MetLife 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

8. Investments (continued)

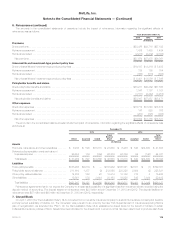

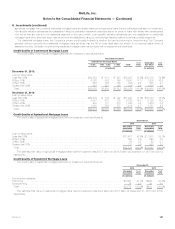

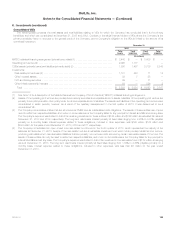

Past Due and Interest Accrual Status of Mortgage Loans

The Company has a high quality, well performing mortgage loan portfolio, with 99% of all mortgage loans classified as performing at both

December 31, 2013 and 2012. The Company defines delinquency consistent with industry practice, when mortgage loans are past due as follows:

commercial and residential mortgage loans — 60 days and agricultural mortgage loans — 90 days. The past due and accrual status of mortgage

loans at recorded investment, prior to valuation allowances, by portfolio segment, were as follows at:

Past Due Greater than 90 Days Past Due

and Still Accruing Interest Nonaccrual Status

December 31, 2013 December 31, 2012 December 31, 2013 December 31, 2012 December 31, 2013 December 31, 2012

(In millions)

Commercial .................. $ 12 $ 2 $12 $— $191 $ 84

Agricultural ................... 44 116 — 53 47 67

Residential ................... 79 29 — — 65 18

Total ...................... $135 $147 $12 $53 $303 $169

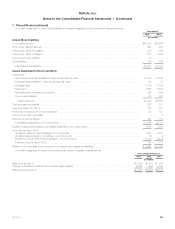

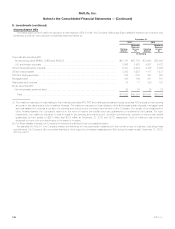

Impaired Mortgage Loans

Impaired mortgage loans held-for-investment, including those modified in a troubled debt restructuring, by portfolio segment, were as follows at and

for the years ended:

Loans with a Valuation Allowance Loans without

a Valuation Allowance All Impaired Loans

Unpaid

Principal

Balance Recorded

Investment Valuation

Allowances Carrying

Value

Unpaid

Principal

Balance Recorded

Investment

Unpaid

Principal

Balance Carrying

Value

Average

Recorded

Investment Interest

Income

(In millions)

December 31, 2013:

Commercial ..................... $214 $210 $ 58 $152 $299 $296 $513 $448 $526 $15

Agricultural ...................... 68 66 7 59 35 34 103 93 153 9

Residential ...................... 12 12 1 11 5 4 17 15 14 —

Total ......................... $294 $288 $ 66 $222 $339 $334 $633 $556 $693 $24

December 31, 2012:

Commercial ..................... $445 $436 $ 94 $342 $103 $103 $548 $445 $464 $14

Agricultural ...................... 110 107 21 86 79 74 189 160 204 8

Residential ...................... 13 13 2 11 — — 13 11 13 —

Total ......................... $568 $556 $117 $439 $182 $177 $750 $616 $681 $22

Unpaid principal balance is generally prior to any charge-offs. Interest income recognized is primarily cash basis income. The average recorded

investment for commercial, agricultural and residential mortgage loans was $313 million, $252 million and $23 million, respectively, for the year ended

December 31, 2011; and interest income recognized for commercial, agricultural and residential mortgage loans was $6 million, $5 million and $0,

respectively, for the year ended December 31, 2011.

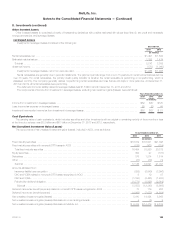

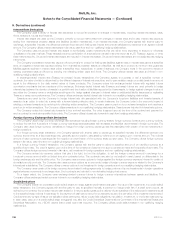

Mortgage Loans Modified in a Troubled Debt Restructuring

For a small portion of the mortgage loan portfolio, classified as troubled debt restructurings, concessions are granted related to borrowers

experiencing financial difficulties. Generally, the types of concessions include: reduction of the contractual interest rate, extension of the maturity date

at an interest rate lower than current market interest rates, and/or a reduction of accrued interest. The amount, timing and extent of the concession

granted is considered in determining any impairment or changes in the specific valuation allowance recorded with the restructuring. Through the

continuous monitoring process, a specific valuation allowance may have been recorded prior to the quarter when the mortgage loan is modified in a

troubled debt restructuring. Accordingly, the carrying value (after specific valuation allowance) before and after modification through a troubled debt

restructuring may not change significantly, or may increase if the expected recovery is higher than the pre-modification recovery assessment. The

number of mortgage loans and carrying value after specific valuation allowance of mortgage loans modified during the period in a troubled debt

restructuring were as follows:

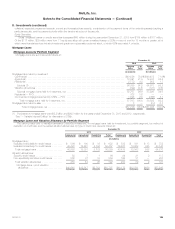

Years Ended December 31,

2013 2012

Number of

Mortgage

Loans Carrying Value after Specific

Valuation Allowance

Number of

Mortgage

Loans

Carrying Value after

Specific

Valuation Allowance

Pre-

Modification Post-

Modification Pre-

Modification Post-

Modification

(In millions) (In millions)

Commercial ........................................... 1 $49 $49 1 $222 $199

Agricultural ............................................ 3 28 28 5 17 16

Residential ............................................ 27 5 5 — — —

Total ............................................... 31 $82 $82 6 $239 $215

The Company had one residential mortgage loan modified in a troubled debt restructuring with a subsequent payment default with a carrying value

of less than $1 million at December 31, 2013. There were no mortgage loans modified in a troubled debt restructuring with a subsequent payment

default at December 31, 2012. Payment default is determined in the same manner as delinquency status as described above.

128 MetLife, Inc.