MetLife 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

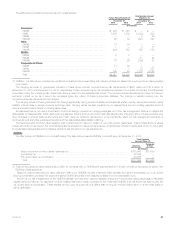

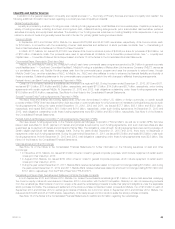

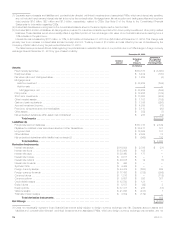

Amounts presented represent the estimated cash payments undiscounted as to interest and including assumptions related to the receipt of future

premiums and deposits; withdrawals, including unscheduled or partial withdrawals; policy lapses; surrender charges; annuitization; mortality; future

interest credited; policy loans and other contingent events as appropriate for the respective product type. Such estimated cash payments are also

presented net of estimated future premiums on policies currently in-force and gross of any reinsurance recoverable. For obligations denominated in

foreign currencies, cash payments have been estimated using current spot foreign currency rates.

The sum of the estimated cash flows shown for all years of $294.0 billion exceeds the liability amount of $212.9 billion included on the

consolidated balance sheets principally due to (i) the time value of money, which accounts for a substantial portion of the difference; (ii) differences in

assumptions, between the date the liabilities were initially established and the current date; and (iii) liabilities related to accounting conventions, or

which are not contractually due, which are excluded.

Payables for Collateral Under Securities Loaned and Other Transactions

We have accepted cash collateral in connection with securities lending and derivatives. As the securities lending transactions expire within the

next year and the timing of the return of the derivatives collateral is uncertain, the return of the collateral has been included in the one year or less

category in the table. We also held non-cash collateral, which is not reflected as a liability in the consolidated balance sheets of $2.3 billion at

December 31, 2013.

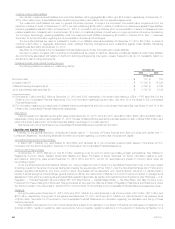

Debt

Amounts presented for debt include short-term debt, long-term debt, collateral financing arrangements and junior subordinated debt securities,

the total of which differs from the total of the corresponding amounts presented on the consolidated balance sheet due to the following: (i) the

amounts presented herein do not include premiums or discounts upon issuance or purchase accounting fair value adjustments; (ii) the amounts

presented herein include future interest on such obligations for the period from January 1, 2014 through maturity; and (iii) the amounts presented

herein do not include $1.5 billion at December 31, 2013 of long-term debt relating to CSEs — FVO as such debt does not represent our contractual

obligations. Future interest on variable rate debt was computed using prevailing rates at December 31, 2013 and, as such, does not consider the

impact of future rate movements. Future interest on fixed rate debt was computed using the stated rate on the obligations for the period from

January 1, 2014 through maturity, except with respect to junior subordinated debt which was computed using the stated rates through the scheduled

redemption dates as it is our expectation that such obligations will be redeemed at that time. Inclusion of interest payments on junior subordinated

debt securities through the final maturity dates would increase the contractual obligation by $7.7 billion. Pursuant to collateral financing arrangements,

MetLife, Inc. may be required to deliver cash or pledge collateral to the respective unaffiliated financial institutions. See Note 13 of the Notes to the

Consolidated Financial Statements.

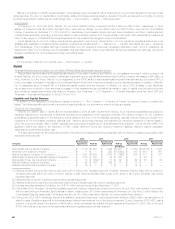

Investment Commitments

To enhance the return on our investment portfolio, we commit to lend funds under mortgage loans, bank credit facilities, bridge loans and private

corporate bond investments and we commit to fund partnership investments. In the table, the timing of the funding of mortgage loans and private

corporate bond investments is based on the expiration dates of the corresponding commitments. As it relates to commitments to fund partnerships

and bank credit facilities, we anticipate that these amounts could be invested any time over the next five years; however, as the timing of the fulfillment

of the obligation cannot be predicted, such obligations are presented in the one year or less category. Commitments to fund bridge loans are short-

term obligations and, as a result, are presented in the one year or less category. See Note 21 of the Notes to the Consolidated Financial Statements

and “— Off-Balance Sheet Arrangements.”

Operating Leases

As a lessee, we have various operating leases, primarily for office space. Contractual provisions exist that could increase or accelerate those lease

obligations presented, including various leases with early buyouts and/or escalation clauses. However, the impact of any such transactions would not

be material to our financial position or results of operations. See Note 21 of the Notes to the Consolidated Financial Statements.

Other

Other obligations presented are principally comprised of amounts due under reinsurance agreements, payables related to securities purchased

but not yet settled, securities sold short, accrued interest on debt obligations, estimated fair value of derivative obligations, deferred compensation

arrangements, guaranty liabilities, the estimated fair value of forward stock purchase contracts, and accruals and accounts payable due under

contractual obligations, which are all reported in other liabilities on the consolidated balance sheets. If the timing of any of these other obligations is

sufficiently uncertain, the amounts are included within the one year or less category. Items reported in other liabilities on the consolidated balance

sheets that were excluded from the table represent accounting conventions or are not liabilities due under contractual obligations. Unrecognized tax

benefits and related accrued interest totaling $1.0 billion was excluded as the timing of payment cannot be reliably determined.

Separate account liabilities are excluded as they are fully funded by cash flows from the corresponding separate account assets and are set equal

to the estimated fair value of separate account assets.

We also enter into agreements to purchase goods and services in the normal course of business; however, such amounts are excluded as these

purchase obligations were not material to our consolidated results of operations or financial position at December 31, 2013.

Additionally, we have agreements in place for services we conduct, generally at cost, between subsidiaries relating to insurance, reinsurance,

loans and capitalization. Intercompany transactions have been eliminated in consolidation. Intercompany transactions among insurance subsidiaries

and affiliates have been approved by the appropriate insurance regulators as required.

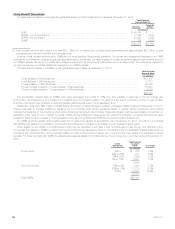

MetLife, Inc.

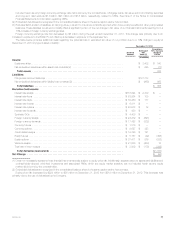

Liquidity Management and Capital Management

Liquidity and capital are managed to preserve stable, reliable and cost-effective sources of cash to meet all current and future financial obligations

and are provided by a variety of sources, including a portfolio of liquid assets, a diversified mix of short- and long-term funding sources from the

wholesale financial markets and the ability to borrow through credit and committed facilities. Liquidity is monitored through the use of internal liquidity risk

metrics, including the composition and level of the liquid asset portfolio, timing differences in short-term cash flow obligations, access to the financial

markets for capital and debt transactions and exposure to contingent draws on MetLife, Inc.’s liquidity. MetLife, Inc. is an active participant in theglobal

financial markets through which it obtains a significant amount of funding. These markets, which serve as cost-effective sources of funds, are critical

components of MetLife, Inc.’s liquidity and capital management. Decisions to access these markets are based upon relative costs, prospective views of

balance sheet growth and a targeted liquidity profile and capital structure. A disruption in the financial markets could limit MetLife, Inc.’s access to liquidity.

MetLife, Inc. 67