MetLife 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

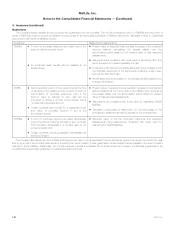

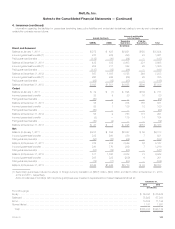

4. Insurance (continued)

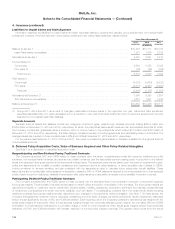

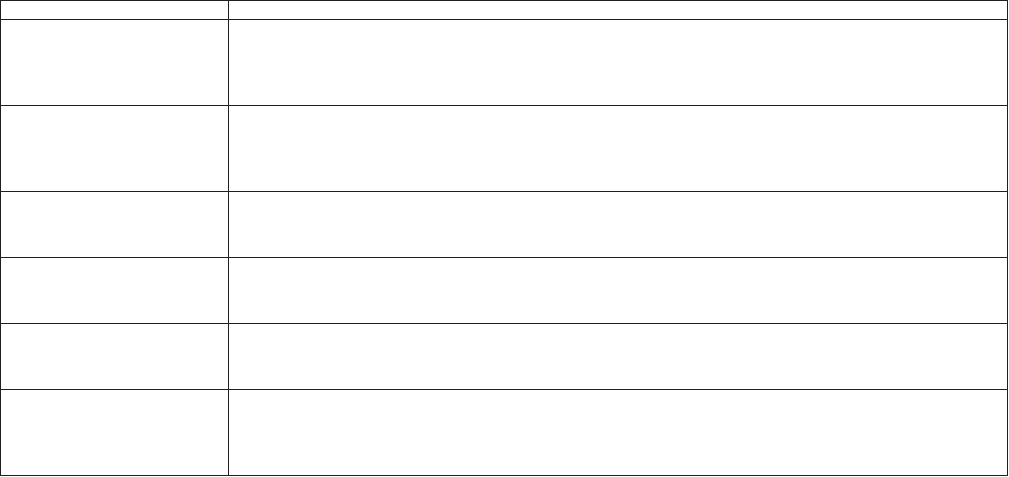

Future policy benefits are measured as follows:

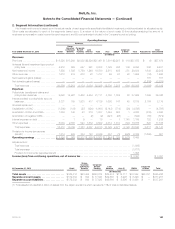

Product Type: Measurement Assumptions:

Participating life Aggregate of (i) net level premium reserves for death and endowment policy benefits (calculated based upon the

non-forfeiture interest rate, ranging from 3% to 7% for domestic business and 1% to 13% for international business,

and mortality rates guaranteed in calculating the cash surrender values described in such contracts); and (ii) the

liability for terminal dividends for domestic business.

Nonparticipating life Aggregate of the present value of expected future benefit payments and related expenses less the present value

of expected future net premiums. Assumptions as to mortality and persistency are based upon the Company’s

experience when the basis of the liability is established. Interest rate assumptions for the aggregate future policy

benefit liabilities range from 2% to 10% for domestic business and 1% to 13% for international business.

Individual and group

traditional fixed annuities after

annuitization

Present value of expected future payments. Interest rate assumptions used in establishing such liabilities range

from 1% to 11% for domestic business and 1% to 12% for international business.

Non-medical health

insurance

The net level premium method and assumptions as to future morbidity, withdrawals and interest, which provide a

margin for adverse deviation. Interest rate assumptions used in establishing such liabilities range from 4% to 7%

(primarily related to domestic business).

Disabled lives Present value of benefits method and experience assumptions as to claim terminations, expenses and interest.

Interest rate assumptions used in establishing such liabilities range from 2% to 8% for domestic business and 1%

to 9% for international business.

Property and casualty

insurance

The amount estimated for claims that have been reported but not settled and claims incurred but not reported are

based upon the Company’s historical experience and other actuarial assumptions that consider the effects of

current developments, anticipated trends and risk management programs, reduced for anticipated salvage and

subrogation.

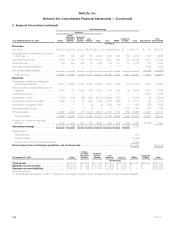

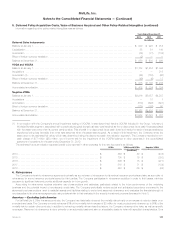

Participating business represented 5% and 6% of the Company’s life insurance in-force at December 31, 2013 and 2012, respectively. Participating

policies represented 19%, 20% and 21% of gross life insurance premiums for the years ended December 31, 2013, 2012 and 2011, respectively.

PABs are equal to: (i) policy account values, which consist of an accumulation of gross premium payments and investment performance; (ii) credited

interest, ranging from 1% to 13% for domestic business and 1% to 12% for international business, less expenses, mortality charges and withdrawals;

and (iii) fair value adjustments relating to business combinations.

MetLife, Inc. 109