MetLife 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

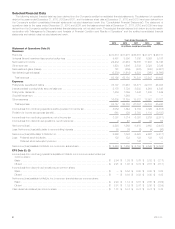

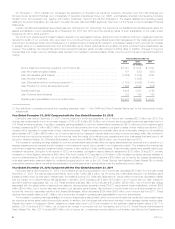

December 31,

2013 2012 2011 2010 2009

(In millions)

Balance Sheet Data (1)

Separate account assets (3) ................................................ $317,201 $ 235,393 $ 203,023 $ 183,138 $ 148,854

Total assets (3) .......................................................... $885,296 $ 836,781 $ 796,226 $ 728,249 $ 537,531

Policyholder liabilities and other policy-related balances (3), (4) ..................... $418,487 $ 438,191 $ 421,267 $ 399,135 $ 281,495

Short-term debt .......................................................... $ 175 $ 100 $ 686 $ 306 $ 912

Long-term debt (3) ....................................................... $ 18,653 $ 19,062 $ 23,692 $ 27,586 $ 13,220

Collateral financing arrangements ............................................ $ 4,196 $ 4,196 $ 4,647 $ 5,297 $ 5,297

Junior subordinated debt securities .......................................... $ 3,193 $ 3,192 $ 3,192 $ 3,191 $ 3,191

Separate account liabilities (3) ............................................... $317,201 $ 235,393 $ 203,023 $ 183,138 $ 148,854

Accumulated other comprehensive income (loss) ............................... $ 5,104 $ 11,397 $ 6,083 $ 1,145 $ (3,049)

Total MetLife, Inc.’s stockholders’ equity ....................................... $ 61,553 $ 64,453 $ 57,519 $ 46,853 $ 31,336

Noncontrolling interests .................................................... $ 543 $ 384 $ 370 $ 365 $ 371

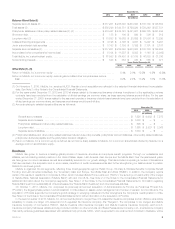

Years Ended December 31,

2013 2012 2011 2010 2009

Other Data (1), (5)

Return on MetLife, Inc.’s common equity ................................................ 5.4% 2.0% 12.2% 6.9% (9.9)%

Return on MetLife, Inc.’s common equity, excluding accumulated other comprehensive income

(loss) .......................................................................... 6.2% 2.4% 13.2% 7.0% (7.3)%

(1) On November 1, 2010, MetLife, Inc. acquired ALICO. Results of such acquisition are reflected in the selected financial data since the acquisition

date. See Note 3 of the Notes to the Consolidated Financial Statements.

(2) For the years ended December 31, 2012 and 2010 all shares related to the assumed issuance of shares in settlement of the applicable purchase

contracts have been excluded from the calculation of diluted earnings per common share, as these assumed shares are anti-dilutive. For the year

ended December 31, 2009, shares related to the assumed exercise or issuance of stock-based awards have been excluded from the calculation of

diluted earnings per common share, as these assumed shares would be anti-dilutive.

(3) Amounts relating to variable interest entities are as follows at:

December 31,

2013 2012 2011

(In millions)

General account assets ..................................................................... $ 7,525 $ 6,692 $ 7,273

Separate account assets .................................................................... $ 1,033 $ — $ —

Policyholder liabilities and other policy-related balances ............................................. $ 695 $ — $ —

Long-term debt ............................................................................ $ 1,868 $ 2,527 $ 3,068

Separate account liabilities ................................................................... $ 1,033 $ — $ —

(4) Policyholder liabilities and other policy-related balances include future policy benefits, policyholder account balances, other policy-related balances,

policyholder dividends payable and the policyholder dividend obligation.

(5) Return on MetLife, Inc.’s common equity is defined as net income (loss) available to MetLife, Inc.’s common shareholders divided by MetLife, Inc.’s

average common stockholders’ equity.

Business

MetLife has grown to become a leading global provider of insurance, annuities and employee benefit programs. Through our subsidiaries and

affiliates, we hold leading market positions in the United States, Japan, Latin America, Asia, Europe and the Middle East. Over the past several years,

we have grown our core businesses, as well as successfully executed on our growth strategy. This has included completing a number of transactions

that have resulted in the acquisition and, in some cases, divestiture of certain businesses while also further strengthening our balance sheet to position

MetLife for continued growth.

MetLife is organized into six segments, reflecting three broad geographic regions: Retail; Group, Voluntary & Worksite Benefits; Corporate Benefit

Funding; and Latin America (collectively, the “Americas”); Asia; and Europe, the Middle East and Africa (“EMEA”). In addition, the Company reports

certain of its results of operations in Corporate & Other, which includes MetLife Home Loans LLC (“MLHL”), the surviving, non-bank entity of the merger

of MetLife Bank, National Association (“MetLife Bank”) with and into MLHL. See Note 2 of the Notes to the Consolidated Financial Statements for

additional information about the Company’s segments. See Note 3 of the Notes to the Consolidated Financial Statements for information regarding

MetLife Bank’s exit from substantially all of its businesses (the “MetLife Bank Divestiture”) and other business activities.

On October 1, 2013, MetLife, Inc. completed its previously announced acquisition of Administradora de Fondos de Pensiones Provida S.A.

(“ProVida”), the largest private pension fund administrator in Chile based on assets under management and number of pension fund contributors. The

acquisition of ProVida supports the Company’s growth strategy in emerging markets and further strengthens the Company’s overall position in Chile.

See Note 3 of the Notes to the Consolidated Financial Statements for further information on the acquisition of ProVida.

In the second quarter of 2013, MetLife, Inc. announced its plans to merge three U.S.-based life insurance companies and an offshore reinsurance

subsidiary to create one larger U.S.-based and U.S.-regulated life insurance company (the “Mergers”). The companies to be merged are MetLife

Insurance Company of Connecticut (“MICC”), MetLife Investors USA Insurance Company and MetLife Investors Insurance Company, each a U.S.

insurance company that issues variable annuity products in addition to other products, and Exeter Reassurance Company, Ltd., a reinsurance company

that mainly reinsures guarantees associated with variable annuity products. MICC, which is expected to be renamed and domiciled in Delaware, will be

MetLife, Inc. 3