MetLife 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

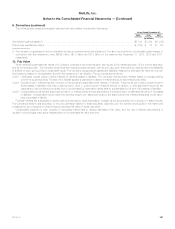

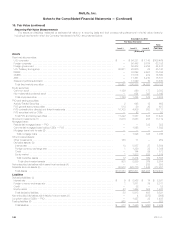

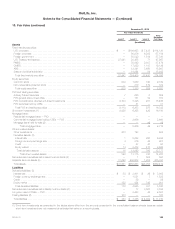

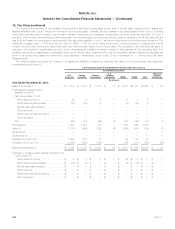

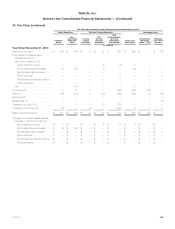

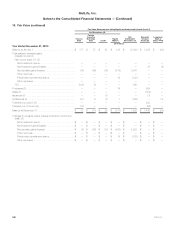

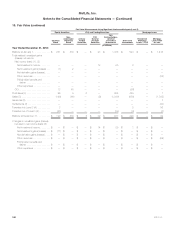

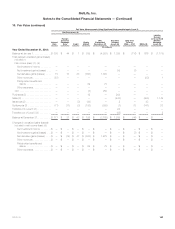

10. Fair Value (continued)

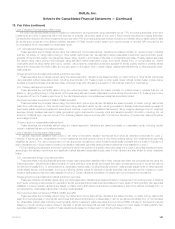

agreements and collateral arrangements. The Company values its OTC-bilateral and OTC-cleared derivatives using standard swap curves which may

include a spread to the risk free rate, depending upon specific collateral arrangements. This credit spread is appropriate for those parties that execute

trades at pricing levels consistent with similar collateral arrangements. As the Company and its significant derivative counterparties generally execute

trades at such pricing levels and hold sufficient collateral, additional credit risk adjustments are not currently required in the valuation process. The

Company’s ability to consistently execute at such pricing levels is in part due to the netting agreements and collateral arrangements that are in place

with all of its significant derivative counterparties. An evaluation of the requirement to make additional credit risk adjustments is performed by the

Company each reporting period.

Freestanding Derivatives

Level 2 Valuation Techniques and Key Inputs:

This level includes all types of derivatives utilized by the Company with the exception of exchange-traded derivatives included within Level 1 and

those derivatives with unobservable inputs as described in Level 3. These derivatives are principally valued using the income approach.

Interest rate

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve

and basis curves.

Option-based. — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, basis

curves and interest rate volatility.

Foreign currency exchange rate

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

basis curves, currency spot rates and cross currency basis curves.

Option-based. — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, basis

curves, currency spot rates, cross currency basis curves and currency volatility.

Credit

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

credit curves and recovery rates.

Equity market

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

spot equity index levels and dividend yield curves.

Option-based. — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, spot

equity index levels, dividend yield curves and equity volatility.

Level 3 Valuation Techniques and Key Inputs:

These derivatives are principally valued using the income approach. Valuations of non-option-based derivatives utilize present value techniques,

whereas valuations of option-based derivatives utilize option pricing models. These valuation methodologies generally use the same inputs as

described in the corresponding sections above for Level 2 measurements of derivatives. However, these derivatives result in Level 3 classification

because one or more of the significant inputs are not observable in the market or cannot be derived principally from, or corroborated by, observable

market data.

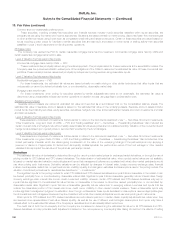

Interest rate

Non-option-based. — Significant unobservable inputs may include the extrapolation beyond observable limits of the swap yield curve and basis

curves.

Option-based. — Significant unobservable inputs may include the extrapolation beyond observable limits of the swap yield curve, basis curves

and interest rate volatility.

Foreign currency exchange rate

Non-option-based. — Significant unobservable inputs may include the extrapolation beyond observable limits of the swap yield curve, basis

curves, cross currency basis curves and currency correlation.

Option-based. — Significant unobservable inputs may include currency correlation and the extrapolation beyond observable limits of the swap

yield curve, basis curves, cross currency basis curves and currency volatility.

Credit

Non-option-based. — Significant unobservable inputs may include credit spreads, repurchase rates and the extrapolation beyond observable

limits of the swap yield curve and credit curves. Certain of these derivatives are valued based on independent non-binding broker quotations.

Equity market

Non-option-based. — Significant unobservable inputs may include the extrapolation beyond observable limits of dividend yield curves and

equity volatility.

Option-based. — Significant unobservable inputs may include the extrapolation beyond observable limits of dividend yield curves, equity

volatility and unobservable correlation between model inputs.

Embedded Derivatives

Embedded derivatives principally include certain direct, assumed and ceded variable annuity guarantees and equity or bond indexed crediting rates

within certain funding agreements. Embedded derivatives are recorded at estimated fair value with changes in estimated fair value reported in net

income.

MetLife, Inc. 153