MetLife 2013 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

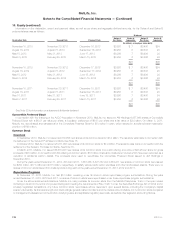

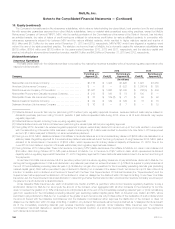

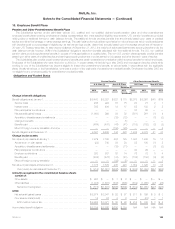

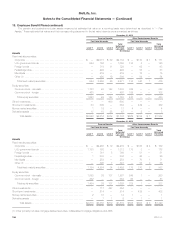

17. Other Expenses

Information on other expenses was as follows:

Years Ended December 31,

2013 2012 2011

(In millions)

Compensation ................................................................................ $ 5,108 $ 5,562 $ 5,287

Pension, postretirement and postemployment benefit costs ............................................. 488 428 463

Commissions ................................................................................. 5,428 5,909 6,378

Volume-related costs ........................................................................... 842 599 335

Interest credited to bank deposits ................................................................. 2 78 95

Capitalization of DAC ........................................................................... (4,786) (5,289) (5,558)

Amortization of DAC and VOBA ................................................................... 3,550 4,199 4,898

Amortization of negative VOBA .................................................................... (579) (622) (697)

Interest expense on debt and debt issuance costs .................................................... 1,282 1,356 1,629

Premium taxes, licenses and fees ................................................................. 658 677 633

Professional services ........................................................................... 1,454 1,664 1,597

Rent and related expenses, net of sublease income ................................................... 376 422 426

Other (1) ..................................................................................... 2,779 2,772 3,051

Total other expenses ......................................................................... $16,602 $17,755 $18,537

(1) See Note 19 for information on the Japan income tax refund included in other expenses for the year ended December 31, 2013.

Capitalization of DAC and Amortization of DAC and VOBA

See Note 5 for additional information on DAC and VOBA including impacts of capitalization and amortization. See also Note 7 for a description of the

DAC amortization impact associated with the closed block.

Interest Expense on Debt and Debt Issuance Costs

See Notes 12, 13, 14 and 15 for attribution of interest expense by debt issuance. Interest expense on debt and debt issuance costs includes

interest expense related to CSEs. See Note 8.

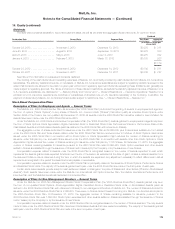

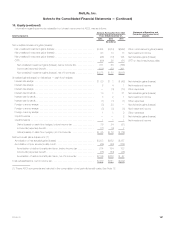

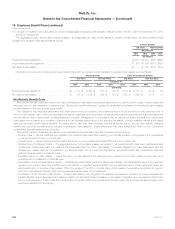

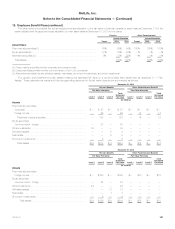

Restructuring Charges

The Company commenced in 2012 an enterprise-wide strategic initiative. This global strategy focuses on leveraging the Company’s scale to

improve the value it provides to customers and shareholders in order to reduce costs, enhance revenues, achieve efficiencies and reinvest in its

technology, platforms and functionality to improve its current operations and develop new capabilities.

These restructuring charges are included in other expenses. As the expenses relate to an enterprise-wide initiative, they are reported in Corporate &

Other. Estimated restructuring costs may change as management continues to execute this enterprise-wide strategic initiative. Such restructuring

charges were as follows:

Years Ended December 31,

2013 2012

Severance

Lease and

Asset

Impairment Total Severance

Lease and

Asset

Impairment Total

(In millions)

Balance at January 1, ................................................. $ 23 $— $ 23 $ — $— $ —

Restructuring charges ................................................. 99 16 115 141 18 159

Cash payments ...................................................... (82) (10) (92) (118) (18) (136)

Balance at December 31, .............................................. $ 40 $ 6 $ 46 $ 23 $ — $ 23

Total restructuring charges incurred since inception of initiative ................. $240 $ 34 $274 $ 141 $ 18 $ 159

Management anticipates further restructuring charges including severance, as well as lease and asset impairments, through the year ending

December 31, 2015. However, such restructuring plans were not sufficiently developed to enable management to make an estimate of such

restructuring charges at December 31, 2013.

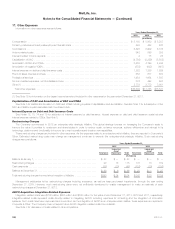

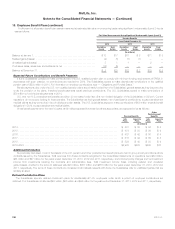

ALICO Acquisition Integration-Related Expenses

Integration-related costs were $138 million, $305 million and $362 million for the years ended December 31, 2013, 2012 and 2011, respectively.

Integration-related costs represent costs directly related to integrating ALICO, including expenses for consulting and the integration of information

systems. Such costs have been expensed as incurred and, as the integration of ALICO is an enterprise-wide initiative, these expenses are reported in

Corporate & Other. The Company does not expect future ALICO integration-related costs to be material.

See Note 3 for discussion of costs related to other acquisitions.

188 MetLife, Inc.