MetLife 2013 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

16. Equity (continued)

accrued interest on its junior subordinated debentures through the most recent interest payment date, it may not repurchase or pay dividends on its

common stock or other capital stock (including the preferred stock), subject to certain exceptions. The junior subordinated debentures provide that

MetLife may, at its option and provided that certain conditions are met, defer payment of interest without giving rise to an event of default for periodsof

up to 10 years (although after five years MetLife, Inc. would be obligated to use commercially reasonable efforts to sell equity securities to raise

proceeds to pay the interest), with no limitation on the number of deferral periods that MetLife, Inc. may begin, so long as all accrued and unpaid

interest is paid with respect to prior deferral periods. If MetLife, Inc. were to elect to defer payments of interest, the “dividend stopper” provisions in the

junior subordinated debentures would thus prevent MetLife, Inc. from repurchasing or paying dividends on its common stock or other capital stock

(including the preferred stock) during the period of deferral, subject to exceptions.

In addition, the preferred stock and the junior subordinated debentures contain provisions that would automatically suspend the payment of

preferred stock dividends and junior subordinated debenture interest payments if MetLife, Inc. fails to meet certain risk based capital ratio, net income

and stockholders’ equity tests at specified times. In such cases, however, MetLife would be permitted to make the payments if it were able to utilize a

prescribed alternative payment mechanism. As a result of the suspension of these payments, the “dividend stopper” provisions would come into effect.

MetLife, Inc. is a party to certain RCCs which limit its ability to eliminate these restrictions through the repayment, redemption or purchase of

preferred stock or junior subordinated debentures by requiring MetLife, subject to certain limitations, to receive cash proceeds during a specified period

from the sale of specified replacement securities prior to any such repayment, redemption or purchase. See “— Preferred Stock” for a description of

such covenants in effect with respect to the preferred stock, and Note 14 for a description of such covenants in effect with respect to junior

subordinated debentures.

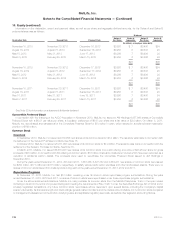

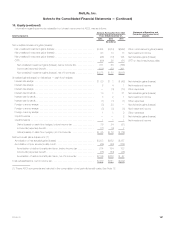

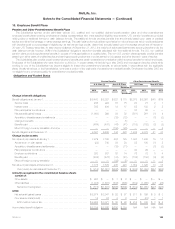

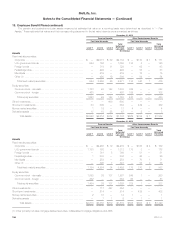

Accumulated Other Comprehensive Income (Loss)

Information regarding changes in the balances of each component of AOCI attributable to MetLife, Inc., net of income tax, was as follows:

Unrealized

Investment Gains

(Losses), Net of

Related Offsets (1)

Unrealized

Gains (Losses)

on Derivatives

Foreign

Currency

Translation

Adjustments

Defined

Benefit

Plans

Adjustment Total

(In millions)

Balance at December 31, 2010 ..................................... $ 3,161 $ (39) $ (528) $(1,449) $ 1,145

OCI before reclassifications ........................................ 7,637 1,595 42 (893) 8,381

Income tax expense (benefit) ....................................... (2,604) (557) (162) 312 (3,011)

OCI before reclassifications, net of income tax ........................ 8,194 999 (648) (2,030) 6,515

Amounts reclassified from AOCI ..................................... (766) (21) — 133 (654)

Income tax expense (benefit) ....................................... 261 7 — (46) 222

Amounts reclassified from AOCI, net of income tax .................... (505) (14) — 87 (432)

Balance at December 31, 2011 ..................................... 7,689 985 (648) (1,943) 6,083

OCI before reclassifications ........................................ 9,321 (262) (134) (996) 7,929

Income tax expense (benefit) ....................................... (3,457) 92 249 350 (2,766)

OCI before reclassifications, net of income tax ........................ 13,553 815 (533) (2,589) 11,246

Amounts reclassified from AOCI ..................................... 58 24 — 154 236

Income tax expense (benefit) ....................................... (23) (8) — (54) (85)

Amounts reclassified from AOCI, net of income tax .................... 35 16 — 100 151

Balance at December 31, 2012 ..................................... 13,588 831 (533) (2,489) 11,397

OCI before reclassifications ........................................ (8,487) (937) (937) 1,078 (9,283)

Income tax expense (benefit) ....................................... 2,807 312 (189) (379) 2,551

OCI before reclassifications, net of income tax ........................ 7,908 206 (1,659) (1,790) 4,665

Amounts reclassified from AOCI ..................................... 411 36 — 214 661

Income tax expense (benefit) ....................................... (136) (11) — (75) (222)

Amounts reclassified from AOCI, net of income tax .................... 275 25 — 139 439

Balance at December 31, 2013 ..................................... $ 8,183 $ 231 $(1,659) $(1,651) $ 5,104

(1) See Note 8 for information on offsets to investments related to insurance liabilities, DAC and VOBA and the policyholder dividend obligation.

186 MetLife, Inc.