MetLife 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

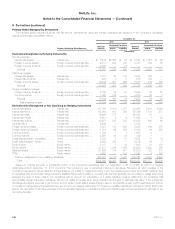

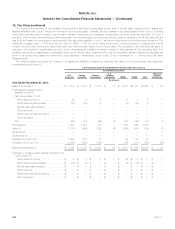

10. Fair Value (continued)

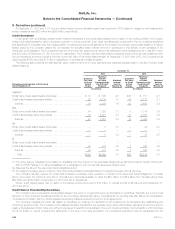

Recurring Fair Value Measurements

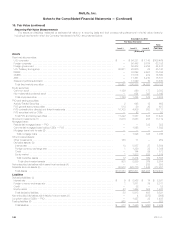

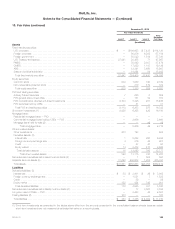

The assets and liabilities measured at estimated fair value on a recurring basis and their corresponding placement in the fair value hierarchy,

including those items for which the Company has elected the FVO, are presented below.

December 31, 2013

Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Fixed maturity securities:

U.S. corporate .................................................................. $ — $ 99,321 $ 7,148 $106,469

Foreign corporate ................................................................ — 56,448 6,704 63,152

Foreign government .............................................................. — 52,202 2,235 54,437

U.S. Treasury and agency ......................................................... 25,061 20,000 62 45,123

RMBS ......................................................................... — 32,098 2,957 35,055

CMBS ......................................................................... — 15,578 972 16,550

ABS........................................................................... — 11,361 4,210 15,571

State and political subdivision ....................................................... — 13,820 10 13,830

Total fixed maturity securities ...................................................... 25,061 300,828 24,298 350,187

Equity securities:

Common stock .................................................................. 1,186 990 177 2,353

Non-redeemable preferred stock .................................................... — 654 395 1,049

Total equity securities ............................................................ 1,186 1,644 572 3,402

FVO and trading securities:

Actively Traded Securities .......................................................... 2 648 12 662

FVO general account securities ..................................................... 518 80 29 627

FVO contractholder-directed unit-linked investments ..................................... 10,702 4,806 603 16,111

FVO securities held by CSEs ....................................................... — 23 — 23

Total FVO and trading securities .................................................... 11,222 5,557 644 17,423

Short-term investments (1) .......................................................... 5,915 6,943 254 13,112

Mortgage loans:

Residential mortgage loans — FVO .................................................. — — 338 338

Commercial mortgage loans held by CSEs — FVO ...................................... — 1,598 — 1,598

Mortgage loans held-for-sale (2) ..................................................... — — — —

Total mortgage loans ........................................................... — 1,598 338 1,936

Other invested assets:

Other investments ................................................................ 188 71 — 259

Derivative assets: (3)

Interest rate .................................................................... 10 5,557 27 5,594

Foreign currency exchange rate .................................................... 1 1,280 28 1,309

Credit ........................................................................ — 144 29 173

Equity market .................................................................. 1 1,233 285 1,519

Total derivative assets ........................................................... 12 8,214 369 8,595

Total other invested assets ..................................................... 200 8,285 369 8,854

Net embedded derivatives within asset host contracts (4) .................................. — — 285 285

Separate account assets (5) ......................................................... 89,960 225,776 1,465 317,201

Total assets ................................................................... $133,544 $550,631 $28,225 $712,400

Liabilities

Derivative liabilities: (3)

Interest rate ..................................................................... $ 9 $ 2,568 $ 14 $ 2,591

Foreign currency exchange rate ..................................................... 1 1,971 39 2,011

Credit ......................................................................... — 52 — 52

Equity market ................................................................... 43 1,222 602 1,867

Total derivative liabilities .......................................................... 53 5,813 655 6,521

Net embedded derivatives within liability host contracts (4) .................................. — 4 (973) (969)

Long-term debt of CSEs — FVO ...................................................... — 1,427 28 1,455

Trading liabilities (6) ................................................................ 260 2 — 262

Total liabilities .................................................................. $ 313 $ 7,246 $ (290) $ 7,269

148 MetLife, Inc.