MetLife 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

10. Fair Value (continued)

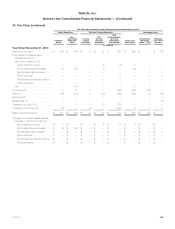

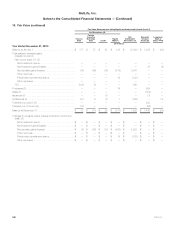

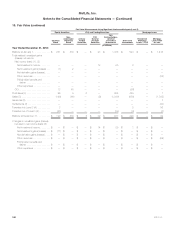

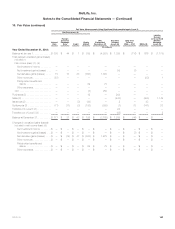

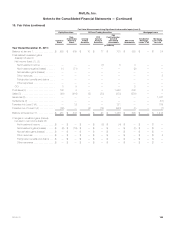

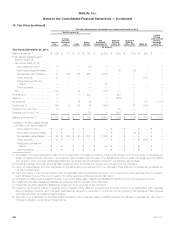

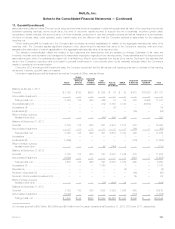

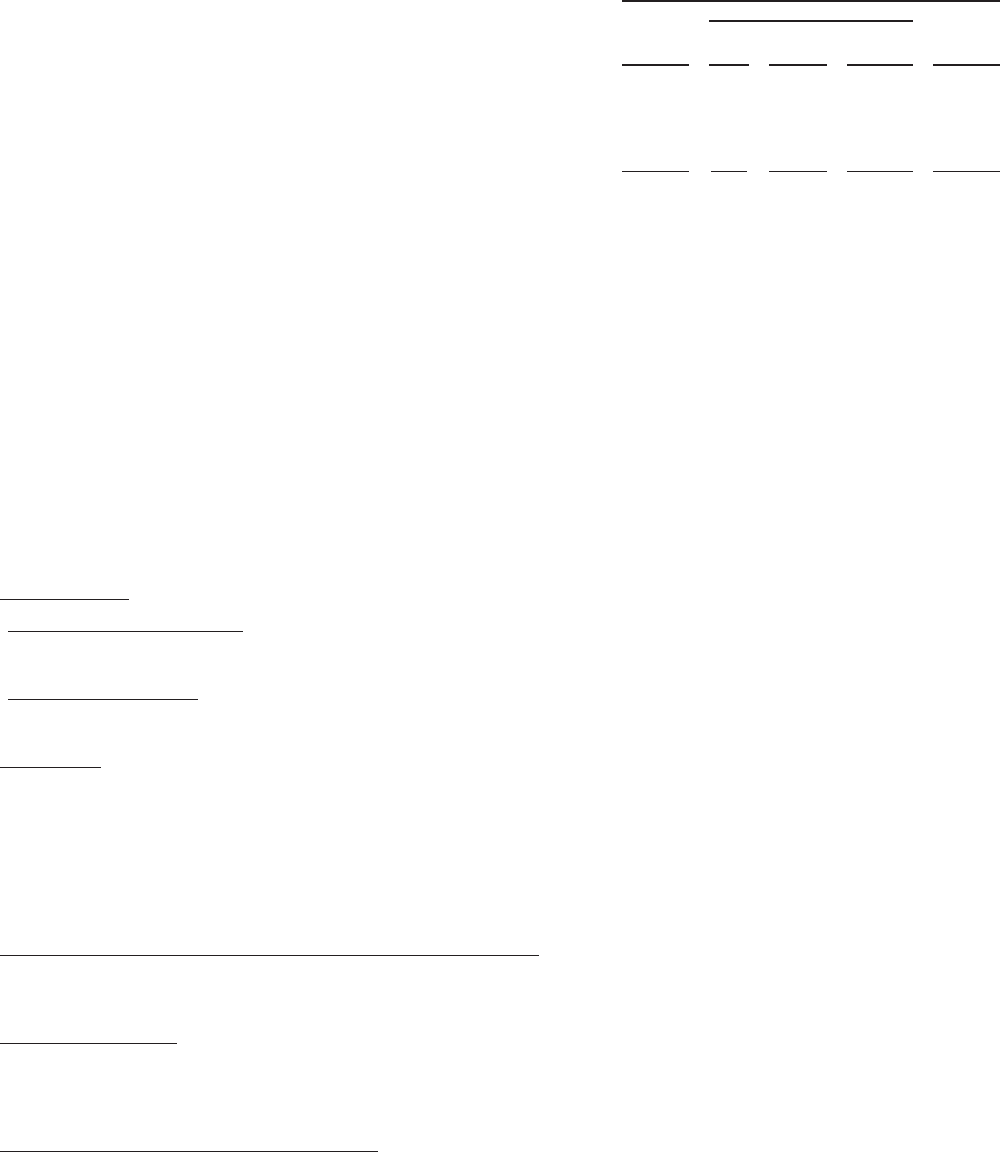

December 31, 2012

Fair Value Hierarchy

Carrying

Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Mortgage loans:

Held-for-investment ....................................................... $ 53,926 $ — $ — $ 57,381 $ 57,381

Held-for-sale ............................................................ 365 — — 365 365

Mortgage loans, net ..................................................... $ 54,291 $ — $ — $ 57,746 $ 57,746

Policy loans ............................................................... $ 11,884 $ — $ 1,690 $ 12,567 $ 14,257

Real estate joint ventures .................................................... $ 113 $ — $ — $ 171 $ 171

Other limited partnership interests .............................................. $ 1,154 $ — $ — $ 1,277 $ 1,277

Other invested assets ....................................................... $ 815 $305 $ 144 $ 366 $ 815

Premiums, reinsurance and other receivables ..................................... $ 3,287 $ — $ 745 $ 2,960 $ 3,705

Other assets .............................................................. $ 260 $ — $ 214 $ 78 $ 292

Liabilities

PABs .................................................................... $149,928 $ — $ — $158,040 $158,040

Bank deposits ............................................................. $ 6,416 $ — $ 2,018 $ 4,398 $ 6,416

Long-term debt ............................................................ $ 16,502 $ — $18,978 $ — $ 18,978

Collateral financing arrangements .............................................. $ 4,196 $ — $ — $ 3,839 $ 3,839

Junior subordinated debt securities ............................................ $ 3,192 $ — $ 3,984 $ — $ 3,984

Other liabilities ............................................................. $ 1,913 $ — $ 673 $ 1,243 $ 1,916

Separate account liabilities ................................................... $ 58,726 $ — $58,726 $ — $ 58,726

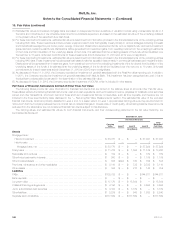

The methods, assumptions and significant valuation techniques and inputs used to estimate the fair value of financial instruments are summarized as

follows:

Mortgage Loans

Mortgage loans held-for-investment

For mortgage loans held-for-investment, estimated fair value is primarily determined by estimating expected future cash flows and discounting

them using current interest rates for similar mortgage loans with similar credit risk, or is determined from pricing for similar loans.

Mortgage loans held-for-sale

For mortgage loans held-for-sale, estimated fair value is determined using independent non-binding broker quotations or internal valuation models

using significant unobservable inputs.

Policy Loans

Policy loans with fixed interest rates are classified within Level 3. The estimated fair values for these loans are determined using a discounted cash

flow model applied to groups of similar policy loans determined by the nature of the underlying insurance liabilities. Cash flow estimates are developed

by applying a weighted-average interest rate to the outstanding principal balance of the respective group of policy loans and an estimated average

maturity determined through experience studies of the past performance of policyholder repayment behavior for similar loans. These cash flows are

discounted using current risk-free interest rates with no adjustment for borrower credit risk as these loans are fully collateralized by the cash surrender

value of the underlying insurance policy. Policy loans with variable interest rates are classified within Level 2 and the estimated fair value approximates

carrying value due to the absence of borrower credit risk and the short time period between interest rate resets, which presents minimal risk of a

material change in estimated fair value due to changes in market interest rates.

Real Estate Joint Ventures and Other Limited Partnership Interests

The estimated fair values of these cost method investments are generally based on the Company’s share of the NAV as provided in the financial

statements of the investees. In certain circumstances, management may adjust the NAV by a premium or discount when it has sufficient evidence to

support applying such adjustments.

Other Invested Assets

These other invested assets are principally comprised of various interest-bearing assets held in foreign subsidiaries and certain amounts due under

contractual indemnifications. For the various interest-bearing assets held in foreign subsidiaries, the Company evaluates the specific facts and

circumstances of each instrument to determine the appropriate estimated fair values. These estimated fair values were not materially different from the

recognized carrying values.

Premiums, Reinsurance and Other Receivables

Premiums, reinsurance and other receivables are principally comprised of certain amounts recoverable under reinsurance agreements, amounts on

deposit with financial institutions to facilitate daily settlements related to certain derivatives and amounts receivable for securities sold but not yet settled.

MetLife, Inc. 169