MetLife 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

8. Investments (continued)

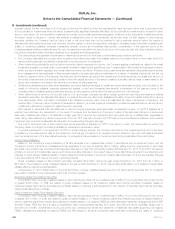

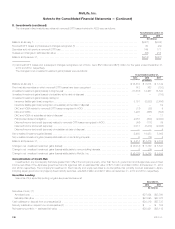

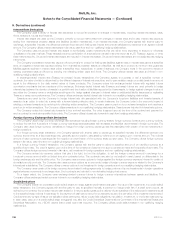

The following table presents information about PCI investments acquired during the periods indicated:

Years Ended December 31,

2013 2012 2013 2012

Fixed Maturity Securities Mortgage Loans

(In millions)

Contractually required payments (including interest) ............................................ $1,872 $2,083 $— $—

Cash flows expected to be collected (1) ..................................................... $1,446 $1,524 $— $—

Fair value of investments acquired ......................................................... $ 978 $ 991 $— $—

(1) Represents undiscounted principal and interest cash flow expectations, at the date of acquisition.

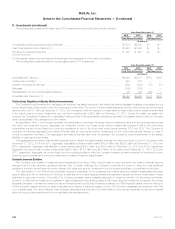

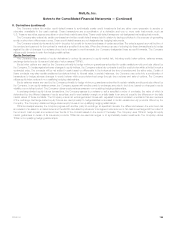

The following table presents activity for the accretable yield on PCI investments:

Years Ended December 31,

2013 2012 2013 2012

Fixed Maturity Securities Mortgage Loans

(In millions)

Accretable yield, January 1, .............................................................. $2,665 $2,311 $184 $254

Investments purchased .................................................................. 468 533 — —

Accretion recognized in earnings .......................................................... (260) (203) (87) (71)

Disposals ............................................................................ (152) (102) — —

Reclassification (to) from nonaccretable difference ............................................. 25 126 (23) 1

Accretable yield, December 31, ........................................................... $2,746 $2,665 $ 74 $184

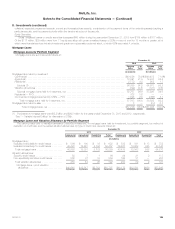

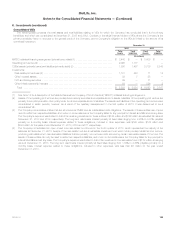

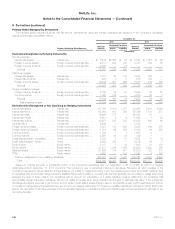

Collectively Significant Equity Method Investments

The Company holds investments in real estate joint ventures, real estate funds and other limited partnership interests consisting of leveraged buy-out

funds, hedge funds, private equity funds, joint ventures and other funds. The portion of these investments accounted for under the equity method had a

carrying value of $12.1 billion at December 31, 2013. The Company’s maximum exposure to loss related to these equity method investments is limited

to the carrying value of these investments plus unfunded commitments of $4.0 billion at December 31, 2013. Except for certain real estate joint

ventures, the Company’s investments in real estate funds and other limited partnership interests are generally of a passive nature in that the Company

does not participate in the management of the entities.

As described in Note 1, the Company generally records its share of earnings in its equity method investments using a three-month lag methodology

and within net investment income. Aggregate net investment income from these equity method investments exceeded 10% of the Company’s

consolidated pre-tax income (loss) from continuing operations for two of the three most recent annual periods: 2013 and 2012. The Company is

providing the following aggregated summarized financial data for such equity method investments, for the most recent annual periods, in order to

provide comparative information. This aggregated summarized financial data does not represent the Company’s proportionate share of the assets,

liabilities, or earnings of such entities.

The aggregated summarized financial data presented below reflects the latest available financial information and is as of, and for, the years ended

December 31, 2013, 2012 and 2011. Aggregate total assets of these entities totaled $303.4 billion and $285.2 billion at December 31, 2013 and

2012, respectively. Aggregate total liabilities of these entities totaled $29.7 billion and $28.8 billion at December 31, 2013 and 2012, respectively.

Aggregate net income (loss) of these entities totaled $26.3 billion, $17.9 billion and $9.7 billion for the years ended December 31, 2013, 2012 and

2011, respectively. Aggregate net income (loss) from the underlying entities in which the Company invests is primarily comprised of investment income,

including recurring investment income and realized and unrealized investment gains (losses).

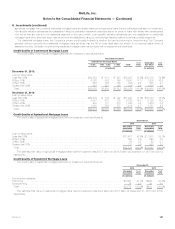

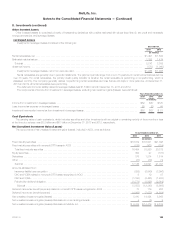

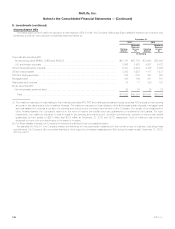

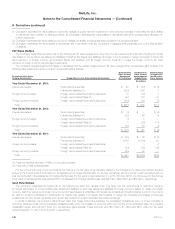

Variable Interest Entities

The Company has invested in certain structured transactions (including CSEs), formed trusts to invest proceeds from certain collateral financing

arrangements and has insurance operations that are VIEs. In certain instances, the Company holds both the power to direct the most significant

activities of the entity, as well as an economic interest in the entity and, as such, is deemed to be the primary beneficiary or consolidator of the entity.

The determination of the VIE’s primary beneficiary requires an evaluation of the contractual and implied rights and obligations associated with each

party’s relationship with or involvement in the entity, an estimate of the entity’s expected losses and expected residual returns and the allocation of such

estimates to each party involved in the entity. The Company generally uses a qualitative approach to determine whether it is the primary beneficiary.

However, for VIEs that are investment companies or apply measurement principles consistent with those utilized by investment companies, the primary

beneficiary is based on a risks and rewards model and is defined as the entity that will absorb a majority of a VIE’s expected losses, receive a majority of

a VIE’s expected residual returns if no single entity absorbs a majority of expected losses, or both. The Company reassesses its involvement with VIEs

on a quarterly basis. The use of different methodologies, assumptions and inputs in the determination of the primary beneficiary could have a material

effect on the amounts presented within the consolidated financial statements.

132 MetLife, Inc.