MetLife 2013 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

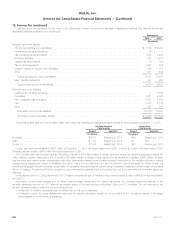

21. Contingencies, Commitments and Guarantees (continued)

The ability of MLIC to estimate its ultimate asbestos exposure is subject to considerable uncertainty, and the conditions impacting its liability can

be dynamic and subject to change. The availability of reliable data is limited and it is difficult to predict the numerous variables that can affect liability

estimates, including the number of future claims, the cost to resolve claims, the disease mix and severity of disease in pending and future claims, the

impact of the number of new claims filed in a particular jurisdiction and variations in the law in the jurisdictions in which claims are filed, the possible

impact of tort reform efforts, the willingness of courts to allow plaintiffs to pursue claims against MLIC when exposure to asbestos took place after the

dangers of asbestos exposure were well known, and the impact of any possible future adverse verdicts and their amounts.

The ability to make estimates regarding ultimate asbestos exposure declines significantly as the estimates relate to years further in the future. In the

Company’s judgment, there is a future point after which losses cease to be probable and reasonably estimable. It is reasonably possible that the

Company’s total exposure to asbestos claims may be materially greater than the asbestos liability currently accrued and that future charges to income

may be necessary. While the potential future charges could be material in the particular quarterly or annual periods in which they are recorded, based

on information currently known by management, management does not believe any such charges are likely to have a material effect on the

Company’s financial position.

The Company believes adequate provision has been made in its consolidated financial statements for all probable and reasonably estimable

losses for asbestos-related claims. MLIC’s recorded asbestos liability is based on its estimation of the following elements, as informed by the facts

presently known to it, its understanding of current law and its past experiences: (i) the probable and reasonably estimable liability for asbestos claims

already asserted against MLIC, including claims settled but not yet paid; (ii) the probable and reasonably estimable liability for asbestos claims not yet

asserted against MLIC, but which MLIC believes are reasonably probable of assertion; and (iii) the legal defense costs associated with the foregoing

claims. Significant assumptions underlying MLIC’s analysis of the adequacy of its recorded liability with respect to asbestos litigation include: (i) the

number of future claims; (ii) the cost to resolve claims; and (iii) the cost to defend claims.

MLIC reevaluates on a quarterly and annual basis its exposure from asbestos litigation, including studying its claims experience, reviewing external

literature regarding asbestos claims experience in the United States, assessing relevant trends impacting asbestos liability and considering numerous

variables that can affect its asbestos liability exposure on an overall or per claim basis. These variables include bankruptcies of other companies

involved in asbestos litigation, legislative and judicial developments, the number of pending claims involving serious disease, the number of new

claims filed against it and other defendants and the jurisdictions in which claims are pending. Based upon its reevaluation of its exposure from

asbestos litigation, MLIC has updated its liability analysis for asbestos-related claims through December 31, 2013. The frequency of severe claims

relating to asbestos has not declined as expected, and MLIC has reflected this in its provisions. Accordingly, MLIC increased its recorded liability for

asbestos-related claims from $417 million to $572 million at December 31, 2013.

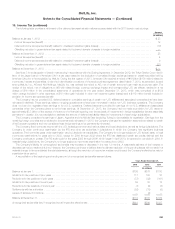

Regulatory Matters

The Company receives and responds to subpoenas or other inquiries from state regulators, including state insurance commissioners; state

attorneys general or other state governmental authorities; federal regulators, including the U.S. Securities and Exchange Commission (“SEC”); federal

governmental authorities, including congressional committees; and the Financial Industry Regulatory Authority (“FINRA”) seeking a broad range of

information. The issues involved in information requests and regulatory matters vary widely. The Company cooperates in these inquiries.

Mortgage Regulatory and Law Enforcement Authorities’ Inquiries

MetLife, through its affiliate, MetLife Bank, was engaged in the origination, sale and servicing of forward and reverse residential mortgage loans

since 2008. In 2012, MetLife Bank exited the business of originating residential mortgage loans. In 2012 and 2013, MetLife Bank sold its residential

mortgage servicing portfolios, and in 2013 wound down its mortgage servicing business. See Note 3 for information regarding the MetLife Bank

Divestiture. In August 2013, MetLife Bank merged with and into MLHL, its former subsidiary, with MLHL as the surviving non-bank entity.

On April 13, 2011, the Office of the Comptroller of the Currency (the “OCC”) entered into a consent order with MetLife Bank (the “OCC consent

order”). The OCC consent order required an independent review of foreclosure practices and set forth new residential mortgage servicing standards.

In February 2013, MetLife Bank entered into an agreement with the OCC to amend the OCC consent order, and paid approximately $46 million to

settle its obligations and end the foreclosure review. In addition, the Federal Reserve Board entered into a consent order with MetLife, Inc. in 2011

(the “Federal Reserve Board consent order”), to enhance its supervision of the mortgage servicing activities of MetLife Bank. On August 6, 2012, the

Federal Reserve Board and MetLife, Inc. entered into an Order of Assessment of a Civil Monetary Penalty Issued Upon Consent that imposes a

penalty of up to $3.2 million for the alleged deficiencies in MetLife, Inc.’s oversight of MetLife Bank’s servicing of residential mortgage loans and

processing foreclosures that were the subject of the Federal Reserve Board consent order.

In May 2013, MetLife Bank received a subpoena from the U.S. Department of Justice requiring production of documents relating to MetLife

Bank’s payment of certain foreclosure-related expenses to law firms and business entities affiliated with law firms and relating to MetLife Bank’s

supervision of such payments, including expenses submitted to the Federal National Mortgage Association, the Federal Home Loan Mortgage Corp.

and the U.S. Department of Housing and Urban Development (“HUD”) for reimbursement. It is possible that various state or federal regulatory and

law enforcement authorities may seek monetary penalties from MLHL relating to foreclosure practices.

MetLife Bank has also responded to a subpoena issued by the Department of Financial Services regarding hazard insurance and flood insurance

that MetLife Bank obtained to protect the lienholder’s interest when the borrower’s insurance has lapsed.

In April and May 2012, MetLife Bank received two subpoenas issued by the Office of Inspector General for HUD regarding Federal Housing

Administration (“FHA”) insured loans. In June and September 2012, MetLife Bank received two Civil Investigative Demands that the U.S. Department

of Justice issued as part of a False Claims Act investigation of allegations that MetLife Bank had improperly originated and/or underwritten loans

insured by the FHA. MetLife Bank has met with the U.S. Department of Justice to discuss the allegations and possible resolution of the FHA False

Claims Act investigation. The Company has included what it currently believes to be the probable and estimable amount of such loss in the

Company’s consolidated financial statements and is continuing to investigate matters raised during the meeting.

The consent decrees, as well as the inquiries or investigations referred to above, could adversely affect MetLife’s reputation or result in significant

fines, penalties, equitable remedies or other enforcement actions, and result in significant legal costs in responding to governmental investigations or

other litigation. The MetLife Bank Divestiture may not relieve MetLife from complying with the consent decrees, or protect it from inquiries and

MetLife, Inc. 205