MetLife 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Competitive Pressures

The life insurance industry remains highly competitive. The product development and product life cycles have shortened in many product segments,

leading to more intense competition with respect to product features. Larger companies have the ability to invest in brand equity, product development,

technology and risk management, which are among the fundamentals for sustained profitable growth in the life insurance industry. In addition, several of

the industry’s products can be quite homogeneous and subject to intense price competition. Sufficient scale, financial strength and financial flexibility are

becoming prerequisites for sustainable growth in the life insurance industry. Larger market participants tend to have the capacity to invest in additional

distribution capability and the information technology needed to offer the superior customer service demanded by an increasingly sophisticated industry

client base. We believe that the continued volatility of the financial markets, its impact on the capital position of many competitors, and subsequent

actions by regulators and rating agencies have altered the competitive environment. In particular, we believe that these factors have highlighted financial

strength as the most significant differentiator from the perspective of some customers and certain distributors. We believe the Company is well

positioned to compete in this environment.

Regulatory Developments

The U.S. life insurance industry is regulated primarily at the state level, with some products and services also subject to federal regulation. As life

insurers introduce new and often more complex products, regulators refine capital requirements and introduce new reserving standards for the life

insurance industry. Regulations recently adopted or currently under review can potentially impact the statutory reserve and capital requirements of the

industry. In addition, regulators have undertaken market and sales practices reviews of several markets or products, including equity-indexed annuities,

variable annuities and group products, as well as reviews of the utilization of affiliated captive reinsurers or off-shore entities to reinsure insurance risks.

The regulation of the global financial services industry has received renewed scrutiny as a result of the disruptions in the financial markets. Significant

regulatory reforms have been recently adopted and additional reforms proposed, and these or other reforms could be implemented. See “Business —

U.S. Regulation,” “Business — International Regulation,” “Risk Factors — Regulatory and Legal Risks — Our Insurance and Brokerage Businesses Are

Highly Regulated, and Changes in Regulation and in Supervisory and Enforcement Policies May Reduce Our Profitability and Limit Our Growth.” “Risk

Factors — Risks Related to Our Business — Our Statutory Life Insurance Reserve Financings May Be Subject to Cost Increases and New Financings

May Be Subject to Limited Market Capacity,” and “Risk Factors — Regulatory and Legal Risks — Changes in U.S. Federal and State Securities Laws

and Regulations, and State Insurance Regulations Regarding Suitability of Annuity Product Sales, May Affect Our Operations and Our Profitability” in the

2013 Form 10-K. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), which was signed by President

Obama in July 2010, effected the most far-reaching overhaul of financial regulation in the U.S. in decades. The full impact of Dodd-Frank on us will

depend on the numerous rulemaking initiatives required or permitted by Dodd-Frank which are in various stages of implementation, many of which are

not likely to be completed for some time.

Mortgage and Foreclosure-Related Exposures

MetLife, through its affiliate, MetLife Bank, was engaged in the origination, sale and servicing of forward and reverse residential mortgage loans since

2008. In 2012, MetLife Bank exited the business of originating residential mortgage loans. In 2012 and 2013, MetLife Bank sold its residential mortgage

servicing portfolios, and in 2013 wound down its mortgage servicing business. See Note 3 of the Notes to the Consolidated Financial Statements for

information regarding the MetLife Bank Divestiture. In August 2013, MetLife Bank merged with and into MLHL, its former subsidiary, with MLHL as the

surviving, non-bank entity.

In conjunction with the sales of residential mortgage loans and servicing portfolios, MetLife Bank made representations and warranties that the loans

sold met certain requirements (relating, for example, to the underwriting and origination of the loans), and that the loans were serviced in accordance

with investor guidelines. Notwithstanding its exit from the origination and servicing businesses, MetLife Bank remained obligated to repurchase loans or

compensate for losses upon demand due to alleged defects by MetLife Bank or its predecessor servicers in past servicing of the loans and material

representations made in connection with MetLife Bank’s sale of the loans. Estimation of repurchase liability arising from breaches of origination

representations and warranties requires considerable management judgment. Management considers the level of outstanding unresolved repurchase

demands and challenges to mortgage insurance, probable future demands in light of historical experience and changes in general economic conditions

such as unemployment and the housing market, and the likelihood of recovery from indemnifications made to MetLife Bank relating to loans that MetLife

Bank acquired rather than originated. Reserves for representation and warranty repurchases and indemnifications were $104 million and $95 million at

December 31, 2013 and December 31, 2012, respectively. Reserves for estimated future losses due to alleged deficiencies on loans originated and

sold, as well as servicing of the loans including servicing acquired, are estimated based on unresolved claims and projected losses under investor

servicing contracts where MetLife Bank’s past actions or inactions are likely to result in missing certain stipulated investor timelines. Reserves for

servicing defects were $46 million and $54 million at December 31, 2013 and December 31, 2012, respectively. Management is satisfied that

adequate provision has been made in the Company’s consolidated financial statements for those representation and warranty obligations that are

currently probable and reasonably estimable.

State and federal regulatory and law enforcement authorities have initiated various inquiries, investigations or examinations of alleged irregularities in

the foreclosure practices of the residential mortgage servicing industry. Mortgage servicing practices have also been the subject of Congressional

attention. Authorities have publicly stated that the scope of the investigations extends beyond foreclosure documentation practices to include mortgage

loan modification and loss mitigation practices. See Note 21 of the Notes to the Consolidated Financial Statements for further information regarding our

mortgage and foreclosure-related exposures.

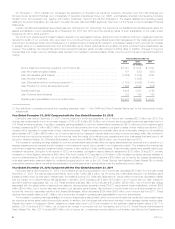

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to adopt accounting policies and make estimates and

assumptions that affect amounts reported in the Consolidated Financial Statements. For a discussion of our significant accounting policies, see Note 1

of the Notes to the Consolidated Financial Statements. The most critical estimates include those used in determining:

(i) liabilities for future policyholder benefits and the accounting for reinsurance;

(ii) capitalization and amortization of DAC and the establishment and amortization of VOBA;

(iii) estimated fair values of investments in the absence of quoted market values;

(iv) investment impairments;

(v) estimated fair values of freestanding derivatives and the recognition and estimated fair value of embedded derivatives requiring bifurcation;

(vi) measurement of goodwill and related impairment;

(vii) measurement of employee benefit plan liabilities;

MetLife, Inc. 13