MetLife 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign Currency Exchange Rate Risk Management

We assume foreign currency exchange rate risk primarily in three ways: investments in foreign subsidiaries, purchases of foreign currency

denominated investments and the sale of certain insurance products.

‰The Foreign Exchange Committee, in coordination with the Treasury Department, is responsible for managing our exposure to investments in

foreign subsidiaries. Limits to exposures are established by the Treasury Department and monitored by GRM. The Investments Department

manages exposure.

‰The Investments Department is responsible for managing the exposure to foreign currency denominated investments. Exposure limits to

unhedged foreign currency investments are incorporated into the standing authorizations granted to management by the Board of Directors and

are reported to the Board of Directors on a periodic basis.

‰Management of each of the Company’s segments, with oversight from the Foreign Exchange Committee, is responsible for establishing limits and

managing any foreign currency exchange rate exposure caused by the sale or issuance of insurance products.

We use foreign currency swaps, forwards and options to mitigate the liability exposure, risk of loss and financial statement volatility associated with

our investments in foreign subsidiaries, foreign currency denominated fixed income investments and the sale of certain insurance products.

Equity Market Risk Management

Equity market risk exposure through the issuance of variable annuities is managed by our ALM Unit in partnership with the Investments Department.

Equity market risk is realized through our investment in equity securities and is managed by our Investments Department. We use derivatives to mitigate

our equity exposure both in certain liability guarantees such as variable annuities with guaranteed minimum benefit and equity securities. These

derivatives include exchange-traded equity futures, equity index options contracts and equity variance swaps. We also employ reinsurance to manage

these exposures.

Hedging Activities

We use derivative contracts primarily to hedge a wide range of risks including interest rate risk, foreign currency exchange rate risk, and equity

market risk. Derivative hedges are designed to reduce risk on an economic basis while considering their impact on accounting results and GAAP and

statutory capital. Our derivative hedge programs vary depending on the type of risk being hedged. Some hedge programs are asset or liability specific

while others are portfolio hedges that reduce risk related to a group of liabilities or assets. Our use of derivatives by major hedge programs is as

follows:

‰Risks Related to Living Guarantee Benefits — We use a wide range of derivative contracts to mitigate the risk associated with variable annuity

living guarantee benefits. These derivatives include equity and interest rate futures, interest rate swaps, currency futures/forwards, equity indexed

options and interest rate option contracts and equity variance swaps.

‰Minimum Interest Rate Guarantees — For certain liability contracts, we provide the contractholder a guaranteed minimum interest rate. These

contracts include certain fixed annuities and other insurance liabilities. We purchase interest rate floors to reduce risk associated with these liability

guarantees.

‰Reinvestment Risk in Long Duration Liability Contracts — Derivatives are used to hedge interest rate risk related to certain long duration liability

contracts. Hedges include interest rate swaps and swaptions.

‰Foreign Currency Exchange Rate Risk — We use currency swaps, forwards and options to hedge foreign currency exchange rate risk. These

hedges primarily swap foreign currency denominated bonds, investments in foreign subsidiaries or equity market exposures to U.S. dollars.

‰General ALM Hedging Strategies — In the ordinary course of managing our asset/liability risks, we use interest rate futures, interest rate swaps,

interest rate caps, interest rate floors and inflation swaps. These hedges are designed to reduce interest rate risk or inflation risk related to the

existing assets or liabilities or related to expected future cash flows.

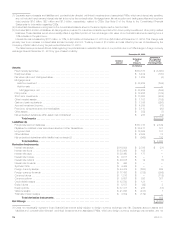

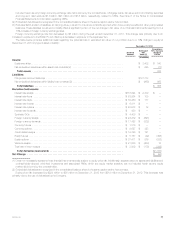

Risk Measurement: Sensitivity Analysis

We measure market risk related to our market sensitive assets and liabilities based on changes in interest rates, equity market prices and foreign

currency exchange rates utilizing a sensitivity analysis. This analysis estimates the potential changes in estimated fair value based on a hypothetical

10% change (increase or decrease) in interest rates, equity market prices and foreign currency exchange rates. We believe that a 10% change

(increase or decrease) in these market rates and prices is reasonably possible in the near term. In performing the analysis summarized below, we used

market rates at December 31, 2013. The sensitivity analysis separately calculates each of our market risk exposures (interest rate, equity market and

foreign currency exchange rate) relating to our trading and non-trading assets and liabilities. We modeled the impact of changes in market rates and

prices on the estimated fair values of our market sensitive assets and liabilities as follows:

‰the net present values of our interest rate sensitive exposures resulting from a 10% change (increase or decrease) in interest rates;

‰the U.S. dollar equivalent estimated fair values of our foreign currency exposures due to a 10% change (increase or decrease) in foreign currency

exchange rates; and

‰the estimated fair value of our equity positions due to a 10% change (increase or decrease) in equity market prices.

The sensitivity analysis is an estimate and should not be viewed as predictive of our future financial performance. We cannot ensure that our actual

losses in any particular period will not exceed the amounts indicated in the table below. Limitations related to this sensitivity analysis include:

‰the market risk information is limited by the assumptions and parameters established in creating the related sensitivity analysis, including the

impact of prepayment rates on mortgage loans;

‰for the derivatives that qualify as hedges, the impact on reported earnings may be materially different from the change in market values;

‰the analysis excludes liabilities pursuant to insurance contracts and real estate holdings; and

‰the model assumes that the composition of assets and liabilities remains unchanged throughout the period.

Accordingly, we use such models as tools and not as substitutes for the experience and judgment of our management. Based on our analysis of

the impact of a 10% change (increase or decrease) in market rates and prices, we have determined that such a change could have a material adverse

effect on the estimated fair value of certain assets and liabilities from interest rate, foreign currency exchange rate and equity market exposures.

74 MetLife, Inc.