MetLife 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

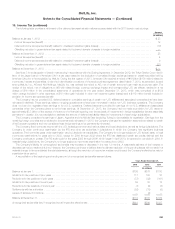

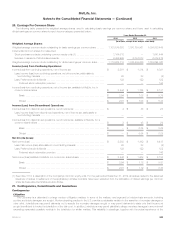

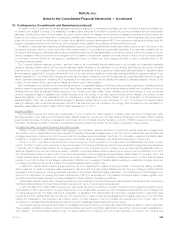

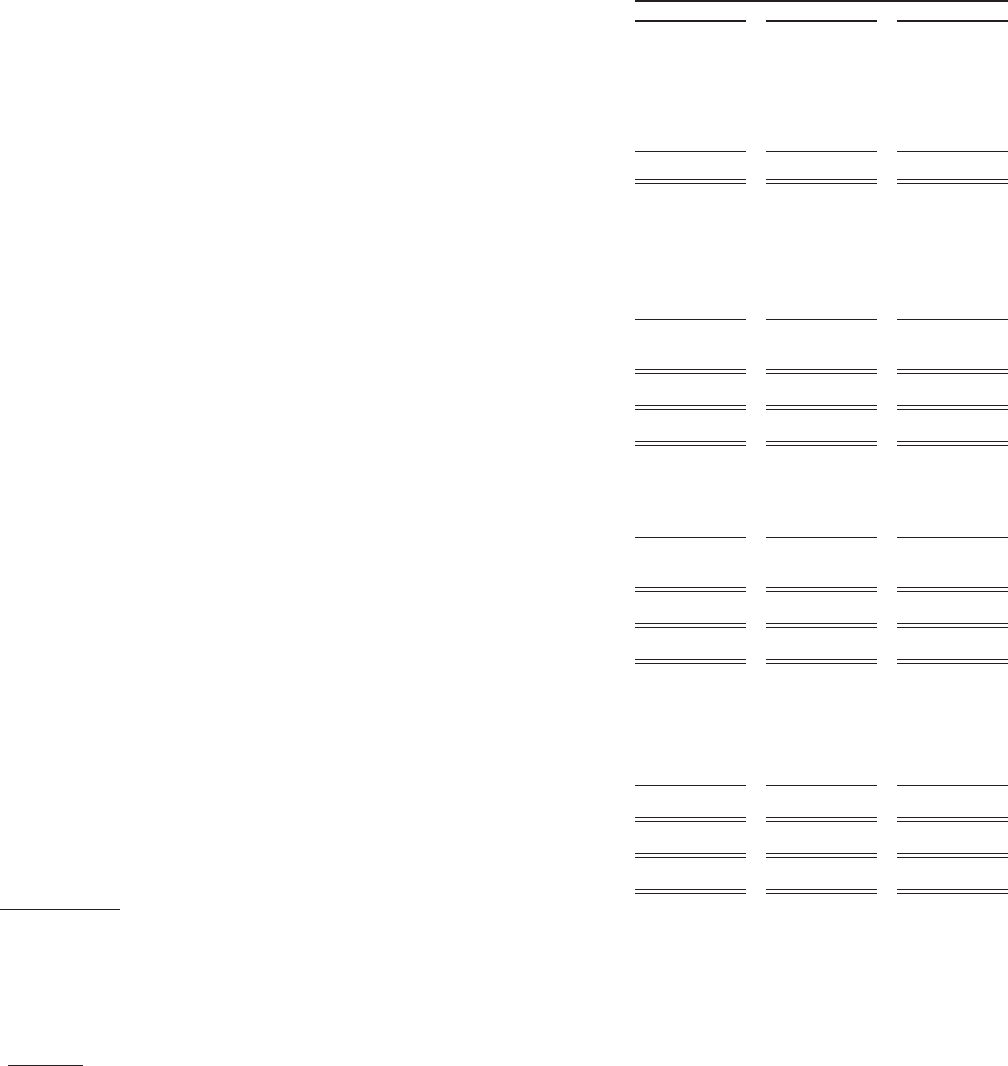

20. Earnings Per Common Share

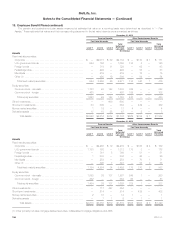

The following table presents the weighted average shares used in calculating basic earnings per common share and those used in calculating

diluted earnings per common share for each income category presented below:

Years Ended December 31,

2013 2012 2011

(In millions, except share and per share data)

Weighted Average Shares:

Weighted average common stock outstanding for basic earnings per common share ...... 1,105,579,693 1,070,755,561 1,059,580,442

Incremental common shares from assumed:

Stock purchase contracts underlying common equity units (1) ...................... 1,164,018 — 1,641,444

Exercise or issuance of stock-based awards .................................... 9,458,999 6,084,078 6,872,474

Weighted average common stock outstanding for diluted earnings per common share ..... 1,116,202,710 1,076,839,639 1,068,094,360

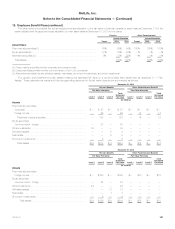

Income (Loss) from Continuing Operations:

Income (loss) from continuing operations, net of income tax $ 3,391 $ 1,314 $ 6,391

Less: Income (loss) from continuing operations, net of income tax, attributable to

noncontrolling interests ................................................... 25 38 (8)

Less: Preferred stock dividends .............................................. 122 122 122

Preferred stock redemption premium ...................................... — — 146

Income (loss) from continuing operations, net of income tax, available to MetLife, Inc.’s

common shareholders $ 3,244 $ 1,154 $ 6,131

Basic ............................................................... $ 2.94 $ 1.08 $ 5.79

Diluted .............................................................. $ 2.91 $ 1.08 $ 5.74

Income (Loss) from Discontinued Operations:

Income (loss) from discontinued operations, net of income tax ........................ $ 2 $ 48 $ 24

Less: Income (loss) from discontinued operations, net of income tax, attributable to

noncontrolling interests ................................................... — — —

Income (loss) from discontinued operations, net of income tax, available to MetLife, Inc.’s

common shareholders ..................................................... $ 2 $ 48 $ 24

Basic ............................................................... $ — $ 0.04 $ 0.02

Diluted .............................................................. $ — $ 0.04 $ 0.02

Net Income (Loss):

Net income (loss) ........................................................... $ 3,393 $ 1,362 $ 6,415

Less: Net income (loss) attributable to noncontrolling interests ...................... 25 38 (8)

Less: Preferred stock dividends .............................................. 122 122 122

Preferred stock redemption premium ...................................... — — 146

Net income (loss) available to MetLife, Inc.’s common shareholders .................... $ 3,246 $ 1,202 $ 6,155

Basic ............................................................... $ 2.94 $ 1.12 $ 5.81

Diluted .............................................................. $ 2.91 $ 1.12 $ 5.76

(1) See Note 15 for a description of the Company’s common equity units. For the year ended December 31, 2012, all shares related to the assumed

issuance of shares in settlement of the applicable purchase contracts have been excluded from the calculation of diluted earnings per common

share as these assumed shares are anti-dilutive.

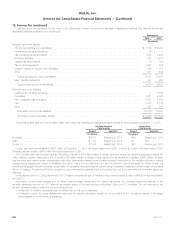

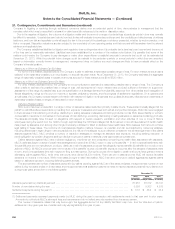

21. Contingencies, Commitments and Guarantees

Contingencies

Litigation

The Company is a defendant in a large number of litigation matters. In some of the matters, very large and/or indeterminate amounts, including

punitive and treble damages, are sought. Modern pleading practice in the U.S. permits considerable variation in the assertion of monetary damages or

other relief. Jurisdictions may permit claimants not to specify the monetary damages sought or may permit claimants to state only that the amount

sought is sufficient to invoke the jurisdiction of the trial court. In addition, jurisdictions may permit plaintiffs to allege monetary damages in amounts well

exceeding reasonably possible verdicts in the jurisdiction for similar matters. This variability in pleadings, together with the actual experience of the

MetLife, Inc. 203