MetLife 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EMEA

Future policy benefits for this segment include unearned premium reserves for group life and credit insurance contracts. Future policy benefits are

also held for traditional life, endowment and annuity contracts with significant mortality risk and accident & health contracts. Factors impacting these

liabilities include sustained periods of lower yields than rates established at issue, lower than expected asset reinvestment rates, market volatility, actual

lapses resulting in lower than expected income, and actual mortality or morbidity resulting in higher than expected benefit payments. We mitigate our

risks by having premiums which are adjustable or cancellable in some cases, and by applying various ALM strategies.

Corporate & Other

Future policy benefits primarily include liabilities for quota-share reinsurance agreements for certain run-off LTC and workers’ compensation

business written by MICC. Additionally, future policy benefits includes liabilities for variable annuity guaranteed minimum benefits assumed froma

former operating joint venture in Japan that are accounted for as insurance.

Policyholder Account Balances

PABs are generally equal to the account value, which includes accrued interest credited, but excludes the impact of any applicable surrender charge

that may be incurred upon surrender. See “— Industry Trends — Impact of a Sustained Low Interest Rate Environment — Interest Rate Stress Scenario”

and “— Variable Annuity Guarantees.” See also Notes 1 and 4 of the Notes to the Consolidated Financial Statements for additional information.

Retail

Life & Other PABs are held for retained asset accounts, universal life policies and the fixed account of variable life insurance policies. For Annuities,

PABs are held for fixed deferred annuities, the fixed account portion of variable annuities, and non-life contingent income annuities. Interest is credited

to the policyholder’s account at interest rates we determine which are influenced by current market rates, subject to specified minimums. A sustained

low interest rate environment could negatively impact earnings as a result of the minimum credited rate guarantees present in most of these PABs. We

have various derivative positions, primarily interest rate floors, to partially mitigate the risks associated with such a scenario. Additionally, PABs are held

for variable annuity guaranteed minimum living benefits that are accounted for as embedded derivatives.

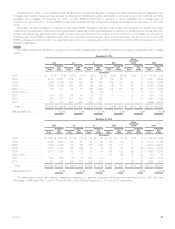

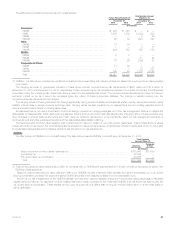

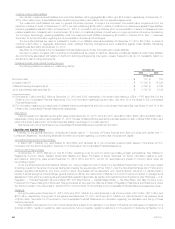

The table below presents the breakdown of account value subject to minimum guaranteed crediting rates for Retail:

December 31, 2013

Guaranteed Minimum Crediting Rate Account

Value(1)

Account

Value at

Guarantee(1)

(In millions)

Life & Other:

Greater than 0% but less than 2% ...................................................... $ 100 $ 100

Equal to 2% but less than 4% ......................................................... $11,402 $ 4,776

Equal to or greater than 4% ........................................................... $10,793 $ 6,428

Annuities:

Greater than 0% but less than 2% .................................................... $ 3,372 $ 2,249

Equal to 2% but less than 4% ....................................................... $33,448 $26,523

Equal to or greater than 4% ......................................................... $ 2,689 $ 2,640

(1) These amounts are not adjusted for policy loans.

As a result of acquisitions, we establish additional liabilities known as excess interest reserves for policies with credited rates in excess of market

rates as of the applicable acquisition dates. At December 31, 2013, excess interest reserves were $134 million and $367 million for Life & Other and

Annuities, respectively.

Group, Voluntary & Worksite Benefits

PABs in this segment are held for retained asset accounts, universal life policies, the fixed account of variable life insurance policies and specialized

life insurance products for benefit programs. PABs are credited interest at a rate we determine, which are influenced by current market rates. A

sustained low interest rate environment could negatively impact earnings as a result of the minimum credited rate guarantees present in most of these

PABs. We have various derivative positions, primarily interest rate floors, to partially mitigate the risks associated with such a scenario.

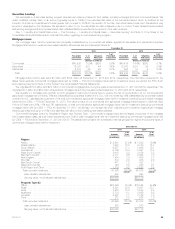

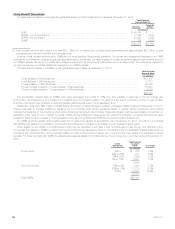

The table below presents the breakdown of account value subject to minimum guaranteed crediting rates for Group, Voluntary & Worksite Benefits:

December 31, 2013

Guaranteed Minimum Crediting Rate Account

Value(1)

Account

Value at

Guarantee(1)

(In millions)

Greater than 0% but less than 2% ......................................................... $5,043 $5,043

Equal to 2% but less than 4% ............................................................. $2,271 $2,253

Equal to or greater than 4% .............................................................. $ 627 $ 600

(1) These amounts are not adjusted for policy loans.

Corporate Benefit Funding

PABs in this segment are comprised of funding agreements. Interest crediting rates vary by type of contract, and can be fixed or variable. Variable

interest crediting rates are generally tied to an external index, most commonly (1-month or 3-month) LIBOR. We are exposed to interest rate risks, as

well as foreign currency exchange rate risk when guaranteeing payment of interest and return of principal at the contractual maturity date. We may

invest in floating rate assets or enter into receive-floating interest rate swaps, also tied to external indices, as well as caps, to mitigate the impact of

changes in market interest rates. We also mitigate our risks by applying various ALM strategies and seek to hedge all foreign currency exchange rate

risk through the use of foreign currency hedges, including cross currency swaps.

Latin America

PABs in this segment are held largely for investment type products and universal life products in Mexico, and deferred annuities in Brazil. Some of

the deferred annuities in Brazil are unit-linked-type funds that do not meet the GAAP definition of separate accounts. The rest of the deferred annuities

MetLife, Inc. 55