MetLife 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assumed senior notes matured and, subsequently, in October 2012, a $250 million senior note was issued by MetLife, Inc. to MLIC. The

$250 million senior note matures on October 1, 2019 and bears interest at a fixed rate of 3.57%, payable semi-annually. The remaining $500 million

senior note matures on June 30, 2014 and bears interest at a fixed rate of 6.44%, payable semi-annually.

Dispositions

Cash proceeds from dispositions during the years ended December 31, 2013 and 2011 were $17 million and $180 million, respectively. During

the year ended December 31, 2012, there were no cash proceeds from dispositions. See Note 3 of the Notes to the Consolidated Financial

Statements for information regarding dispositions.

Liquidity and Capital Uses

The primary uses of liquidity of MetLife, Inc. include debt service, cash dividends on common and preferred stock, capital contributions to

subsidiaries, payment of general operating expenses and acquisitions. Based on our analysis and comparison of our current and future cash inflows

from the dividends we receive from subsidiaries that are permitted to be paid without prior insurance regulatory approval, our investment portfolio and

other cash flows and anticipated access to the capital markets, we believe there will be sufficient liquidity and capital to enable MetLife, Inc. to make

payments on debt, make cash dividend payments on its common and preferred stock, contribute capital to its subsidiaries, pay all general operating

expenses and meet its cash needs.

In addition to the description of liquidity and capital uses in “— The Company — Liquidity and Capital Uses” and “— Contractual Obligations,” the

following additional information is provided regarding MetLife, Inc.’s primary uses of liquidity and capital:

Affiliated Capital Transactions

During the years ended December 31, 2013, 2012 and 2011, MetLife, Inc. invested an aggregate of $934 million, $3.5 billion and $1.9 billion,

respectively, in various subsidiaries.

MetLife, Inc. lends funds, as necessary, to its subsidiaries and affiliates, some of which are regulated, to meet their capital requirements. MetLife,

Inc. had loans to subsidiaries outstanding of $2.3 billion and $750 million at December 31, 2013 and 2012, respectively.

In December 2013, MRD issued a $350 million surplus note to MetLife, Inc. due December 31, 2033. The surplus note bears interest at a fixed

rate of 6.0%, payable semi-annually. MetLife, Inc. issued a $350 million senior note to MRD in exchange for the surplus note.

In July 2013, MetLife Ireland Treasury Limited (“MITL”) borrowed the Chilean peso equivalent of $1.5 billion from MetLife, Inc. The loan bears

interest at a fixed rate of 8.5%, payable annually. In December 2013, MITL repaid $245 million of the loan to MetLife, Inc. See “— Acquisitions.”

In April 2013, MetLife Bank’s Board of Directors, with prior approval of the Office of the Comptroller of the Currency, approved the reduction of its

permanent capital by $550 million through a purchase of its $300 million of outstanding preferred stock held by MetLife, Inc. and a return of capital of

$250 million to MetLife, Inc. In May 2013, MetLife, Inc. received $550 million in cash to settle these transactions.

In December 2012, MRD issued a $750 million surplus note to MetLife, Inc. due September 2032. The surplus note bears interest at a fixed rate

of 5.13%, payable semi-annually. MetLife, Inc. issued a $750 million senior note to MRD in exchange for the surplus note.

Debt Repayments

For information on MetLife, Inc.’s debt repayments, see “— The Company — Liquidity and Capital Uses — Debt Repayments.” MetLife, Inc.

intends to repay all or refinance in whole or in part the debt that is due in 2014.

Debt and Facility Covenants

Certain of MetLife, Inc.’s debt instruments, credit facilities and committed facilities contain various administrative, reporting, legal and financial

covenants. MetLife, Inc. believes it was in compliance with all such covenants at December 31, 2013.

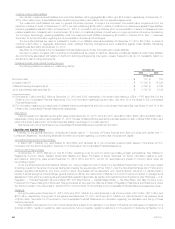

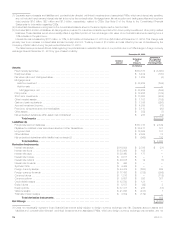

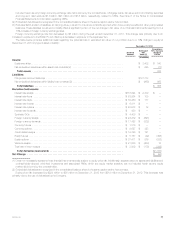

Maturities of Senior Notes

The following table summarizes MetLife, Inc.’s outstanding senior notes by year of maturity through 2018 and 2019 to 2045, excluding any

premium or discount, at December 31, 2013:

Year of Maturity Principal Interest Rate

(In millions)

2014 ........................................................................ $ 1,000 2.38%

2014 ........................................................................ $ 350 5.50%

2014 ........................................................................ $ 500 6.44%

2015 ........................................................................ $ 1,000 5.00%

2016 ........................................................................ $ 1,250 6.75%

2016 ........................................................................ $ 250 7.44%

2017 ........................................................................ $ 500 1.76%

2018 ........................................................................ $ 500 2.46%

2018 ........................................................................ $ 1,035 6.82%

2019 - 2045 .................................................................. $12,677 Ranging from 2.46% - 7.72

Support Agreements

MetLife, Inc. is party to various capital support commitments and guarantees with certain of its subsidiaries. Under these arrangements, MetLife,

Inc. has agreed to cause each such entity to meet specified capital and surplus levels or has guaranteed certain contractual obligations.

In October 2013, MetLife, Inc. guaranteed two-year notes issued by Exeter to affiliates, MICC and MLI-USA, totaling $500 million that bear interest

at 2.47%.

In January 2013, MetLife, Inc. entered into an 18-month agreement with MetLife Bank to lend up to $500 million to MetLife Bank on a revolving

basis. In January 2013, MetLife Bank both drew down and repaid $400 million under the agreement, which bore interest at a rate of three-month

LIBOR plus 1.75%. In February 2013, the agreement was amended to reduce borrowing capacity to $100 million. MetLife Bank’s rights and

obligations under the agreement succeeded to MLHL upon the merger of MetLife Bank with and into MLHL. On October 29, 2013, MetLife, Inc. and

MLHL agreed to terminate the agreement. There were no loans outstanding at such date.

70 MetLife, Inc.