MetLife 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

Value of business acquired (“VOBA”) is an intangible asset resulting from a business combination that represents the excess of book value over the

estimated fair value of acquired insurance, annuity, and investment-type contracts in-force at the acquisition date. The estimated fair value of the

acquired liabilities is based on projections, by each block of business, of future policy and contract charges, premiums, mortality and morbidity,

separate account performance, surrenders, operating expenses, investment returns, nonperformance risk adjustment and other factors. Actual

experience on the purchased business may vary from these projections.

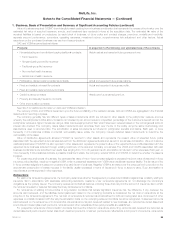

DAC and VOBA are amortized as follows:

Products: In proportion to the following over estimated lives of the contracts:

‰Nonparticipating and non-dividend-paying traditional contracts: Historic actual and expected future gross premiums.

‰Term insurance

‰Nonparticipating whole life insurance

‰Traditional group life insurance

‰Non-medical health insurance

‰Accident and health insurance

‰Participating, dividend-paying traditional contracts Actual and expected future gross margins.

‰Fixed and variable universal life contracts Actual and expected future gross profits.

‰Fixed and variable deferred annuity contracts

‰Credit insurance contracts Historic and future earned premium.

‰Property and casualty insurance contracts

‰Other short-duration contracts

See Note 5 for additional information on DAC and VOBA amortization.

The recovery of DAC and VOBA is dependent upon the future profitability of the related business. DAC and VOBA are aggregated in the financial

statements for reporting purposes.

The Company generally has two different types of sales inducements which are included in other assets: (i) the policyholder receives a bonus

whereby the policyholder’s initial account balance is increased by an amount equal to a specified percentage of the customer’s deposit; and (ii) the

policyholder receives a higher interest rate using a dollar cost averaging method than would have been received based on the normal general account

interest rate credited. The Company defers sales inducements and amortizes them over the life of the policy using the same methodology and

assumptions used to amortize DAC. The amortization of sales inducements is included in policyholder benefits and claims. Each year, or more

frequently if circumstances indicate a potential recoverability issue exists, the Company reviews deferred sales inducements to determine the

recoverability of the asset.

Value of distribution agreements acquired (“VODA”) is reported in other assets and represents the present value of expected future profits

associated with the expected future business derived from the distribution agreements acquired as part of a business combination. Value of customer

relationships acquired (“VOCRA”) is also reported in other assets and represents the present value of the expected future profits associated with the

expected future business acquired through existing customers of the acquired company or business. The VODA and VOCRA associated with past

business combinations are amortized over useful lives ranging from 10 to 40 years and such amortization is included in other expenses. Each year, or

more frequently if circumstances indicate a possible impairment exists, the Company reviews VODA and VOCRA to determine whether the asset is

impaired.

For certain acquired blocks of business, the estimated fair value of the in-force contract obligations exceeded the book value of assumed in-force

insurance policy liabilities, resulting in negative VOBA, which is presented separately from VOBA as an additional insurance liability. The fair value of the

in-force contract obligations is based on projections by each block of business. Negative VOBA is amortized over the policy period in proportion to the

approximate consumption of losses included in the liability usually expressed in terms of insurance in-force or account value. Such amortization is

recorded as a contra-expense in other expenses.

Reinsurance

For each of its reinsurance agreements, the Company determines whether the agreement provides indemnification against loss or liability relating to

insurance risk in accordance with applicable accounting standards. Cessions under reinsurance agreements do not discharge the Company’s

obligations as the primary insurer. The Company reviews all contractual features, including those that may limit the amount of insurance risk to which

the reinsurer is subject or features that delay the timely reimbursement of claims.

For reinsurance of existing in-force blocks of long-duration contracts that transfer significant insurance risk, the difference, if any, between the

amounts paid (received), and the liabilities ceded (assumed) related to the underlying contracts is considered the net cost of reinsurance at the

inception of the reinsurance agreement. The net cost of reinsurance is recorded as an adjustment to DAC and recognized as a component of other

expenses on a basis consistent with the way the acquisition costs on the underlying reinsured contracts would be recognized. Subsequent amounts

paid (received) on the reinsurance of in-force blocks, as well as amounts paid (received) related to new business, are recorded as ceded (assumed)

premiums; and ceded (assumed) premiums, reinsurance and other receivables (future policy benefits) are established.

For prospective reinsurance of short-duration contracts that meet the criteria for reinsurance accounting, amounts paid (received) are recorded as

ceded (assumed) premiums and ceded (assumed) unearned premiums. Unearned premiums are reflected as a component of premiums, reinsurance

MetLife, Inc. 93