MetLife 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

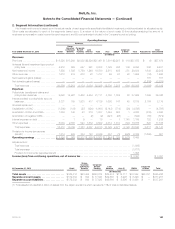

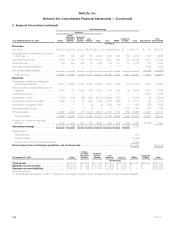

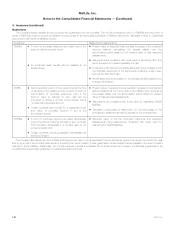

2. Segment Information (continued)

Revenues derived from any customer did not exceed 10% of consolidated premiums, universal life and investment-type product policy fees and

other revenues for the years ended December 31, 2013, 2012 and 2011.

The following table presents total premiums, universal life and investment-type product policy fees and other revenues associated with the

Company’s U.S. and foreign operations:

Years Ended December 31,

2013 2012 2011

(In millions)

U.S. ........................................................................................ $32,529 $31,500 $30,108

Foreign:

Japan ..................................................................................... 7,373 7,833 7,184

Other ..................................................................................... 9,143 9,104 9,407

Total .................................................................................... $49,045 $48,437 $46,699

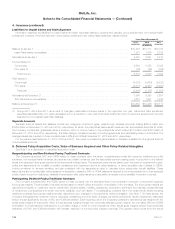

3. Acquisitions and Dispositions

2013 Acquisition

ProVida

Description of Transaction

On October 1, 2013, MetLife completed its previously announced acquisition of Administradora de Fondos de Pensiones Provida S.A.

(“ProVida”), the largest private pension fund administrator in Chile based on assets under management and number of pension fund contributors.

The acquisition of ProVida supports the Company’s growth strategy in emerging markets and further strengthens the Company’s overall position in

Chile. Pursuant to an agreement with Banco Bilbao Vizcaya Argentaria, S.A. and BBVA Inversiones Chile S.A. (together, “BBVA”), a subsidiary of

MetLife, Inc. acquired 64.32% of the outstanding shares of ProVida from BBVA and conducted a public cash tender offer, through which MetLife

acquired an additional 27.06% of the outstanding shares of ProVida. As a result, as of October 1, 2013, MetLife owned 91.38% of the total

outstanding shares of ProVida, for a total acquisition price of $1.9 billion.

MetLife’s accounting for pension products sold in foreign jurisdictions, where the sale and administration of those products are restricted by

government regulations to pension companies, is under an insurance company accounting model. ProVida’s assets under management meet the

qualifications for separate account presentation. As such, the portion of the assets representing pension participants’ funds are reported at

estimated fair value as separate account assets, with an equivalent amount reported as separate account liabilities. The fair value of separate

account assets and liabilities as of the acquisition date was $45.2 billion. ProVida’s mandatory ownership interest in the funds (the “Encaje

investment” ) representing a 1% interest in each of the funds offered, is accounted for as FVO Securities and reported in fair value option and trading

securities on the balance sheet. Direct and incremental costs resulting in successful sales are capitalized and amortized over the estimated gross

profits of the new business sold. Additionally, a portion of the revenue collected through fees on ProVida’s mandatory savings product are deferred

and recognized when future services are provided to participants who have stopped contributing to the savings product due to retirement, disability

or unemployment (“non-contributors”).

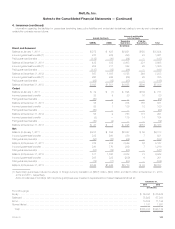

Allocation of Purchase Price

Of the $1.9 billion purchase price, $631 million and $159 million was allocated to the fair value of tangible assets acquired and liabilities

assumed, respectively, of which $451 million in assets represented the Encaje investment. Additionally, $941 million was allocated to VOBA, which

represented the value of the future profit margin from existing in-force pension participants (“acquired affiliates”) who are contributors as of the

acquisition date and is subject to amortization as a percentage of estimated gross profits from the acquired contributing affiliates over an estimated

weighted average period of 15 years. The amounts allocated to the ProVida trade name and goodwill were $179 million and $1.1 billion,

respectively, both of which are not subject to amortization. The value of the trade name represents the savings or relief from royalty costs due to

owning the ProVida name. Goodwill represents the expected future profits resulting from new sales after the acquisition date. The purchase price

was also allocated to a future service liability (“FSL”) of $589 million attributable to acquired affiliates who are currently not contributing or will become

non-contributors in the future. This liability represents the discounted future cost of servicing these affiliate accounts. The FSL will be releasedto

earnings over the non-contributor phase period based on the actual expenses incurred during the respective period for servicing non-contributors

from the acquired business. The allocated purchase price also included deferred tax assets and deferred tax liabilities of $118 million and

$224 million, respectively, which are attributable to the intangible assets and liabilities, excluding goodwill, established at the purchase date.No

portion of goodwill is expected to be deductible for tax purposes. The fair value of noncontrolling interests was $176 million, and is valued based

upon the offered public cash tender price for each outstanding share of ProVida not acquired by MetLife.

Revenues and Earnings of ProVida

Revenues and net income of $100 million and $42 million, respectively, resulting from the acquisition of ProVida since the acquisition date, are

included in the consolidated statement of operations within the Latin America segment for the year ended December 31, 2013.

Costs Related to Acquisition

The Company incurred $18 million of transaction costs for the year ended December 31, 2013. Such costs have been expensed as incurred

and are included in other expenses. These expenses have been recorded within Corporate & Other.

Integration-related expenses incurred for the year ended December 31, 2013 and included in other expenses were $12 million. Integration costs

represent incremental costs directly relating to integrating ProVida, including expenses for severance, consulting and the integration of information

systems. These expenses have been recorded within Corporate & Other.

106 MetLife, Inc.