MetLife 2013 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

12. Long-term and Short-term Debt (continued)

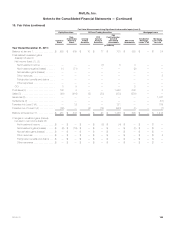

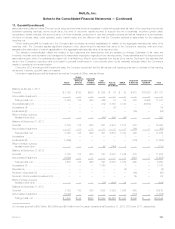

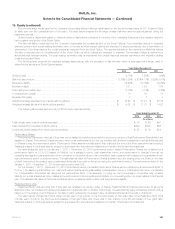

Committed Facilities

The committed facilities are used for collateral for certain of the Company’s affiliated reinsurance liabilities. Total fees expensed associated with these

committed facilities were $103 million, $96 million and $93 million for the years ended December 31, 2013, 2012 and 2011, respectively, and are

included in other expenses. Information on these committed facilities at December 31, 2013 was as follows:

Account Party/Borrower(s) Expiration Capacity

Letters of

Credit

Issued Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. ............................................... August 2014 $ 300 $ 300 $ — $ —

Exeter Reassurance Company, Ltd., MetLife, Inc. & Missouri

Reinsurance, Inc. ......................................... June 2016 500 490 — 10

MetLife Reinsurance Company of Vermont & MetLife, Inc. ........... December 2020 (1) 350 350 — —

Exeter Reassurance Company, Ltd. ............................ December 2027 (1) 650 600 — 50

MetLife Reinsurance Company of South Carolina & MetLife, Inc. ...... June 2037 (2) 3,500 — 2,797 703

MetLife Reinsurance Company of Vermont & MetLife, Inc. ........... December 2037 (1) 2,896 1,937 — 959

MetLife Reinsurance Company of Vermont & MetLife, Inc. ........... September 2038 (1) 4,250 3,062 — 1,188

Total ................................................. $12,446 $6,739 $2,797 $2,910

(1) MetLife, Inc. is guarantor under this agreement.

(2) The drawdown on this facility is associated with a collateral financing arrangement described more fully in Note 13.

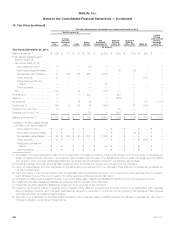

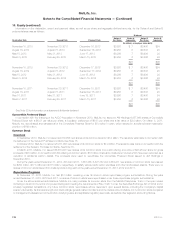

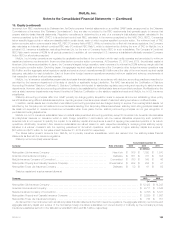

13. Collateral Financing Arrangements

Associated with the Closed Block

In December 2007, MLIC reinsured a portion of its closed block liabilities to MRC, a wholly-owned subsidiary of MetLife, Inc. In connection with this

transaction, MRC issued, to investors placed by an unaffiliated financial institution, $2.5 billion in aggregate principal amount of 35-year surplus notes to

provide statutory reserve support for the assumed closed block liabilities. Interest on the surplus notes accrues at an annual rate of three-month LIBOR

plus 0.55%, payable quarterly. The ability of MRC to make interest and principal payments on the surplus notes is contingent upon South Carolina

regulatory approval.

Simultaneous with the issuance of the surplus notes, MetLife, Inc. entered into an agreement with the unaffiliated financial institution, under which

MetLife, Inc. is entitled to the interest paid by MRC on the surplus notes of three-month LIBOR plus 0.55% in exchange for the payment of three-month

LIBOR plus 1.12%, payable quarterly on such amount as adjusted, as described below. MetLife, Inc. may also be required to pledge collateral or make

payments to the unaffiliated financial institution related to any decline in the estimated fair value of the surplus notes. Any such payments would be

accounted for as a receivable and included in other assets on the Company’s consolidated balance sheets and would not reduce the principal amount

outstanding of the surplus notes. Such payments would, however, reduce the amount of interest payments due from MetLife, Inc. under the agreement.

Any payment received from the unaffiliated financial institution would reduce the receivable by an amount equal to such payment and would also

increase the amount of interest payments due from MetLife, Inc. under the agreement. In addition, the unaffiliated financial institution may be required to

pledge collateral to MetLife, Inc. related to any increase in the estimated fair value of the surplus notes. MetLife, Inc. may also be required to make a

payment to the unaffiliated financial institution in connection with any early termination of this agreement.

In June 2012 and December 2011, following regulatory approval, MRC repurchased and canceled $451 million and $650 million, respectively, in

aggregate principal amount of the surplus notes. Payments made by the Company in June 2012 and December 2011 associated with the partial

repurchases, which also included payments made to the unaffiliated financial institution, totaled $451 million and $650 million, respectively, exclusive of

accrued interest on the surplus notes. In connection with the partial repurchases, in June 2012 and December 2011, the amount of the receivable from

the unaffiliated financial institution decreased $59 million and $84 million, respectively.

In addition, in June 2011, MetLife, Inc. received $100 million from the unaffiliated financial institution related to an increase in the estimated fair value

of the surplus notes. No such payments were made or received by MetLife, Inc. during 2013 and 2012.

At both December 31, 2013 and 2012, the amount of the surplus notes outstanding was $1.4 billion. At both December 31, 2013 and 2012, the

amount of the receivable from the unaffiliated financial institution was $182 million.

In addition, at December 31, 2013 and 2012, MetLife, Inc. had pledged collateral with an estimated fair value of $23 million and $120 million,

respectively, to the unaffiliated financial institution.

A majority of the proceeds from the offering of the surplus notes was placed in a trust, which is consolidated by the Company, to support MRC’s

statutory obligations associated with the assumed closed block liabilities. At December 31, 2013 and 2012, the estimated fair value of assets held in

trust by the Company was $1.7 billion and $1.6 billion, respectively. The assets are principally invested in fixed maturity securities and are presented as

such within the Company’s consolidated balance sheets, with the related income included within net investment income in the Company’s consolidated

statements of operations. Interest expense on the collateral financing arrangement is included as a component of other expenses.

Interest expense related to this collateral financing arrangement was $20 million, $26 million and $35 million for the years ended December 31,

2013, 2012 and 2011, respectively.

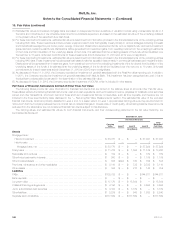

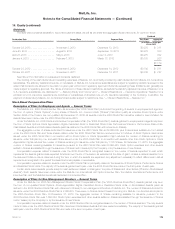

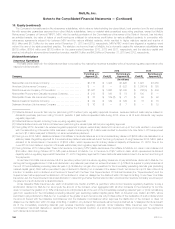

Associated with Secondary Guarantees

In May 2007, MetLife, Inc. and MRSC, a wholly-owned subsidiary of MetLife, Inc., entered into a 30-year collateral financing arrangement with an

unaffiliated financial institution that provides up to $3.5 billion of statutory reserve support for MRSC associated with reinsurance obligations under

174 MetLife, Inc.