MetLife 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

8. Investments (continued)

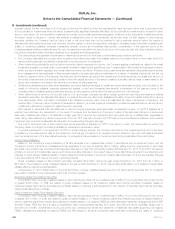

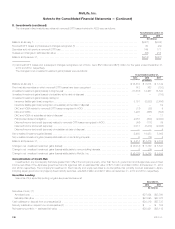

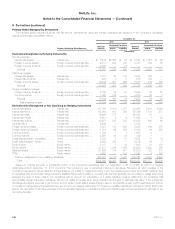

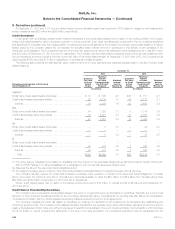

Unconsolidated VIEs

The carrying amount and maximum exposure to loss relating to VIEs in which the Company holds a significant variable interest but is not the primary

beneficiary and which have not been consolidated were as follows at:

December 31,

2013 2012

Carrying

Amount

Maximum

Exposure

to Loss

(1) Carrying

Amount

Maximum

Exposure

to Loss

(1)

(In millions)

Fixed maturity securities AFS:

Structured securities (RMBS, CMBS and ABS) (2) ......................................... $67,176 $67,176 $72,605 $72,605

U.S. and foreign corporate ............................................................ 3,966 3,966 5,287 5,287

Other limited partnership interests ........................................................ 5,041 6,994 4,436 5,908

Other invested assets ................................................................. 1,509 1,897 1,117 1,431

FVO and trading securities .............................................................. 619 619 563 563

Mortgage loans ...................................................................... 106 106 351 351

Real estate joint ventures ............................................................... 70 71 150 157

Equity securities AFS:

Non-redeemable preferred stock ....................................................... 35 35 32 32

Total ........................................................................... $78,522 $80,864 $84,541 $86,334

(1) The maximum exposure to loss relating to fixed maturity securities AFS, FVO and trading securities and equity securities AFS is equal to their carrying

amounts or the carrying amounts of retained interests. The maximum exposure to loss relating to other limited partnership interests, mortgage loans

and real estate joint ventures is equal to the carrying amounts plus any unfunded commitments of the Company. For certain of its investments in

other invested assets, the Company’s return is in the form of income tax credits which are guaranteed by creditworthy third parties. For such

investments, the maximum exposure to loss is equal to the carrying amounts plus any unfunded commitments, reduced by income tax credits

guaranteed by third parties of $257 million and $318 million at December 31, 2013 and 2012, respectively. Such a maximum loss would be

expected to occur only upon bankruptcy of the issuer or investee.

(2) For these variable interests, the Company’s involvement is limited to that of a passive investor.

As described in Note 21, the Company makes commitments to fund partnership investments in the normal course of business. Excluding these

commitments, the Company did not provide financial or other support to investees designated as VIEs during the years ended December 31, 2013,

2012 and 2011.

134 MetLife, Inc.