MetLife 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

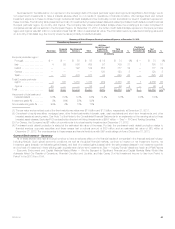

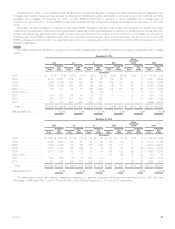

ABS

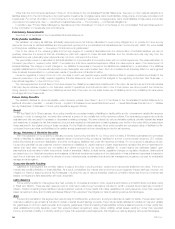

Our ABS are diversified both by collateral type and by issuer. The following table presents our ABS holdings at:

December 31,

2013 2012

Estimated

Fair

Value %of

Total

Net

Unrealized

Gains (Losses)

Estimated

Fair

Value %of

Total

Net

Unrealized

Gains (Losses)

(In millions) (In millions) (In millions) (In millions)

By collateral type:

Foreign residential loans ....................................... $ 3,415 21.9% $ 80 $ 3,811 23.8% $ 88

Collateralized debt obligations ................................... 2,960 19.0 (6) 2,453 15.3 (68)

Automobile loans ............................................. 2,635 16.9 12 2,454 15.4 28

Student loans ............................................... 2,332 15.0 17 2,480 15.5 14

Credit card loans ............................................. 2,187 14.1 20 2,640 16.5 106

Equipment loans ............................................. 427 2.7 6 597 3.7 22

Other loans ................................................. 1,615 10.4 (16) 1,562 9.8 45

Total ..................................................... $15,571 100.0% $113 $15,997 100.0% $235

Ratings profile:

Rated Aaa/AAA .............................................. $ 9,616 61.8% $10,405 65.0%

Rated NAIC 1 ............................................... $14,184 91.1% $15,247 95.3%

Evaluation of AFS Securities for OTTI and Evaluating Temporarily Impaired AFS Securities

See Notes 1 and 8 of the Notes to the Consolidated Financial Statements for information about the evaluation of fixed maturity securities and equity

securities AFS for OTTI and evaluation of temporarily impaired AFS securities.

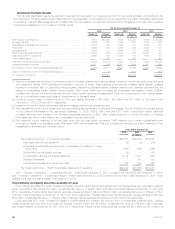

OTTI Losses on Fixed Maturity and Equity Securities AFS Recognized in Earnings

See Note 8 of the Notes to the Consolidated Financial Statements for information about OTTI losses and gross gains and gross losses on AFS securities sold.

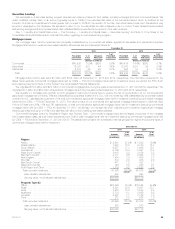

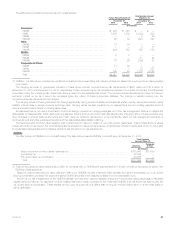

Overview of Fixed Maturity and Equity Security OTTI Losses Recognized in Earnings

Impairments of fixed maturity and equity securities were $192 million, $351 million and $1.0 billion for the years ended December 31, 2013, 2012

and 2011, respectively. Impairments of fixed maturity securities were $166 million, $317 million and $955 million for the years ended December 31,

2013, 2012 and 2011, respectively. Impairments of equity securities were $26 million, $34 million and $60 million for the years ended December 31,

2013, 2012 and 2011, respectively.

Credit-related impairments of fixed maturity securities were $147 million, $223 million and $645 million for the years ended December 31, 2013,

2012 and 2011, respectively.

Explanations of changes in fixed maturity and equity securities impairments are as follows:

Year Ended December 31, 2013 compared to the Year Ended December 31, 2012

Overall OTTI losses recognized in earnings on fixed maturity and equity securities were $192 million for the current year as compared to $351 million

in the prior year. The most significant decreases were in U.S. and foreign corporate securities and CMBS which, combined, were $86 million for the

year ended December 31, 2013, as compared to $210 million for the year ended December 31, 2012. A decrease of $85 million in OTTI losses on

U.S. and foreign corporate securities was concentrated in financial services, communications, transportation and utility industries and was primarily

attributable to intent-to-sell impairments in 2012, while a $39 million decrease in OTTI losses on CMBS reflected improving economic fundamentals.

Year Ended December 31, 2012 compared to the Year Ended December 31, 2011

Overall OTTI losses recognized in earnings on fixed maturity and equity securities were $351 million for the year ended December 31, 2012 as

compared to $1.0 billion for the year ended December 31, 2011. The most significant decrease in 2012, as compared to 2011, was in foreign

government securities. The decrease was primarily attributable to impairments in 2011 on Greece sovereign debt securities of $405 million as a result

of the reduction in the expected recoverable amount and intent-to-sell fixed maturity security OTTI on other sovereign debt securities due to the

repositioning of the acquired ALICO portfolio into longer duration and higher yielding investments. In addition, intent-to-sell OTTI related to the Divested

Businesses of $154 million were recognized in 2011 and were primarily concentrated in the RMBS sector, while utility industry impairments within

U.S. and foreign corporate securities increased $51 million in 2012.

Future Impairments

Future OTTI will depend primarily on economic fundamentals, issuer performance (including changes in the present value of future cash flows

expected to be collected), and changes in credit ratings, collateral valuation, interest rates and credit spreads. If economic fundamentals deteriorate or

if there are adverse changes in the above factors, OTTI may be incurred in upcoming periods.

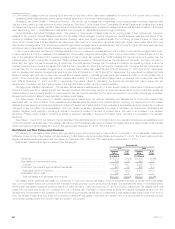

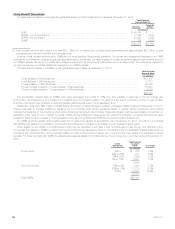

FVO and Trading Securities

FVO and trading securities are primarily comprised of securities for which the FVO has been elected (“FVO Securities”). FVO Securities include certain fixed

maturity and equity securities held-for-investment by the general account to support ALM strategies for certain insurance products and investments in certain

separate accounts. FVO Securities are primarily comprised of contractholder-directed investments supporting unit-linked variable annuity type liabilities which

do not qualify for presentation as separate account summary total assets and liabilities. These investments are primarily mutual funds and, to a lesser extent,

fixed maturity and equity securities, short-term investments and cash and cash equivalents. The investment returns on these investments inure to

contractholders and are offset by a corresponding change in PABs through interest credited to policyholder account balances. FVO Securities also include

securities held by CSEs. We have a trading securities portfolio, principally invested in fixed maturity securities, to support investment strategies that involve the

active and frequent purchase and sale of actively traded securities and the execution of short sale agreements. FVO and trading securities were $17.4 billion

and $16.3 billion at estimated fair value, or 3.5% and 3.1% of total cash and invested assets, at December 31, 2013 and 2012, respectively. See Note 10 of

the Notes to the Consolidated Financial Statements for the FVO and trading securities fair value hierarchy and a rollforward of the fair value measurements for

FVO and trading securities measured at estimated fair value on a recurring basis using significant unobservable (Level 3) inputs.

48 MetLife, Inc.