MetLife 2013 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

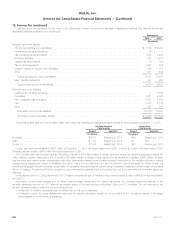

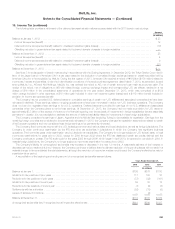

19. Income Tax

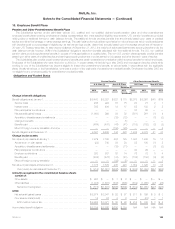

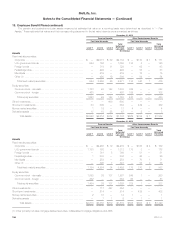

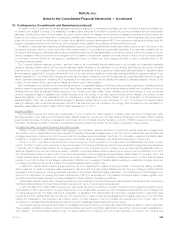

The provision for income tax from continuing operations was as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Current:

Federal ......................................................................................... $ 85 $ (29) $ (200)

State and local ................................................................................... 2 6 (1)

Foreign ......................................................................................... 422 846 614

Subtotal ....................................................................................... 509 823 413

Deferred:

Federal ......................................................................................... (250) (244) 2,241

State and local ................................................................................... (11) (1) (3)

Foreign ......................................................................................... 413 (450) 142

Subtotal ....................................................................................... 152 (695) 2,380

Provision for income tax expense (benefit) ........................................................... $661 $128 $2,793

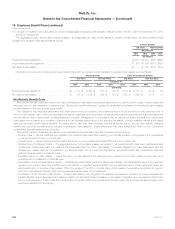

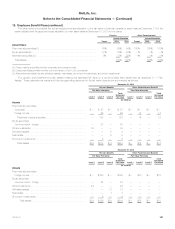

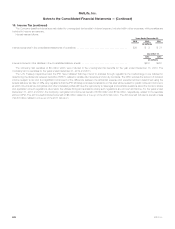

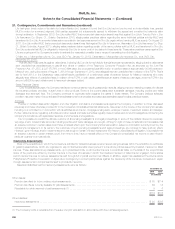

The Company’s income (loss) from continuing operations before income tax expense (benefit) from domestic and foreign operations were as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Income (loss) from continuing operations:

Domestic ..................................................................................... $1,186 $(1,496) $6,869

Foreign ....................................................................................... 2,866 2,938 2,315

Total ....................................................................................... $4,052 $ 1,442 $9,184

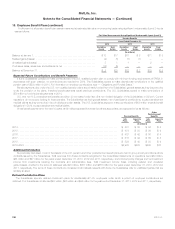

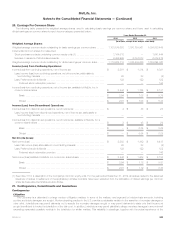

The reconciliation of the income tax provision at the U.S. statutory rate to the provision for income tax as reported for continuing operations was as

follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Tax provision at U.S. statutory rate ..................................................................... $1,418 $ 505 $3,215

Tax effect of:

Dividend received deduction ........................................................................ (166) (162) (160)

Tax-exempt income .............................................................................. (96) (94) (86)

Prior year tax .................................................................................... 75 23 (4)

Low income housing tax credits ..................................................................... (194) (150) (102)

Other tax credits ................................................................................. (54) (28) (36)

Foreign tax rate differential (1) ....................................................................... (340) (45) (41)

Change in valuation allowance ...................................................................... 30 15 16

Goodwill impairment .............................................................................. — 408 —

Deferred tax effects of branch conversions ............................................................. 4 (324) —

Other, net ...................................................................................... (16) (20) (9)

Provision for income tax expense (benefit) ........................................................... $ 661 $128 $2,793

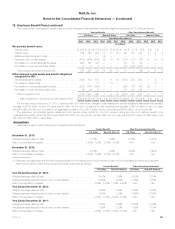

(1) For the year ended December 31, 2013, foreign tax rate differential includes one-time tax benefits of $119 million related to the receipt of a Japan

tax refund, $69 million related to the estimated reversal of Japan temporary differences, and $65 million related to the change in repatriation

assumptions for foreign earnings of certain European operations.

MetLife, Inc. 199