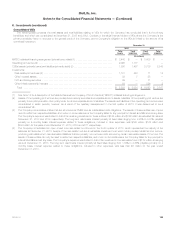

MetLife 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

8. Investments (continued)

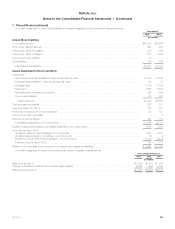

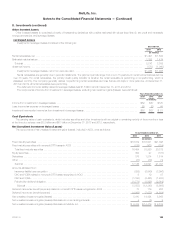

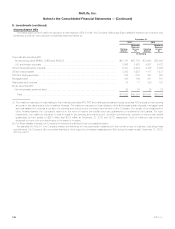

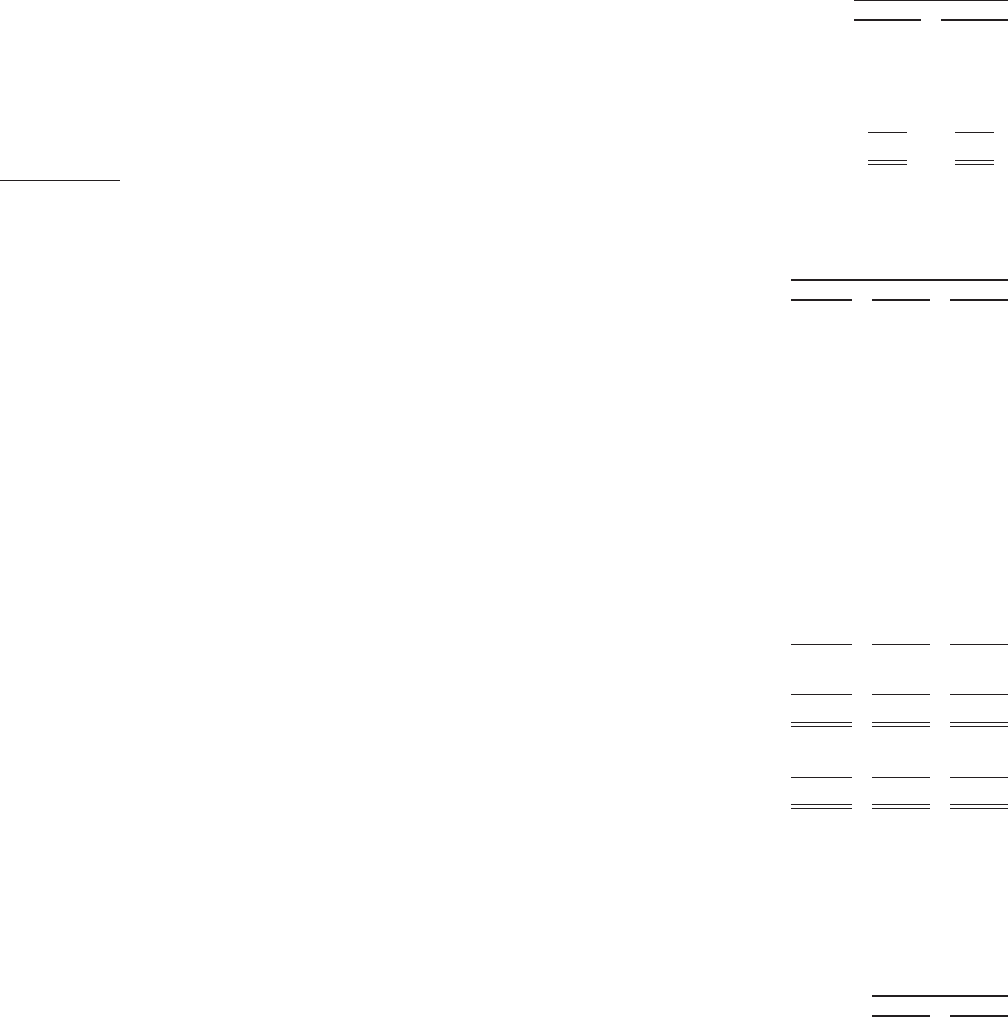

The changes in fixed maturity securities with noncredit OTTI losses included in AOCI were as follows:

Years Ended December 31,

2013 2012

(In millions)

Balance at January 1, .................................................................................. $(361) $(724)

Noncredit OTTI losses and subsequent changes recognized (1) ................................................. 60 (29)

Securities sold with previous noncredit OTTI loss ............................................................. 149 177

Subsequent changes in estimated fair value ................................................................ (66) 215

Balance at December 31, .............................................................................. $(218) $(361)

(1) Noncredit OTTI losses and subsequent changes recognized, net of DAC, were $52 million and ($21) million for the years ended December 31,

2013 and 2012, respectively.

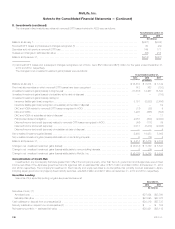

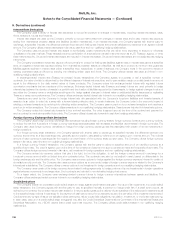

The changes in net unrealized investment gains (losses) were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Balance at January 1, .......................................................................... $14,419 $ 8,674 $ 3,122

Fixed maturity securities on which noncredit OTTI losses have been recognized ............................. 143 363 (123)

Unrealized investment gains (losses) during the year .................................................. (17,618) 12,467 14,823

Unrealized investment gains (losses) of subsidiary at the date of disposal .................................. — — (105)

Unrealized investment gains (losses) relating to:

Insurance liability gain (loss) recognition ........................................................... 5,151 (2,053) (3,406)

Insurance liability gain (loss) recognition of subsidiary at the date of disposal .............................. — — 82

DAC and VOBA related to noncredit OTTI losses recognized in AOCI ................................... (13) (28) 9

DAC and VOBA ............................................................................. 1,295 (685) (808)

DAC and VOBA of subsidiary at date of disposal ................................................... — — 11

Policyholder dividend obligation ................................................................. 2,057 (909) (2,043)

Deferred income tax benefit (expense) related to noncredit OTTI losses recognized in AOCI .................. (46) (117) 39

Deferred income tax benefit (expense) ........................................................... 3,017 (3,279) (2,936)

Deferred income tax benefit (expense) of subsidiary at date of disposal .................................. — — 4

Net unrealized investment gains (losses) ............................................................ 8,405 14,433 8,669

Net unrealized investment gains (losses) attributable to noncontrolling interests .............................. 9 (14) 5

Balance at December 31, ....................................................................... $ 8,414 $14,419 $ 8,674

Change in net unrealized investment gains (losses) ................................................... $ (6,014) $ 5,759 $ 5,547

Change in net unrealized investment gains (losses) attributable to noncontrolling interests ...................... 9 (14) 5

Change in net unrealized investment gains (losses) attributable to MetLife, Inc. .............................. $ (6,005) $ 5,745 $ 5,552

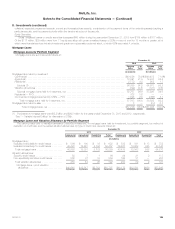

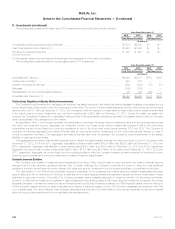

Concentrations of Credit Risk

Investments in any counterparty that were greater than 10% of the Company’s equity, other than the U.S. government and its agencies, were in fixed

income securities of the Japanese government and its agencies with an estimated fair value of $21.7 billion and $22.4 billion at December 31, 2013

and 2012, respectively. The Company’s investment in fixed maturity and equity securities to counterparties that primarily conduct business in Japan,

including Japan government and agency fixed maturity securities, was $26.9 billion and $28.7 billion at December 31, 2013 and 2012, respectively.

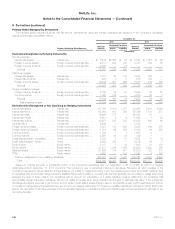

Securities Lending

Elements of the securities lending program are presented below at:

December 31,

2013 2012

(In millions)

Securities on loan: (1)

Amortized cost ....................................................................................... $27,094 $23,380

Estimated fair value .................................................................................... $27,595 $27,077

Cash collateral on deposit from counterparties (2) .............................................................. $28,319 $27,727

Security collateral on deposit from counterparties (3) ............................................................ $ — $ 104

Reinvestment portfolio — estimated fair value ................................................................. $28,481 $28,112

130 MetLife, Inc.