MetLife 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

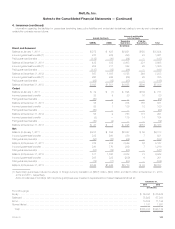

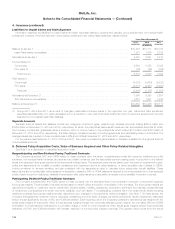

3. Acquisitions and Dispositions (continued)

2013 Dispositions

MetLife Bank

On January 11, 2013, MetLife Bank and MetLife, Inc. completed the sale of MetLife Bank’s $6.4 billion of deposits to GE Capital Retail Bank for

$6.4 billion in net consideration paid. On February 14, 2013, MetLife, Inc. announced that it had received the required approvals from both the Federal

Deposit Insurance Corporation and the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) to de-register as a bank

holding company. Subsequently, MetLife Bank terminated its deposit insurance and MetLife, Inc. de-registered as a bank holding company. In August

2013, MetLife Bank merged with and into MLHL, its former subsidiary, with MLHL as the surviving, non-bank entity.

MetLife Bank has sold or has otherwise committed to exit substantially all of its operations. In conjunction with exiting MetLife Bank’s

businesses (the “MetLife Bank Divestiture”), for the years ended December 31, 2013, 2012 and 2011, the Company recorded net losses of $115

million, $163 million and $212 million, respectively, net of income tax, related to the gain on disposal of the depository business, the loss on disposal

of mortgage servicing rights (“MSRs”), gains (losses) on securities and mortgage loans sold and other costs related to MetLife Bank’s businesses. The

Company expects to incur additional charges of $20 million to $45 million, exclusive of incremental legal settlements, related to the MetLife Bank

Divestiture. See Note 21.

Total assets and liabilities recorded in the consolidated balance sheets related to MetLife Bank’s businesses were $446 million and $282 million at

December 31, 2013, respectively and $7.8 billion and $6.8 billion at December 31, 2012, respectively. Each of the businesses that were exited as

part of the MetLife Bank Divestiture could not be separated from the rest of the operations since the Company did not separately manage the

businesses as a reportable segment, operating segment, or reporting unit. As a result, the businesses have not been reported as discontinued

operations in the consolidated financial statements.

MetLife Bank has historically taken advantage of collateralized borrowing opportunities with the Federal Home Loan Bank (“FHLB”) of New York

(“FHLB of NY”). In January 2012, MetLife Bank discontinued taking advances from the FHLB of NY. In April 2012, MetLife Bank transferred cash to

Metropolitan Life Insurance Company (“MLIC”) related to $3.8 billion of outstanding advances which had been included in long-term debt, and MLIC

assumed the associated obligations under terms similar to those of the transferred advances by issuing funding agreements which are included in

PABs. See Note 12.

Caribbean Business

In 2011, the Company entered into an agreement to sell its insurance operations in the Caribbean region, Panama and Costa Rica (the “Caribbean

Business”). As a result of this agreement, the Company recorded a loss of $21 million, net of income tax, for the year ended December 31, 2011.

During 2012, regulatory approvals were obtained for a majority of the jurisdictions and closings were finalized with the buyer, resulting in a gain of $5

million, net of income tax. Sales in the remaining jurisdictions closed in 2013, resulting in a loss of $2 million, net of income tax. These amounts are

reflected in net investment gains (losses) within the consolidated statements of operations. The results of the Caribbean Business are included in

continuing operations.

2012 Disposition

American Life U.K. Assumption Reinsurance

During July 2012, the Company completed the disposal, through a ceded assumption reinsurance agreement, of certain closed blocks of

business in the United Kingdom (“U.K.”), to a third party. Simultaneously, the Company recaptured from the third party the indemnity reinsurance

agreement related to this business, previously reinsured as of July 1, 2011. These transactions resulted in a decrease in both insurance and

reinsurance assets and liabilities of $4.1 billion. The Company recognized a gain of $25 million, net of income tax, on the transactions for the year

ended December 31, 2012, which was recorded in net investment gains (losses) in the consolidated statement of operations.

2011 Dispositions

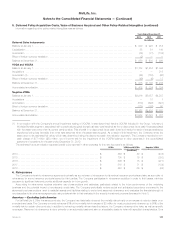

MSI MetLife

On April 1, 2011, the Company sold its 50% interest in Mitsui Sumitomo MetLife Insurance Co., Ltd. (“MSI MetLife”), a Japan domiciled life

insurance company, to its joint venture partner, MS&AD Insurance Group Holdings, Inc. (“MS&AD”), for $269 million (¥22.5 billion) in cash

consideration, less $4 million (¥310 million) to reimburse MS&AD for specific expenses incurred related to the transaction. The accumulated other

comprehensive losses in the foreign currency translation adjustment component of equity resulting from the hedges of the Company’s investment in

the joint venture of $46 million, net of income tax, were released upon sale but did not impact net income for the year ended December 31, 2011 as

such losses were considered in the overall impairment evaluation of the investment prior to the sale. During the year ended December 31, 2011, the

Company recorded a loss of $57 million, net of income tax, in net investment gains (losses) within the consolidated statements of operations related to

the sale. The Company’s operating earnings relating to its investment in MSI MetLife were included in the Asia segment.

MetLife Taiwan

On November 1, 2011, the Company sold its wholly-owned subsidiary, MetLife Taiwan Insurance Company Limited (“MetLife Taiwan”) for

$180 million in cash consideration. The net assets sold were $282 million, resulting in a loss on disposal of $64 million, net of income tax, recorded in

discontinued operations, for the year ended December 31, 2011. Income (loss) from the operations of MetLife Taiwan of $20 million, net of income

tax, for the year ended December 31, 2011, was also recorded in discontinued operations. See “ — Discontinued Operations” below.

MetLife, Inc. 107