities for traditional life and for universal and variable life insurance

contracts. In order to manage risk, we have often reinsured a portion of the mortality risk on life insurance policies. The reinsurance programs are routinely

evaluated and this may result in increases or decreases to existing coverage. We have entered into various derivative positions, primarily interest rate swaps

and swaptions, to mitigate the risk that investment of premiums received and reinvestment of maturing assets over the life of the policy will be at ratesbelow

those assumed in the original pricing of these contracts. For the Retail Annuities business, future policy benefits are comprised mainly of liabilities for life-

contingent income annuities, and liabilities for the variable annuity guaranteed minimum benefits accounted for as insurance.

Group, Voluntary & Worksite Benefits

With the exception of our property & casualty products, future policy benefits for our Group and Voluntary & Worksite businesses are comprised

mainly of liabilities for disabled lives under disability waiver of premium policy provisions, liabilities for survivor income benefit insurance, LTC policies,

active life policies and premium stabilization and other contingency liabilities held under life insurance contracts. For our property & casualty products,

future policy benefits include unearned premium reserves and liabilities for unpaid claims and claim expenses and represent the amount estimated for

claims that have been reported but not settled and claims incurred but not reported. Liabilities for unpaid claims are estimated based upon

assumptions such as rates of claim frequencies, levels of severities, inflation, judicial trends, legislative changes or regulatory decisions. Assumptions

are based upon our historical experience and analyses of historical development patterns of the relationship of loss adjustment expenses to losses for

each line of business, and consider the effects of current developments, anticipated trends and risk management programs, reduced for anticipated

salvage and subrogation.

Corporate Benefit Funding

Liabilities for this segment are primarily related to payout annuities, including pension closeouts and structured settlement annuities. There is no

interest rate crediting flexibility on these liabilities. As a result, a sustained low interest rate environment could negatively impact earnings; however, we

mitigate our risks by applying various ALM strategies, including the use of various derivative positions, primarily interest rate floors and interest rate

swaps, to mitigate the risks associated with such a scenario.

Latin America

Future policy benefits for this segment are held primarily for immediate annuities in Chile, Argentina and Mexico and traditional life contracts mainly

in Brazil and Mexico. There are also reserves held for total return pass-through provisions included in certain universal life and savings products in

Mexico. Factors impacting these liabilities include sustained periods of lower yields than rates established at policy issuance, lower than expected

asset reinvestment rates, and mortality and lapses different than expected. We mitigate our risks by applying various ALM strategies.

Asia

Future policy benefits for this segment are held primarily for traditional life, endowment, annuity and accident & health contracts. They are also held for

total return pass-through provisions included in certain universal life and savings products. They include certain liabilities for variable annuity and variable

life guarantees of minimum death benefits, and longevity guarantees. Factors impacting these liabilities include sustained periods of lower yieldsthan

rates established at policy issuance, lower than expected asset reinvestment rates, market volatility, actual lapses resulting in lower than expected

income, and actual mortality or morbidity resulting in higher than expected benefit payments. We mitigate our risks by applying various ALM strategies.

54 MetLife, Inc.