MetLife 2013 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

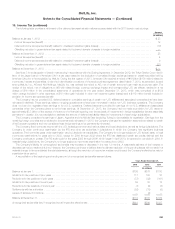

19. Income Tax (continued)

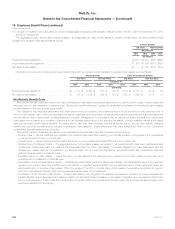

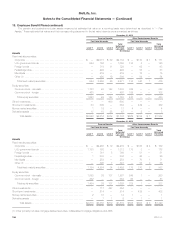

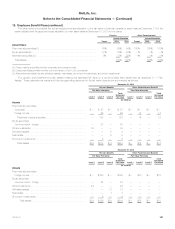

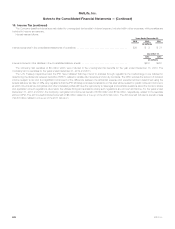

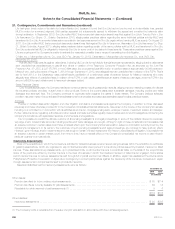

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred income tax

assets and liabilities consisted of the following at:

December 31,

2013 2012

(In millions)

Deferred income tax assets:

Policyholder liabilities and receivables ...................................................................... $ 1,014 $ 6,233

Investments, including derivatives ......................................................................... 86 —

Net operating loss carryforwards .......................................................................... 1,808 1,408

Employee benefits ..................................................................................... 737 1,234

Capital loss carryforwards ............................................................................... 32 160

Tax credit carryforwards ................................................................................ 1,653 545

Litigation-related and government mandated ................................................................ 232 197

Other ............................................................................................... 471 484

Total gross deferred income tax assets .................................................................. 6,033 10,261

Less: Valuation allowance ............................................................................... 357 368

Total net deferred income tax assets .................................................................... 5,676 9,893

Deferred income tax liabilities:

Investments, including derivatives ......................................................................... — 3,149

Intangibles ........................................................................................... 2,081 2,668

Net unrealized investment gains .......................................................................... 4,883 7,854

DAC ............................................................................................... 5,133 4,775

Other ............................................................................................... 222 140

Total deferred income tax liabilities ...................................................................... 12,319 18,586

Net deferred income tax asset (liability) ................................................................... $(6,643) $ (8,693)

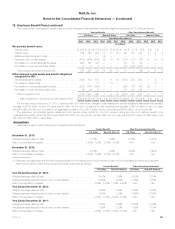

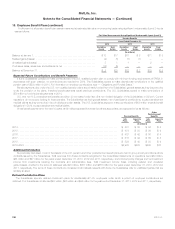

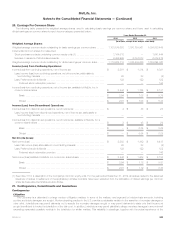

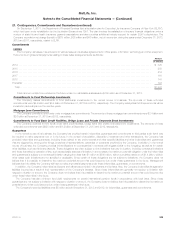

The following table sets forth the domestic, state, and foreign net operating and capital loss carryforwards for tax purposes at December 31, 2013.

Net Operating Loss

Carryforwards Capital Loss

Carryforwards

Amount Expiration Amount Expiration

(In millions) (In millions)

Domestic ............................................... $4,153 Beginning in 2018 $52 Beginning in 2018

State .................................................. $ 153 Beginning in 2014 $ — N/A

Foreign ................................................ $1,576 Beginning in 2014 $40 Beginning in 2014

Foreign tax credit carryforwards of $991 million at December 31, 2013 will expire beginning in 2015, of which $12 million will expire before 2020.

General business credits of $662 million will expire beginning in 2025.

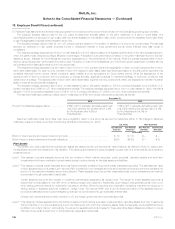

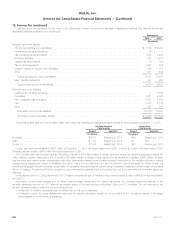

The Company also has recorded valuation allowance charges of $36 million related to certain state and foreign net operating loss carryforwards, $4

million related to branch restructuring and a benefit of $6 million related to certain foreign capital loss carryforwards. In addition a $45 million reduction

was recorded as a balance sheet reclassification with other deferred tax assets primarily related to branch restructuring. The valuation allowance reflects

management’s assessment, based on available information, that it is more likely than not that the deferred income tax asset for certain foreign net

operating and capital loss carryforwards, certain state net operating loss carryforwards, certain foreign unrealized losses and certain foreign other assets

will not be realized. The tax benefit will be recognized when management believes that it is more likely than not that these deferred income tax assets are

realizable.

In accordance with the Closing Agreement, the Company completed its plan to transfer foreign branch assets to various MetLife foreign subsidiaries

during 2013.

As a result of these asset transfers and the filing of various foreign branch and U.S. income tax returns, the Company revised the estimate of the

valuation allowance required for U.S. deferred tax assets relating to the restructuring of American Life’s non-U.S. branches. The net reduction in the

valuation allowance was primarily due to the following factors:

‰Additional U.S. deferred tax assets that more likely than not will not be realizable;

‰A reduction in both the gross deferred tax asset and the valuation allowance related to the completion of the Company’s transfer of its foreign

branch assets to wholly-owned subsidiaries.

200 MetLife, Inc.