MetLife 2013 Annual Report Download - page 61

Download and view the complete annual report

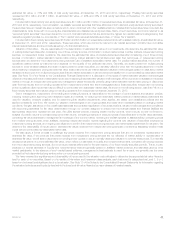

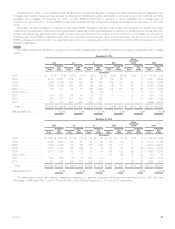

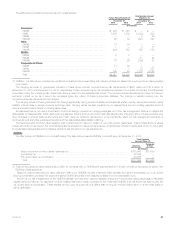

Please find page 61 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(4) Gains (losses) do not include earned income (expense) on credit default swaps.

The favorable change in net gains (losses) on purchased credit default swaps of $277 million was due to a combination of credit spreads narrowing

less in the current period as compared to the prior period and the average notional amount decreasing in the current period as compared to the prior

period on credit default swaps hedging certain bonds. The unfavorable change in net gains (losses) on written credit default swaps of ($19) million was

primarily due to a decrease in sensitivity of certain credit default swaps that are approaching maturity.

The maximum amount at risk related to our written credit default swaps is equal to the corresponding notional amount. The increase in the notional

amount of written credit default swaps is primarily a result of our decision to add to our credit replication holdings within the Company. In a replication

transaction, we pair an asset on our balance sheet with a written credit default swap to synthetically replicate a corporate bond, a core asset holding of

life insurance companies. Replications are entered into in accordance with the guidelines approved by insurance regulators and are an important toolin

managing the overall corporate credit risk within the Company. In order to match our long-dated insurance liabilities, we will seek to buy long-dated

corporate bonds. In some instances, these may not be readily available in the market, or they may be issued by corporations to which we already have

significant corporate credit exposure. For example, by purchasing Treasury bonds (or other high-quality assets) and associating them with written credit

default swaps on the desired corporate credit name, we, at times, can replicate the desired bond exposures and meet our ALM needs. In addition,

given the shorter tenor of the credit default swaps (generally five-year tenors) versus a long-dated corporate bond, we have more flexibility in managing

our credit exposures.

Embedded Derivatives

See Note 10 of the Notes to the Consolidated Financial Statements for information about embedded derivatives measured at estimated fair value on

a recurring basis and their corresponding fair value hierarchy.

See Note 10 of the Notes to the Consolidated Financial Statements for a rollforward of the fair value measurements for net embedded derivatives

measured at estimated fair value on a recurring basis using significant unobservable (Level 3) inputs.

See Note 9 of the Notes to the Consolidated Financial Statements for information about the nonperformance risk adjustment included in the

valuation of guaranteed minimum benefits accounted for as embedded derivatives.

See “Summary of Critical Accounting Estimates — Derivatives” for further information on the estimates and assumptions that affect embedded

derivatives.

Off-Balance Sheet Arrangements

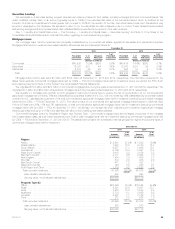

Credit and Committed Facilities

We maintain unsecured credit facilities and committed facilities with various financial institutions. See “— Liquidity and Capital Resources — The

Company — Liquidity and Capital Sources — Credit and Committed Facilities” for further descriptions of such arrangements. See also Note 12 of the

Notes to the Consolidated Financial Statements, as well as “— Liquidity and Capital Resources — The Company — Liquidity and Capital Sources —

Credit and Committed Facilities” for the classification of expenses on such credit and committed facilities and the nature of the associated liability for

letters of credit issued and drawdowns on these credit and committed facilities.

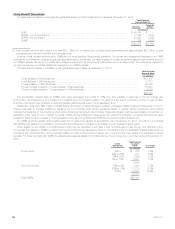

Collateral for Securities Lending, Repurchase Program and Derivatives

We participate in a securities lending program in the normal course of business for the purpose of enhancing the total return on our investment

portfolio. Periodically we receive non-cash collateral for securities lending from counterparties on deposit from customers, which cannot be sold or

repledged, and which has not been recorded on our consolidated balance sheets. We had no such collateral as of December 31, 2013. The amount of

this collateral was $104 million at estimated fair value at December 31, 2012. See Notes 1 and 8 of the Notes to the Consolidated Financial

Statements, as well as “— Investments — Securities Lending” for discussion of our securities lending program, the classification of revenues and

expenses, and the nature of the secured financing arrangement and associated liability.

We also participate in third-party custodian administered repurchase programs for the purpose of enhancing the total return on our investment

portfolio. We loan certain of our fixed maturity securities to financial institutions and, in exchange, non-cash collateral is put on deposit by the financial

institutions on our behalf with third-party custodians. The estimated fair value of securities loaned in connection with these transactions was $231 million

and $729 million at December 31, 2013 and 2012, respectively. Non-cash collateral on deposit with third-party custodians on our behalf was $256

million and $785 million at December 31, 2013 and 2012, respectively, which cannot be sold or re-pledged, and which has not been recorded on our

consolidated balance sheets.

We enter into derivatives to manage various risks relating to our ongoing business operations. We have non-cash collateral from counterparties for

derivatives, which can be sold or re-pledged subject to certain constraints, and which has not been recorded on our consolidated balance sheets. The

amount of this collateral was $2.3 billion and $3.7 billion at December 31, 2013 and 2012, respectively. See “— Liquidity and Capital Resources —

The Company — Liquidity and Capital Uses — Pledged Collateral” and “Derivatives” in Note 9 of the Notes to the Consolidated Financial Statements for

information on the earned income on and the gross notional amount, estimated fair value of assets and liabilities and primary underlying risk exposureof

our derivatives.

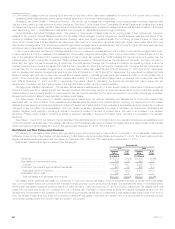

Lease Commitments

As lessee, we have entered into various lease and sublease agreements for office space, information technology and other equipment. Our

commitments under such lease agreements are included within the contractual obligations table. See “— Liquidity and Capital Resources — The

Company — Contractual Obligations” and Note 21 of the Notes to the Consolidated Financial Statements.

Guarantees

See “Guarantees” in Note 21 of the Notes to the Consolidated Financial Statements.

Other

Additionally, we have the following commitments in the normal course of business for the purpose of enhancing the total return on our investment

portfolio: commitments to fund partnership investments; mortgage loan commitments; and commitments to fund bank credit facilities, bridge loans and

private corporate bond investments.

See “Net Investment Income” and “Net Investment Gains (Losses)” in Note 8 of the Notes to the Consolidated Financial Statements for information

on the investment income, investment expense, gains and losses from such investments. See also “Fixed Maturity and Equity Securities Available-for-

Sale” and “Mortgage Loans” for information on our investments in fixed maturity securities and mortgage loans. See “— Investments — Real Estate and

Real Estate Joint Ventures” and “— Investments — Other Limited Partnership Interests” for information on our partnership investments.

MetLife, Inc. 53