MetLife 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

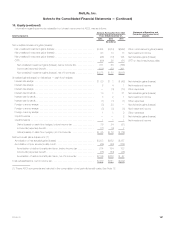

16. Equity (continued)

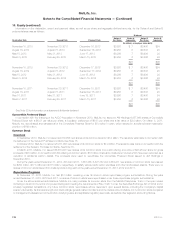

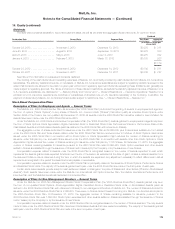

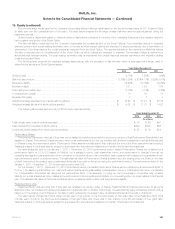

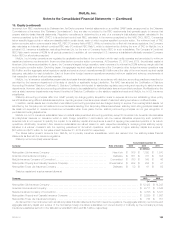

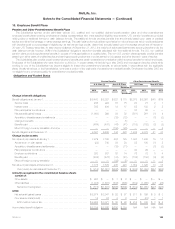

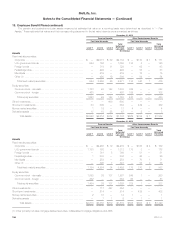

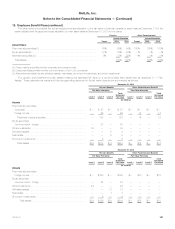

Information regarding amounts reclassified out of each component of AOCI, was as follows:

AOCI Components

Amounts Reclassified from AOCI Statement of Operations and

Comprehensive Income (Loss)

LocationYears Ended December 31,

2013 2012 2011

(In millions)

Net unrealized investment gains (losses):

Net unrealized investment gains (losses) ............................... $ 404 $ (34) $(952) Other net investment gains (losses)

Net unrealized investment gains (losses) ............................... 93 73 73 Net investment income

Net unrealized investment gains (losses) ............................... (26) (10) 144 Net derivative gains (losses)

OTTI ........................................................... (60) 29 (31) OTTI on fixed maturity securities

Net unrealized investment gains (losses), before income tax .............. 411 58 (766)

Income tax (expense) benefit ...................................... (136) (23) 261

Net unrealized investment gains (losses), net of income tax .............. $275 $ 35 $(505)

Unrealized gains (losses) on derivatives — cash flow hedges:

Interest rate swaps ............................................... $ 20 $ 1 $ (42) Net derivative gains (losses)

Interest rate swaps ............................................... 8 4 1 Net investment income

Interest rate swaps ............................................... — (3) (10) Other expenses

Interest rate forwards .............................................. 10 1 31 Net derivative gains (losses)

Interest rate forwards .............................................. 3 2 1 Net investment income

Interest rate forwards .............................................. (1) (1) (1) Other expenses

Foreign currency swaps ........................................... (3) 23 — Net derivative gains (losses)

Foreign currency swaps ........................................... (3) (5) (6) Net investment income

Foreign currency swaps ........................................... 1 1 2 Other expenses

Credit forwards .................................................. — — 2 Net derivative gains (losses)

Credit forwards .................................................. 1 1 1 Net investment income

Gains (losses) on cash flow hedges, before income tax ................. 36 24 (21)

Income tax (expense) benefit ...................................... (11) (8) 7

Gains (losses) on cash flow hedges, net of income tax ................. $ 25 $ 16 $ (14)

Defined benefit plans adjustment: (1)

Amortization of net actuarial gains (losses) ............................. $283 $252 $ 237

Amortization of prior service (costs) credit .............................. (69) (98) (104)

Amortization of defined benefit plan items, before income tax ............. 214 154 133

Income tax (expense) benefit ...................................... (75) (54) (46)

Amortization of defined benefit plan items, net of income tax ............. $139 $100 $ 87

Total reclassifications, net of income tax ................................. $439 $151 $(432)

(1) These AOCI components are included in the computation of net periodic benefit costs. See Note 18.

MetLife, Inc. 187