MetLife 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

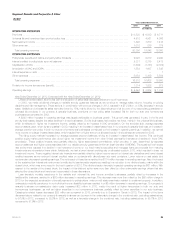

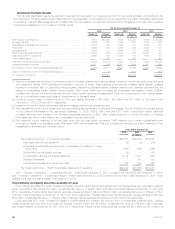

our U.K. closeout business. We expect that customers may choose to close out portions of pension plans over time, at costs reflecting current

interest rates and availability of capital. In addition, higher structured settlement sales of $56 million, before income tax, resulted from fewer

competitors in the market in 2013. Changes in premiums for these businesses were almost entirely offset by the related changes in policyholder

benefits.

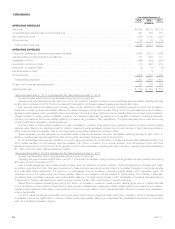

The impact of 2013 deposits and funding agreement issuances contributed to an increase in invested assets, resulting in an increase of $183

million in operating earnings. Growth in deposits and funding agreement issuances generally results in a corresponding increase in interest credited

on certain insurance liabilities; this decreased operating earnings by $149 million compared to 2012.

The sustained low interest rate environment continued to impact our investment returns, as well as interest credited on certain insurance liabilities.

Lower investment returns on our fixed maturity securities, mortgage loans and real estate joint ventures were partially offset by increased earningson

interest rate derivatives and our securities lending program. Many of our funding agreement and guaranteed interest contract liabilities have interest

credited rates that are contractually tied to external indices and, as a result, we set lower interest credited rates on new business, as well as on

existing business with terms that can fluctuate. The impact of lower interest credited expense was partially offset by lower investment returns and

resulted in a net increase in operating earnings of $90 million.

Mortality results were mixed across our products and resulted in a slight increase in operating earnings. The net impact of insurance liability

refinements in both 2013 and 2012 decreased operating earnings by $25 million.

Higher costs associated with technology initiatives and pension and postretirement benefit plans, as well as an increase in litigation reserves, were

partially offset by lower employee-related expenses realized through operating efficiencies. This increase in operating expenses was slightly offset by

higher fees earned on our separate account balances, which grew during 2013 as a result of an increase in average separate account deposits. The

net impact of these items was a $15 million decrease in operating earnings.

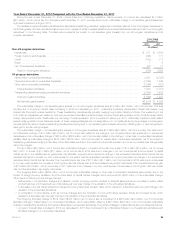

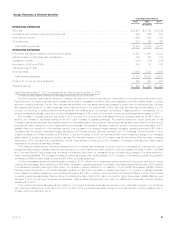

Year Ended December 31, 2012 Compared with the Year Ended December 31, 2011

Unless otherwise stated, all amounts discussed below are net of income tax.

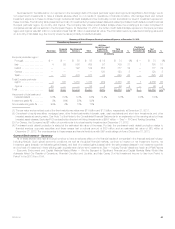

The sustained low interest rate environment has resulted in underfunded pension plans, which limits our customers’ ability to engage in full

pension plan closeout terminations. However, we expect that customers may choose to close out portions of pension plans over time, at costs

reflecting current interest rates and availability of capital. During 2012, the conversion of an existing contract involving the transfer of funds from the

separate account to the general account resulted in a significant increase in premiums in our domestic closeout business. Structured settlement sales

have decreased $463 million, before income tax, reflecting a more competitive market and a decrease in demand due to the low interest rate

environment. Changes in premiums for these businesses were almost entirely offset by the related changes in policyholder benefits. The impact of

2012 premiums, deposits, funding agreement issuances, and increased participation in the securities lending program, contributed to an increase in

invested assets, resulting in an increase of $179 million in operating earnings. The growth in premiums, deposits and funding agreement issuances

generally result in a corresponding increase in interest credited on certain insurance liabilities; this decreased operating earnings by $158 million in

2012 as compared to 2011.

Expenses declined largely as a result of disciplined spending and a decrease in sales volume-related costs, such as commissions and premium

taxes. A decrease in structured settlement commissions was partially offset by an increase in commissions from sales of funding agreements, which

improved operating earnings by $23 million.

The low interest rate environment continued to impact our investment returns, as well as interest credited on certain insurance liabilities. Lower

investment returns on our fixed maturity securities and securities lending program were partially offset by increased earnings on interest rate

derivatives and on private equity investments from improved equity markets. Many of our funding agreement and guaranteed interest contract liabilities

have interest credited rates that are contractually tied to external indices and, as a result, we set lower interest credited rates on new business, as well

as on existing business with terms that can fluctuate. The positive impact of lower interest credited rates was partially offset by an increase in interest

credited expense resulting from the impact of derivatives that are used to hedge certain liabilities. The net impact of lower interest credited expense

and lower investment returns resulted in an increase in operating earnings of $43 million.

The net impact of insurance liability refinements in both 2012 and 2011 coupled with a 2011 charge in connection with our use of the U.S. Social

Security Administration’s Death Master File in our postretirement benefit business increased operating earnings by $31 million. This increase was

partially offset by unfavorable mortality experience in the pension closeout businesses which resulted in an $8 million decrease in operating earnings.

MetLife, Inc. 33