MetLife 2013 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

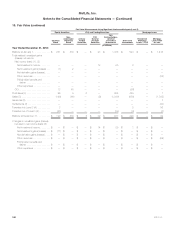

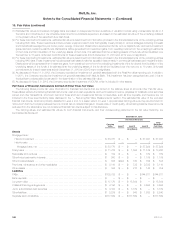

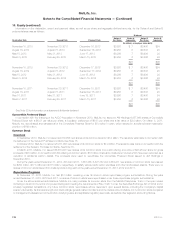

11. Goodwill (continued)

(2) For purposes of goodwill impairment testing, the $229 million of net goodwill in Corporate & Other at December 31, 2012, which resulted from

goodwill acquired as part of the 2005 Travelers acquisition, was allocated to business units of the Retail; Group, Voluntary & Worksite Benefits; and

Corporate Benefit Funding segments in the amounts of $34 million, $9 million and $186 million, respectively.

(3) Goodwill associated with the ALICO Acquisition was allocated among the Company’s segments in the first quarter of 2011.

(4) As of November 1, 2011, American Life’s current and deferred income taxes were affected by measurement period adjustments, which resulted in a

$39 million increase to the goodwill recorded as part of the ALICO Acquisition related to Japan which is included in the Asia segment.

(5) In 2011, the Company performed a goodwill impairment test on MetLife Bank, which was a separate reporting unit in Corporate & Other. A

comparison of the fair value of the reporting unit, using a market multiple approach, to its carrying value indicated a potential for goodwill impairment.

A further comparison of the implied fair value of the reporting unit’s goodwill with its carrying amount indicated that the entire amount of goodwill

associated with MetLife Bank was impaired. Consequently, the Company recorded a $65 million goodwill impairment charge that is reflected as a

net investment loss for the year ended December 31, 2011. In connection with the MetLife Bank Divestiture, goodwill and the related accumulated

impairment were reduced by $65 million for the year ended December 31, 2013. See Note 3.

(6) In connection with its annual goodwill impairment testing in 2012, the market multiple and discounted cash flow valuation approaches indicated that

the fair value of the Retail Annuities reporting unit was below its carrying value. As a result, an actuarial appraisal, which estimates the net worth of

the reporting unit, the value of existing business and the value of new business, was also performed. This appraisal also resulted in a fair value of the

Retail Annuities reporting unit that was less than the carrying value, indicating a potential for goodwill impairment. A further comparison of the implied

fair value of its goodwill with the reporting unit’s carrying amount indicated that the entire amount of goodwill associated with the Retail Annuities

reporting unit was impaired. Consequently, the Company recorded a non-cash charge of $1.9 billion ($1.6 billion, net of income tax) for the

impairment of the entire goodwill balance in the consolidated statements of operations for the year ended December 31, 2012. Of this amount, $1.4

billion was impaired at MetLife, Inc. There was no impact on income taxes.

(7) See Note 3 for a discussion of the acquisition of ProVida, which is included in the Latin America segment.

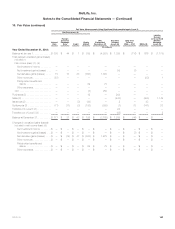

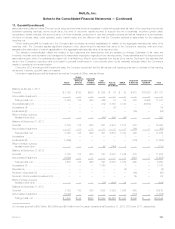

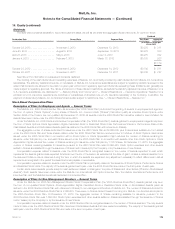

12. Long-term and Short-term Debt

Long-term and short-term debt outstanding was as follows:

Interest Rates (1)

MaturityRange Weighted

Average

December 31,

2013 2012

(In millions)

Senior notes ..................................................... 1.52% - 7.72% 4.96% 2014 - 2045 $15,938 $15,669

Surplus notes .................................................... 7.63% - 7.88% 7.84% 2015 - 2025 701 700

Other notes ...................................................... 1.39% - 8.00% 4.04% 2014 - 2030 531 133

Capital lease obligations ............................................ 28 33

Total long-term debt (2) ............................................. 17,198 16,535

Total short-term debt ............................................... 175 100

Total .......................................................... $17,373 $16,635

(1) Range of interest rates and weighted average interest rates are for the year ended December 31, 2013.

(2) Excludes $1.5 billion and $2.5 billion of long-term debt relating to CSEs — FVO at December 31, 2013 and 2012, respectively. See Note 8.

The aggregate maturities of long-term debt at December 31, 2013 for the next five years and thereafter are $1.4 billion in 2014, $1.2 billion in 2015,

$1.3 billion in 2016, $502 million in 2017, $1.5 billion in 2018 and $11.3 billion thereafter.

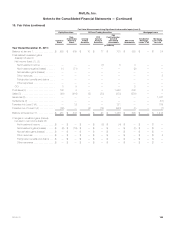

Capital lease obligations are collateralized and rank highest in priority, followed by unsecured senior debt which consists of senior notes and other

notes, followed by subordinated debt which consists of junior subordinated debt securities (see Note 14). Payments of interest and principal on the

Company’s surplus notes, which are subordinate to all other obligations at the operating company level and are senior to obligations at MetLife, Inc.,

may be made only with the prior approval of the insurance department of the state of domicile. Collateral financing arrangements (see Note 13) are

supported by either surplus notes of subsidiaries or financing arrangements with MetLife, Inc. and, accordingly, have priority consistent with other such

obligations.

Certain of the Company’s debt instruments, credit facilities and committed facilities contain various administrative, reporting, legal and financial

covenants. The Company believes it was in compliance with all such covenants at December 31, 2013.

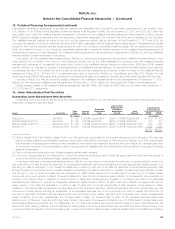

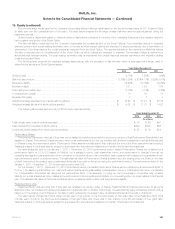

Senior Notes — Senior Debt Securities Underlying Common Equity Units

In connection with the financing of the ALICO Acquisition in November 2010, MetLife, Inc. issued to AM Holdings $3.0 billion (estimated fair value of

$3.0 billion) of three series of debt securities (the “Series C Debt Securities,” the “Series D Debt Securities,” and the “Series E Debt Securities,”

collectively, the “Debt Securities”), which constitute a part of the common equity units more fully described in Note 15.

In both September 2013 and October 2012, MetLife, Inc. closed the successful remarketing of senior debt securities underlying the common equity

units. The Series D Debt Securities were remarketed in September 2013 as 4.368% senior debt securities due September 2023. The Series C Debt

Securities were remarketed in October 2012 as 1.756% Series C senior debt securities Tranche 1 and 3.048% Series C senior debt securities

Tranche 2, due December 2017 and December 2022, respectively. MetLife, Inc. did not receive any proceeds from the remarketings.

The Series E Debt Securities initially bear interest at 2.46%, initially mature in June 2045, and are subject to remarketing. The interest rates will be

reset in connection with the successful remarketing of the Series E Debt Securities. Prior to the first scheduled attempted remarketing of the Series E

Debt Securities, such Debt Securities will be divided into two tranches equal in principal amount with maturity dates of June 2018 and June 2045.

172 MetLife, Inc.