MetLife 2013 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

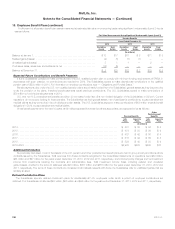

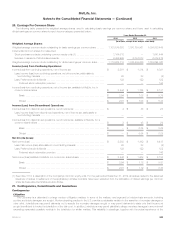

18. Employee Benefit Plans (continued)

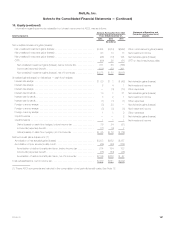

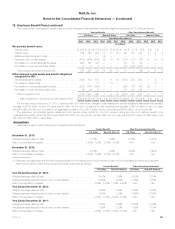

The table below summarizes the actual weighted average allocation of the fair value of total plan assets by asset class at December 31 for the

years indicated and the approved target allocation by major asset class at December 31, 2013 for the plans:

Pension Other Postretirement

Actual Allocation Actual Allocation

Target 2013 2012 Target 2013 2012

Asset Class:

Fixed maturity securities (1) ............................................. 76% 50% 54% 100% 100% 100%

Equity securities (2) ................................................... 17% 33% 24% —% —% —%

Alternative securities (3) ............................................... 7% 17% 22% —% —% —%

Total assets ...................................................... 100% 100% 100% 100%

(1) Fixed maturity securities include corporate and foreign bonds.

(2) Equity securities primarily include common stock of non-U.S. companies.

(3) Alternative securities include derivative assets, real estate, short-term investments, and other investments.

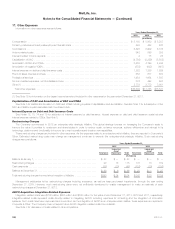

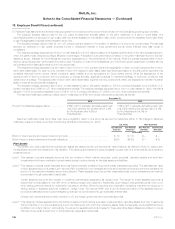

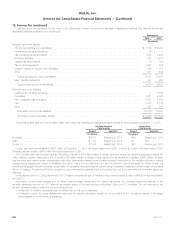

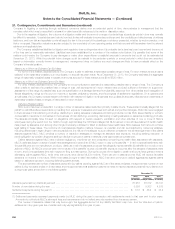

The pension and postretirement plan assets measured at estimated fair value on a recurring basis were determined as described in “— Plan

Assets.” These estimated fair values and their corresponding placement in the fair value hierarchy are summarized as follows:

December 31, 2013

Pension Benefits Other Postretirement Benefits

Fair Value Hierarchy Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Fixed maturity securities:

Corporate ................................................ $— $ 27 $— $ 27 $— $— $— $—

Foreign bonds ............................................. — 96 — 96 — 14 — 14

Total fixed maturity securities ................................ — 123 — 123 — 14 — 14

Equity securities:

Common stock - foreign ..................................... — 83 — 83 — — — —

Other investments ............................................ 32 — — 32 — — — —

Derivative assets ............................................. — — 2 2 — — — —

Real estate ................................................. — — 2 2 — — — —

Short-term investments ........................................ — 6 — 6 — — — —

Total assets ............................................. $32 $212 $ 4 $248 $— $14 $— $14

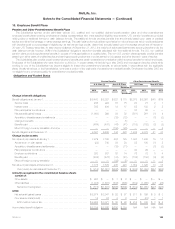

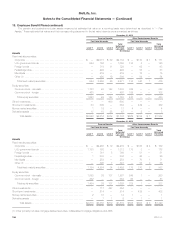

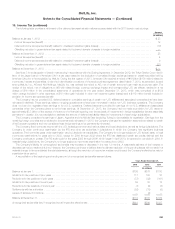

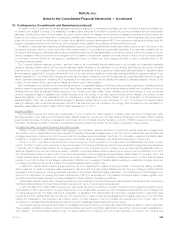

December 31, 2012

Pension Benefits Other Postretirement Benefits

Fair Value Hierarchy Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets

Fixed maturity securities:

Foreign bonds ............................................. $— $120 $— $120 $— $15 $— $15

Equity securities:

Common stock - foreign ..................................... — 54 — 54 — — — —

Other investments ............................................ 24 — — 24 — — — —

Derivative assets ............................................. — — 13 13 — — — —

Real estate ................................................. — — 7 7 — — — —

Short-term investments ........................................ — 6 — 6 — — — —

Total assets ........................................... $24 $180 $20 $224 $— $15 $— $15

MetLife, Inc. 197