MetLife 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

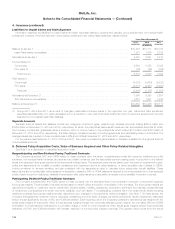

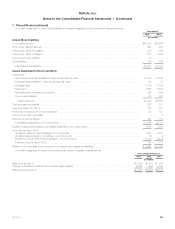

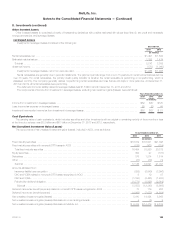

7. Closed Block (continued)

Information regarding the closed block revenues and expenses was as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Revenues

Premiums ....................................................................................... $1,987 $2,139 $2,306

Net investment income ............................................................................. 2,130 2,188 2,231

Net investment gains (losses) ........................................................................ 25 61 32

Net derivative gains (losses) ......................................................................... (6) (12) 8

Total revenues ............................................................................... 4,136 4,376 4,577

Expenses

Policyholder benefits and claims ...................................................................... 2,702 2,783 2,991

Policyholder dividends ............................................................................. 979 1,072 1,137

Other expenses .................................................................................. 165 179 193

Total expenses .............................................................................. 3,846 4,034 4,321

Revenues, net of expenses before provision for income tax expense (benefit) .................................. 290 342 256

Provision for income tax expense (benefit) .............................................................. 101 120 89

Revenues, net of expenses and provision for income tax expense (benefit) from continuing operations ............... 189 222 167

Revenues, net of expenses and provision for income tax expense (benefit) from discontinued operations ............. — 10 1

Revenues, net of expenses and provision for income tax expense (benefit) .................................... $ 189 $ 232 $ 168

MLIC charges the closed block with federal income taxes, state and local premium taxes and other additive state or local taxes, as well as

investment management expenses relating to the closed block as provided in the Plan. MLIC also charges the closed block for expenses of maintaining

the policies included in the closed block.

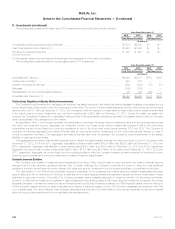

8. Investments

See Note 10 for information about the fair value hierarchy for investments and the related valuation methodologies.

Investment Risks and Uncertainties

Investments are exposed to the following primary sources of risk: credit, interest rate, liquidity, market valuation, currency and real estate risk. The

financial statement risks, stemming from such investment risks, are those associated with the determination of estimated fair values, the diminished

ability to sell certain investments in times of strained market conditions, the recognition of impairments, the recognition of income on certain investments

and the potential consolidation of VIEs. The use of different methodologies, assumptions and inputs relating to these financial statement risks may have

a material effect on the amounts presented within the consolidated financial statements.

The determination of valuation allowances and impairments is highly subjective and is based upon periodic evaluations and assessments of known

and inherent risks associated with the respective asset class. Such evaluations and assessments are revised as conditions change and new information

becomes available.

The recognition of income on certain investments (e.g. structured securities, including mortgage-backed securities, asset-backed securities (“ABS”),

certain structured investment transactions and FVO and trading securities) is dependent upon certain factors such as prepayments and defaults, and

changes in such factors could result in changes in amounts to be earned.

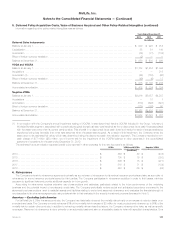

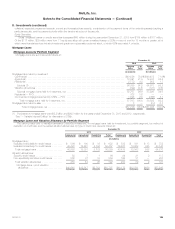

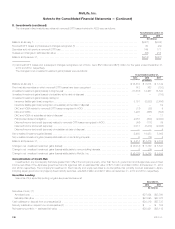

Fixed Maturity and Equity Securities AFS

Fixed Maturity and Equity Securities AFS by Sector

The following table presents the fixed maturity and equity securities AFS by sector. Redeemable preferred stock is reported within U.S. corporate

and foreign corporate fixed maturity securities and non-redeemable preferred stock is reported within equity securities. Included within fixed maturity

securities are structured securities including RMBS, commercial mortgage-backed securities (“CMBS”) and ABS.

December 31, 2013 December 31, 2012

Cost or

Amortized

Cost

Gross Unrealized Estimated

Fair

Value

Cost or

Amortized

Cost

Gross Unrealized Estimated

Fair

ValueGains Temporary

Losses OTTI

Losses Gains Temporary

Losses OTTI

Losses

(In millions)

Fixed maturity securities

U.S. corporate .......................... $100,203 $ 7,495 $1,229 $ — $106,469 $102,669 $11,887 $ 430 $ — $114,126

Foreign corporate (1) ..................... 59,778 3,939 565 — 63,152 61,806 5,654 277 (1) 67,184

Foreign government ...................... 50,717 4,107 387 — 54,437 51,967 5,440 71 — 57,336

U.S. Treasury and agency ................. 43,928 2,251 1,056 — 45,123 41,874 6,104 11 — 47,967

RMBS ................................ 34,167 1,584 490 206 35,055 35,666 2,477 315 349 37,479

CMBS ................................ 16,115 605 170 — 16,550 18,177 1,009 57 — 19,129

ABS .................................. 15,458 296 171 12 15,571 15,762 404 156 13 15,997

State and political subdivision .............. 13,233 903 306 — 13,830 12,949 2,169 70 — 15,048

Total fixed maturity securities .............. $333,599 $21,180 $4,374 $218 $350,187 $340,870 $35,144 $1,387 $361 $374,266

Equity securities

Common stock ......................... $ 1,927 $ 431 $ 5 $ — $ 2,353 $ 2,034 $ 147 $ 19 $ — $ 2,162

Non-redeemable preferred stock ............ 1,085 76 112 — 1,049 804 65 140 — 729

Total equity securities ................... $ 3,012 $ 507 $ 117 $ — $ 3,402 $ 2,838 $ 212 $ 159 $ — $ 2,891

122 MetLife, Inc.