MetLife 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

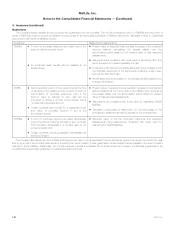

4. Insurance (continued)

Based on the type of guarantee, the Company defines net amount at risk as listed below. These amounts include direct and assumed business, but

exclude offsets from hedging or reinsurance, if any.

Variable Annuity Guarantees

In the Event of Death

Defined as the death benefit less the total contract account value, as of the balance sheet date. It represents the amount of the claim that the

Company would incur if death claims were filed on all contracts on the balance sheet date and includes any additional contractual claims associated

with riders purchased to assist with covering income taxes payable upon death.

At Annuitization

Defined as the amount (if any) that would be required to be added to the total contract account value to purchase a lifetime income stream, based

on current annuity rates, equal to the minimum amount provided under the guaranteed benefit. This amount represents the Company’s potential

economic exposure to such guarantees in the event all contractholders were to annuitize on the balance sheet date, even though the contracts

contain terms that allow annuitization of the guaranteed amount only after the 10th anniversary of the contract, which not all contractholders have

achieved.

Two Tier Annuities

Defined as the excess of the upper tier, adjusted for a profit margin, less the lower tier, as of the balance sheet date. These contracts apply a lower

rate on funds if the contractholder elects to surrender the contract for cash and a higher rate if the contractholder elects to annuitize.

Universal and Variable Life Contracts

Defined as the guarantee amount less the account value, as of the balance sheet date. It represents the amount of the claim that the Company

would incur if death claims were filed on all contracts on the balance sheet date.

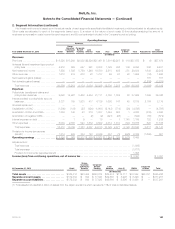

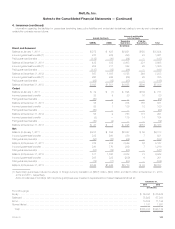

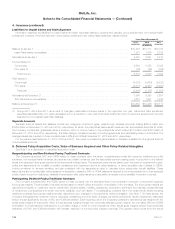

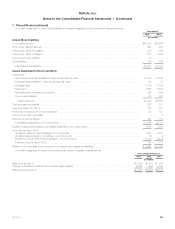

Information regarding the types of guarantees relating to annuity contracts and universal and variable life contracts was as follows at:

December 31,

2013 2012

In the

Event of Death At

Annuitization In the

Event of Death At

Annuitization

(In millions)

Annuity Contracts (1)

Variable Annuity Guarantees

Total contract account value (2) .......................................... $201,395 $100,527 $184,095 $ 89,137

Separate account value ................................................ $164,500 $ 96,459 $143,893 $ 84,354

Net amount at risk .................................................... $ 4,203 $ 1,219 $ 9,501 $ 4,593

Average attained age of contractholders ................................... 63years 63 years 62 years 62 years

Two Tier Annuities

General account value ................................................. N/A $ 880 N/A $ 848

Net amount at risk .................................................... N/A $ 234 N/A $ 232

Average attained age of contractholders ................................... N/A 50years N/A 51 years

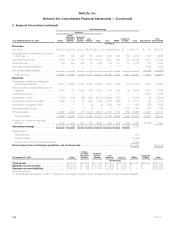

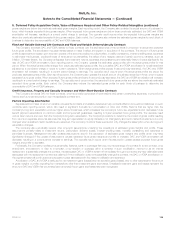

December 31,

2013 2012

Secondary

Guarantees Paid-Up

Guarantees Secondary

Guarantees Paid-Up

Guarantees

(In millions)

Universal and Variable Life Contracts (1)

Account value (general and separate account) .............................. $ 16,048 $ 3,700 $ 14,256 $ 3,828

Net amount at risk .................................................... $185,920 $ 21,737 $189,197 $ 23,276

Average attained age of policyholders ..................................... 55years 60 years 54 years 60 years

(1) The Company’s annuity and life contracts with guarantees may offer more than one type of guarantee in each contract. Therefore, the amounts

listed above may not be mutually exclusive.

(2) Includes amounts, which are not reported in the consolidated balance sheets, from assumed reinsurance of certain variable annuity products from

the Company’s former operating joint venture in Japan.

112 MetLife, Inc.