MetLife 2013 Annual Report Download - page 32

Download and view the complete annual report

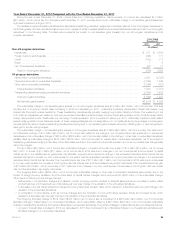

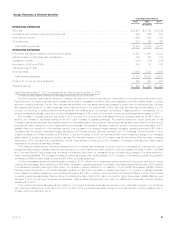

Please find page 32 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.‰Key equity index levels improved in 2012 but decreased in 2011, and equity volatility decreased in 2012 but generally increased in 2011. These

changes contributed to an unfavorable change in our freestanding derivatives and a favorable change in our embedded derivatives.

‰Changes in foreign currency exchange rates contributed to an unfavorable change in our freestanding derivatives and favorable changes in our

embedded derivatives.

The decrease in net investment losses primarily reflects a significant decrease in 2012 impairments, as compared to 2011 on fixed maturity

securities, primarily attributable to 2011 impairments on Greece sovereign debt securities, 2011 intent-to-sell OTTI on other sovereign debt due to the

repositioning of the acquired ALICO portfolio into longer duration and higher yielding investments, and 2011 intent-to-sell impairments related to the

Divested Businesses, partially offset by a decrease in gains on sales of real estate investments.

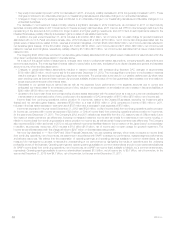

In addition, the year ended December 31, 2012 includes a $1.9 billion ($1.6 billion, net of income tax) non-cash charge for goodwill impairment

associated with our U.S. Retail annuities business. Also, 2012 includes a $1.2 billion ($753 million, net of income tax) charge associated with the

global review of assumptions related to DAC, reserves and certain intangibles, of which $526 million ($342 million, net of income tax) was reflected in

net derivative gains (losses). Of the $1.2 billion charge, $1.1 billion ($740 million, net of income tax) and $77 million ($50 million, net of income tax)

related to reserves and intangibles, respectively, partially offset by $57 million ($37 million, net of income tax) associated with a review of assumptions

related to DAC.

The foregoing $526 million loss recorded in net derivative gains (losses) associated with the global review of assumptions was included within the

other risks in embedded derivatives caption in the table above.

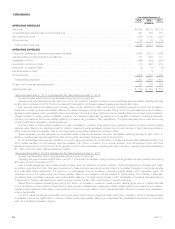

As a result of this global review of assumptions, changes were made to policyholder-related assumptions, company-specific assumptions and

economic assumptions. The most significant impacts related to policyholder surrenders, anticipated future dividend scales and general and separate

account returns, which are discussed below:

‰Changes to policyholder-related assumptions resulted in reserve increases with corresponding favorable DAC changes of approximately

$700 million ($455 million, net of income tax) for the year ended December 31, 2012. The most significant contributor to the increase in reserves

was the change in the assumptions regarding policyholder surrenders. The policyholder surrenders for our variable deferred annuity block have

been trending lower as there are fewer new annuity products available and as the value of the rider guarantees has increased over time relative to

actual equity performance and low interest rates.

‰Decreases to our general account earned rate as well as the expected future performance in the separate accounts due to current and

anticipated low interest rates for an extended period of time, resulted in an acceleration of amortization and an increase in insurance liabilities of

$240 million ($156 million, net of income tax).

‰Updates to the future cash flows and corresponding dividend scales associated with the closed block as a result of current and anticipated low

interest rates for an extended period of time, contributed to the acceleration of DAC amortization of $115 million ($75 million, net of income tax).

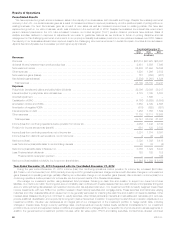

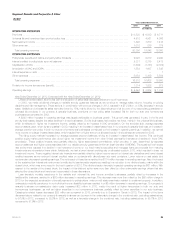

Income (loss) from continuing operations, before provision for income tax, related to the Divested Businesses, excluding net investment gains

(losses) and net derivative gains (losses), decreased $724 million to a loss of $659 million in 2012 compared to income of $65 million in 2011.

Included in this loss was a decrease in total revenues of $797 million and a decrease in total expenses of $73 million.

Income tax expense for the year ended December 31, 2012 was $128 million, or 9% of income (loss) from continuing operations before provision

for income tax, compared with income tax expense of $2.8 billion, or 30% of income (loss) from continuing operations before provision for income tax,

for the year ended December 31, 2011. The Company’s 2012 and 2011 effective tax rates differ from the U.S. statutory rate of 35% primarily due to

the impact of certain permanent tax differences, including non-taxable investment income and tax credits for investments in low income housing, in

relation to income (loss) from continuing operations before provision for income tax, as well as certain foreign permanent tax differences. The Company

also recorded a $324 million tax benefit in 2012 to reduce deferred income tax liabilities related to the conversion of the Japan branch to a subsidiary.

In addition, as previously mentioned, 2012 includes a $1.9 billion ($1.6 billion, net of income tax) non-cash charge for goodwill impairment. The

income tax benefit associated with this charge is limited to $247 million on the associated tax goodwill.

As more fully described in “— Non-GAAP and Other Financial Disclosures,” we use operating earnings, which does not equate to income (loss)

from continuing operations, net of income tax, as determined in accordance with GAAP, to analyze our performance, evaluate segment performance,

and allocate resources. We believe that the presentation of operating earnings and operating earnings available to common shareholders, as we

measure it for management purposes, enhances the understanding of our performance by highlighting the results of operations and the underlying

profitability drivers of the business. Operating earnings and operating earnings available to common shareholders should not be viewed as substitutes

for GAAP income (loss) from continuing operations, net of income tax, and GAAP net income (loss) available to MetLife, Inc.’s common shareholders,

respectively. Operating earnings available to common shareholders increased $1.0 billion, net of income tax, to $5.7 billion, net of income tax, for the

year ended December 31, 2012 from $4.7 billion, net of income tax, for the year ended December 31, 2011.

24 MetLife, Inc.