MetLife 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assumptions, as part of our annual assumption review. Although the analysis shown below considers low interest rates in 2014 and 2015, it does not

assume any change to our long-term assumption for margins. As a result, the impact of a hypothetical interest rate stress scenario described below

does not capture the impact of any of the aforementioned items.

Mitigating Actions

The Company continues to be proactive in its investment and interest crediting rate strategies, as well as its product design and product mix. To

mitigate the risk of unfavorable consequences from the low interest rate environment in the U.S., the Company applies disciplined ALM strategies,

including the use of derivatives, primarily interest rate swaps, floors and swaptions. A significant portion of these derivatives were entered into prior to

the onset of the current low U.S. interest rate environment. In some cases, the Company has entered into offsetting positions as part of its overall ALM

strategy and to reduce volatility in net income. Lowering interest crediting rates on some products, or adjusting the dividend scale on traditional

products, can help offset decreases in investment margins on some products. Our ability to lower interest crediting rates could be limited by

competition, requirements to obtain regulatory approval, or contractual guarantees of minimum rates and may not match the timing or magnitude of

changes in asset yields. As a result, our margins could decrease or potentially become negative. We are able to limit or close certain products to new

sales in order to manage exposures. Business actions, such as shifting the sales focus to less interest rate sensitive products, can also mitigate this

risk. In addition, the Company is well diversified across product, distribution, and geography. Certain of our non-U.S. businesses, reported within our

Latin America and EMEA segments, which accounted for approximately 14% of our operating earnings in 2013, are not significantly interest rate or

market sensitive; in particular, they do not have any direct sensitivity to U.S. interest rates. The Company’s primary exposure within these segmentsis

insurance risk. We expect our non-U.S. businesses to grow faster than our U.S. businesses and, over time, to become a larger percentage of our total

business. As a result of the foregoing, the Company expects to be able to substantially mitigate the negative impact of a sustained low interest rate

environment in the U.S. on the Company’s profitability. Based on a near to intermediate term analysis of a sustained lower interest rate environment in

the U.S., the Company anticipates operating earnings will continue to increase, although at a slower growth rate.

Interest Rate Stress Scenario

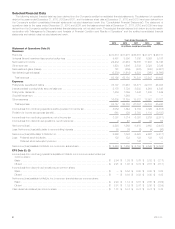

The following summarizes the impact of a hypothetical interest rate stress scenario on our operating earnings and the mark-to-market of our

derivative positions that do not qualify as accounting hedges assuming a continued low interest rate environment in the U.S.

The hypothetical interest rate stress scenario is based on a constant set of U.S. interest rates and credit spreads in the U.S., as compared to our

business plan interest rates and credit spreads, which are based on consensus interest rate view and credit spreads as of August 2013. For example,

our business plan assumes a 10-year treasury rate of 2.88% at December 31, 2013 to rise during 2014 to 3.36% by December 31, 2014 and rise to

3.93% by December 31, 2015. The hypothetical interest rate stress scenario assumes the 10-year treasury rate to be 2.50% at December 31, 2013

and remain constant at that level until December 31, 2015. We make similar assumptions for interest rates at other maturities, and hold this interest

rate curve constant through December 31, 2015. In addition, in the interest rate stress scenario, we assume credit spreads remain constant from

December 2013 through the end of 2015, as compared to our business plan which assumes rising credit spreads through 2014 and thereafter

remaining constant through the end of 2015. Further, we also include the impact of low interest rates on our pension and postretirement plan

expenses. We allocate this impact across our segments and it is included in the segment discussion below. The discount rate used to value these

plans is tied to high quality corporate bond yields. Accordingly, an extended low interest rate environment will result in increased pension and other

postretirement benefit liabilities and expenses. Higher total return on the fixed income portfolio of pension and other postretirement benefit plan assets

will partially offset this increase in pension and other postretirement plan liabilities.

Based on the above assumptions, we estimate the impact of the hypothetical U.S. interest rate stress scenario on our consolidated operating

earnings to be a decrease of approximately $75 million and $205 million in 2014 and 2015, respectively.

As previously mentioned, operating earnings is the measure of segment profit and loss that we use to evaluate segment performance and allocated

resources. Further, we believe the presentation of operating earnings and operating earnings available to common shareholders as we measure it for

management purposes enhances the understanding of our performance by highlighting the results of operations and the underlying profitability drivers

of our business. The most directly comparable GAAP measure is not accessible on a forward-looking basis because we believe it is not possible to

provide other than a range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or outside the

range from period to period and may have a significant impact on GAAP net income. See “— Non-GAAP and Other Financial Disclosures” for

definitions of such measures.

In addition to its impact on operating earnings, we estimated the effect of the hypothetical U.S. interest rate stress scenario on the mark-to-market

of our derivative positions that do not qualify as accounting hedges. We applied the hypothetical U.S. interest rate stress scenario to these derivatives

and compared the impact to that from interest rates in our business plan. We hold a significant position in long duration receive-fixed interest rate

swaps to hedge reinvestment risk. These swaps are most sensitive to the 30-year and 10-year swap rates and we recognize gains as rates drop and

recognize losses as rates rise. This estimated impact on the derivative mark-to-market does not include that of our VA program derivatives as the

impact of low interest rates in the freestanding derivatives would be largely offset by the mark-to-market in net derivative gains (losses) for the related

embedded derivative. See “— Results of Operations — Consolidated Results” for discussions on our net derivative gains and losses.

Based on these additional assumptions, we estimate the impact of the hypothetical U.S. interest rate stress scenario on the mark-to-market of our

derivative positions that do not qualify as accounting hedges to be a decrease in net income of $50 million and $120 million in 2014 and 2015,

respectively.

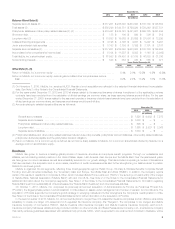

Segments and Corporate & Other

The following discussion summarizes the impact of the above hypothetical U.S. interest rate stress scenario on the operating earnings of our

segments, as well as Corporate & Other. See also “— Policyholder Liabilities — Policyholder Account Balances” for information regarding the account

values subject to minimum guaranteed crediting rates.

Retail

Life & Other – Our interest rate sensitive products include traditional life, universal life, and retained asset accounts. Because the majority of our

traditional life insurance business is participating, we can largely offset lower investment returns on assets backing our traditional life products

through adjustments to the applicable dividend scale. In our universal life products, we manage interest rate risk through a combination of product

design features and ALM strategies, including the use of hedges such as interest rate swaps and floors. While we have the ability to lower crediting

rates on certain in-force universal life policies to mitigate margin compression, such actions would be partially offset by increases in our liabilities

related to policies with secondary guarantees. Our retained asset accounts have minimum interest crediting rate guarantees which range from 1.5%

MetLife, Inc. 11