MetLife 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

16. Equity (continued)

The Company’s domestic captive life reinsurance subsidiaries, which reinsure risks including the closed block, level premium term life and universal

life with secondary guarantees assumed from other MetLife subsidiaries, have no material state prescribed accounting practices, except for MetLife

Reinsurance Company of Vermont (“MRV”). MRV, with the explicit permission of the Commissioner of Insurance of the State of Vermont, has included,

as admitted assets, the value of letters of credit serving as collateral for reinsurance credit taken by various affiliated cedants, in connection with

reinsurance agreements entered into between MRV and the various affiliated cedants, which resulted in higher statutory capital and surplus of

$5.5 billion and $5.1 billion for the years ended December 31, 2013 and 2012, respectively. MRV’s RBC would have triggered a regulatory event

without the use of the state prescribed practice. The statutory net income (loss) of MetLife, Inc.’s domestic captive life reinsurance subsidiaries was

($612) million, ($154) million and ($130) million for the years ended December 2013, 2012 and 2011, respectively, and the statutory capital and

surplus, including the aforementioned prescribed practice, was $4.3 billion and $4.2 billion at December 31, 2013 and 2012, respectively.

Dividend Restrictions

Insurance Operations

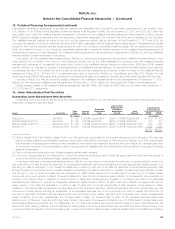

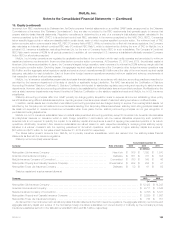

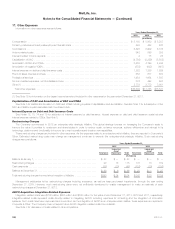

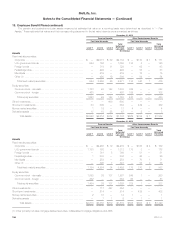

The table below sets forth the dividends permitted to be paid by the respective insurance subsidiary without insurance regulatory approval and the

respective dividends paid:

2014 2013 2012

Company Permitted w/o

Approval (1) Paid (2) Permitted w/o

Approval (3) Paid (2) Permitted w/o

Approval (3)

(In millions)

Metropolitan Life Insurance Company ........................ $1,116 $ 1,428 $1,428 $ 1,023 $1,350

American Life Insurance Company ........................... $ — $ — $ 523 $ 1,300 (4) $ 168

MetLife Insurance Company of Connecticut ................... $1,061 $ 1,000 $1,330 $ 706 (5) $ 504

Metropolitan Property and Casualty Insurance Company .......... $ 218 $ 100 $ 74 $ 100 $ —

Metropolitan Tower Life Insurance Company ................... $ 73 $ 109(6) $ 77 $ 82 $ 82

MetLife Investors Insurance Company ........................ $ 99 $ 129 $ 129 $ 18 $ 18

Delaware American Life Insurance Company ................... $ 16 $ — $ 7 $ — $ 12

(1) Reflects dividend amounts that may be paid during 2014 without prior regulatory approval. However, because dividend tests may be based on

dividends previously paid over rolling 12-month periods, if paid before a specified date during 2014, some or all of such dividends may require

regulatory approval.

(2) Reflects all amounts paid, including those requiring regulatory approval.

(3) Reflects dividend amounts that could have been paid during the relevant year without prior regulatory approval.

(4) During May 2012, American Life received regulatory approval to pay an extraordinary dividend for an amount up to the funds remitted in connection

with the restructuring of American Life’s business in Japan. Subsequently, $1.5 billion was remitted to American Life. See Note 3. Of this approved

amount, $1.3 billion was paid to MetLife, Inc. as an extraordinary dividend.

(5) During June 2012, MICC distributed shares of an affiliate to its stockholders as an in-kind extraordinary dividend of $202 million as calculated ona

statutory basis. Regulatory approval for this extraordinary dividend was obtained due to the timing of payment. During December 2012, MICC paid a

dividend to its stockholders in the amount of $504 million, which represented its ordinary dividend capacity at December 31, 2012. Due to the

June 2012 in-kind dividend, a portion of this was extraordinary and regulatory approval was obtained.

(6) During October 2013, Metropolitan Tower Life Insurance Company (“MTL”) distributed shares of an affiliate to MetLife, Inc. as an in-kind dividendof

$32 million. Also during October 2013, MTL paid a dividend to MetLife, Inc. in the amount of $77 million in cash, which represented its dividend

capacity without regulatory approval at December 31, 2013. Regulatory approval for these dividends was obtained due to the amount and timing of

the payments.

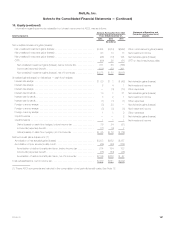

Under New York State Insurance Law, MLIC is permitted, without prior insurance regulatory clearance, to pay stockholder dividends to MetLife, Inc.

as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of: (i) 10% of its surplus to policyholders as of

the end of the immediately preceding calendar year or (ii) its statutory net gain from operations for the immediately preceding calendar year (excluding

realized capital gains). MLIC will be permitted to pay a dividend to MetLife, Inc. in excess of the lesser of such two amounts only if it files notice of its

intention to declare such a dividend and the amount thereof with the New York Superintendent of Financial Services (the “Superintendent”) and the

Superintendent either approves the distribution of the dividend or does not disapprove the dividend within 30 days of its filing. Under New York State

Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a stock life insurance company would support

the payment of such dividends to its stockholders.

Under Delaware State Insurance Law, each of American Life, DelAm and MTL is permitted, without prior insurance regulatory clearance, to pay a

stockholder dividend to MetLife, Inc. as long as the amount of the dividend, when aggregated with all other dividends in the preceding 12 months,

does not exceed the greater of: (i) 10% of its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) its net statutory

gain from operations for the immediately preceding calendar year (excluding realized capital gains). Each of American Life, DelAm and MTL will be

permitted to pay a dividend to MetLife, Inc. in excess of the greater of such two amounts only if it files notice of the declaration of such a dividend and

the amount thereof with the Delaware Commissioner and the Delaware Commissioner either approves the distribution of the dividend or does not

disapprove the distribution within 30 days of its filing. In addition, any dividend that exceeds earned surplus (defined as “unassigned funds (surplus)”)

as of the immediately preceding calendar year requires insurance regulatory approval. Under Delaware State Insurance Law, the Delaware

Commissioner has broad discretion in determining whether the financial condition of a stock life insurance company would support the payment of

such dividends to its stockholders.

184 MetLife, Inc.