MetLife 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

8. Investments (continued)

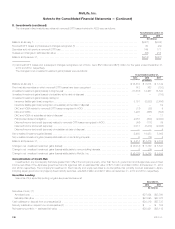

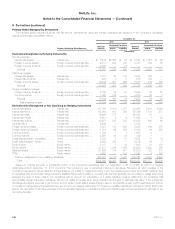

Consolidated VIEs

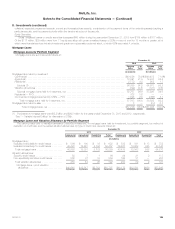

The following table presents the total assets and total liabilities relating to VIEs for which the Company has concluded that it is the primary

beneficiary and which are consolidated at December 31, 2013 and 2012. Creditors or beneficial interest holders of VIEs where the Company is the

primary beneficiary have no recourse to the general credit of the Company, as the Company’s obligation to the VIEs is limited to the amount of its

committed investment.

December 31,

2013 2012

Total

Assets Total

Liabilities Total

Assets Total

Liabilities

(In millions)

MRSC (collateral financing arrangement (primarily securities)) (1) ............................. $ 3,440 $ — $ 3,439 $ —

Operating joint venture (2) ........................................................... 2,095 1,777 — —

CSEs (assets (primarily loans) and liabilities (primarily debt)) (3) ............................... 1,630 1,457 2,730 2,545

Investments:

Real estate joint ventures (4) ....................................................... 1,181 443 11 14

Other invested assets ............................................................ 82 7 85 —

FVO and trading securities ........................................................ 69 — 71 —

Other limited partnership interests ................................................... 61 — 356 8

Total ....................................................................... $ 8,558 $ 3,684 $ 6,692 $ 2,567

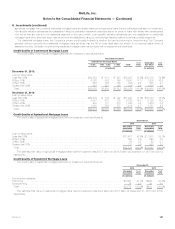

(1) See Note 13 for a description of the MetLife Reinsurance Company of South Carolina (“MRSC”) collateral financing arrangement.

(2) Assets of the operating joint venture are primarily fixed maturity securities and separate account assets. Liabilities of the operating joint venture are

primarily future policy benefits, other policyholder funds and separate account liabilities. The assets and liabilities of the operating joint venture were

consolidated in earlier periods; however, as a result of the quarterly reassessment in the first quarter of 2013, it was determined to be a

consolidated VIE.

(3) The Company consolidates entities that are structured as CMBS and as collateralized debt obligations. The assets of these entities can only be

used to settle their respective liabilities, and under no circumstances is the Company liable for any principal or interest shortfalls should any arise.

The Company’s exposure was limited to that of its remaining investment in these entities of $154 million and $168 million at estimated fair value at

December 31, 2013 and 2012, respectively. The long-term debt bears interest primarily at fixed rates ranging from 2.25% to 5.57%, payable

primarily on a monthly basis. Interest expense related to these obligations, included in other expenses, was $122 million, $163 million and

$324 million for the years ended December 31, 2013, 2012 and 2011 respectively.

(4) The Company consolidated an open ended core real estate fund formed in the fourth quarter of 2013, which represented the majority of the

balances at December 31, 2013. Assets of the real estate fund are a real estate investment trust which holds primarily traditional core income-

producing real estate which has associated liabilities that are primarily non-recourse debt secured by certain real estate assets of the fund. The

assets of these entities can only be used to settle their respective liabilities, and under no circumstances is the Company liable for any principal or

interest shortfalls should any arise. The Company’s exposure was limited to that of its investment in the real estate fund of $178 million at carrying

value at December 31, 2013. The long-term debt bears interest primarily at fixed rates ranging from 1.39% to 4.45%, payable primarily on a

monthly basis. Interest expense related to these obligations, included in other expenses, was less than $1 million for the year ended

December 31, 2013.

MetLife, Inc. 133