MetLife 2013 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

11. Goodwill (continued)

assumptions and discount rates. The key inputs, judgments and assumptions necessary in determining estimated fair value of the reporting units include

projected operating earnings, current book value, the level of economic capital required to support the mix of business, long-term growth rates,

comparative market multiples, the account value of in-force business, projections of new and renewal business, as well as margins on such business,

the level of interest rates, credit spreads, equity market levels, and the discount rate that the Company believes is appropriate for the respective

reporting unit.

When testing goodwill for impairment, the Company also considers its market capitalization in relation to the aggregate estimated fair value of its

reporting units. The Company applies significant judgment when determining the estimated fair value of the Company’s reporting units and when

assessing the relationship of market capitalization to the aggregate estimated fair value of its reporting units.

The valuation methodologies utilized are subject to key judgments and assumptions that are sensitive to change. Estimates of fair value are

inherently uncertain and represent only management’s reasonable expectation regarding future developments. These estimates and the judgments and

assumptions upon which the estimates are based will, in all likelihood, differ in some respects from actual future results. Declines in the estimated fair

value of the Company’s reporting units could result in goodwill impairments in future periods which could materially adversely affect the Company’s

results of operations or financial position.

During the 2013 annual goodwill impairment tests, the Company concluded that the fair values of all reporting units were in excess of their carrying

values and, therefore, goodwill was not impaired.

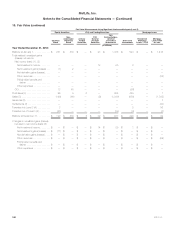

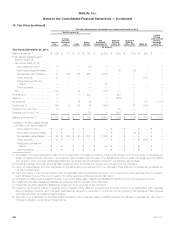

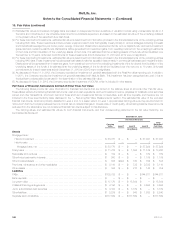

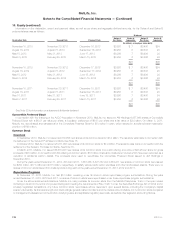

Information regarding goodwill by segment, as well as Corporate & Other, was as follows:

Retail

Group,

Voluntary &

Worksite

Benefits

Corporate

Benefit

Funding Latin

America Asia (1) EMEA Corporate

& Other (2) Unallocated

Goodwill Total

(In millions)

Balance at January 1, 2011

Goodwill .............................. $3,125 $138 $900 $ 229 $ 72 $ 38 $ 470 $ 6,809 $11,781

Accumulated impairment .................. — — — — — — — — —

Total goodwill, net ..................... 3,125 138 900 229 72 38 470 6,809 11,781

Goodwill allocation (3) .................... — — — 312 5,163 1,334 — (6,809) —

Acquisitions (4) ......................... — — — — 39 — — — 39

Impairments (5) ......................... — — — — — — (65) — (65)

Effect of foreign currency

translation and other ................... — — — (40) 259 (39) — — 180

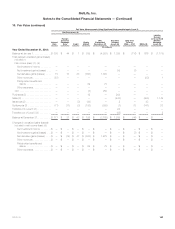

Balance at December 31, 2011

Goodwill .............................. 3,125 138 900 501 5,533 1,333 470 — 12,000

Accumulated impairment .................. — — — — — — (65) — (65)

Total goodwill, net ..................... 3,125 138 900 501 5,533 1,333 405 — 11,935

Acquisitions ............................ — — — — — 1 — — 1

Impairments (6) ......................... (1,692) — — — — — (176) — (1,868)

Effect of foreign currency

translation and other ................... — — — 26 (146) 5 — — (115)

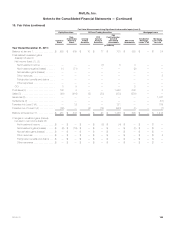

Balance at December 31, 2012

Goodwill .............................. 3,125 138 900 527 5,387 1,339 470 — 11,886

Accumulated impairment .................. (1,692) — — — — — (241) — (1,933)

Total goodwill, net ..................... 1,433 138 900 527 5,387 1,339 229 — 9,953

Acquisitions (7) ......................... — — — 1,140 — 1 — — 1,141

Dispositions ............................ — — — — — (8) — — (8)

Reduction of goodwill (5) .................. — — — — — — (65) — (65)

Reduction of accumulated impairment (5) ..... — — — — — — 65 — 65

Effect of foreign currency

translation and other ................... — — — (79) (489) 24 — — (544)

Balance at December 31, 2013

Goodwill .............................. 3,125 138 900 1,588 4,898 1,356 405 — 12,410

Accumulated impairment .................. (1,692) — — — — — (176) — (1,868)

Total goodwill, net ..................... $1,433 $138 $900 $1,588 $4,898 $1,356 $ 229 $ — $10,542

(1) Includes goodwill of $4.7 billion, $5.2 billion and $5.4 billion from the Japan operations at December 31, 2013, 2012 and 2011, respectively.

MetLife, Inc. 171