MetLife 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

reporting unit is less than its carrying value as a basis for determining whether it needs to perform the quantitative two-step goodwill impairment test.

Only if an entity determines, based on qualitative assessment, that it is more likely than not that a reporting unit’s fair value is less than its carrying value

will it be required to calculate the fair value of the reporting unit. The qualitative assessment is optional and the Company is permitted to bypass it for any

reporting unit in any period and begin its impairment analysis with the quantitative calculation. The Company is permitted to perform the qualitative

assessment in any subsequent period.

Effective January 1, 2012, the Company adopted new guidance regarding fair value measurements that establishes common requirements for measuring

fair value and for disclosing information about fair value measurements in accordance with GAAP and International Financial Reporting Standards. Some of the

amendments clarify the Financial Accounting Standards Board’s (“FASB”) intent on the application of existing fair value measurement requirements. Other

amendments change a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements. The adoption did

not have a material impact on the Company’s financial statements other than the expanded disclosures in Note 10.

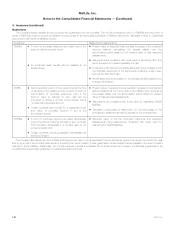

Future Adoption of New Accounting Pronouncements

In March 2013, the FASB issued new guidance regarding foreign currency (Accounting Standards Update (“ASU”) 2013-05, Foreign Currency

Matters (Topic 830): Parent’s Accounting for the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets

within a Foreign Entity or of an Investment in a Foreign Entity), effective prospectively for fiscal years and interim reporting periods within those years

beginning after December 15, 2013. The amendments require an entity that ceases to have a controlling financial interest in a subsidiary or group of

assets within a foreign entity to apply the guidance in Subtopic 830-30, Foreign Currency Matters — Translation of Financial Statements, to release any

related cumulative translation adjustment into net income. Accordingly, the cumulative translation adjustment should be released into net income only if

the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had

resided. For an equity method investment that is a foreign entity, the partial sale guidance in section 830-30-40, Derecognition, still applies. As such, a

pro rata portion of the cumulative translation adjustment should be released into net income upon a partial sale of such an equity method investment.

The Company does not expect the adoption of this new guidance to have a material impact on its financial statements.

In February 2013, the FASB issued new guidance regarding liabilities (ASU 2013-04, Liabilities (Topic 405): Obligations Resulting from Joint and

Several Liability Arrangements for Which the Total Amount of the Obligation Is Fixed at the Reporting Date), effective retrospectively for fiscal years

beginning after December 15, 2013 and interim periods within those years. The amendments require an entity to measure obligations resulting from joint

and several liability arrangements for which the total amount of the obligation within the scope of the guidance is fixed at the reporting date, as the sum of

the amount the reporting entity agreed to pay on the basis of its arrangement among its co-obligors and any additional amount the reporting entity expects

to pay on behalf of its co-obligors. In addition, the amendments require an entity to disclose the nature and amount of the obligation, as well as other

information about the obligation. The Company does not expect the adoption of this new guidance to have a material impact on its financial statements.

In July 2011, the FASB issued new guidance on other expenses (ASU 2011-06, Other Expenses (Topic 720): Fees Paid to the Federal Government

by Health Insurers), effective for calendar years beginning after December 31, 2013. The objective of this standard is to address how health insurers

should recognize and classify in their income statements fees mandated by the Patient Protection and Affordable Care Act, as amended by the Health

Care and Education Reconciliation Act. The amendments in this standard specify that the liability for the fee should be estimated and recorded in full

once the entity provides qualifying health insurance in the applicable calendar year in which the fee is payable with a corresponding deferred cost that is

amortized to expense using the straight-line method of allocation unless another method better allocates the fee over the calendar year that it is payable.

In accordance with the adoption of the new accounting pronouncement on January 1, 2014, the Company recorded $57 million in other liabilities, and a

corresponding deferred cost, in other assets.

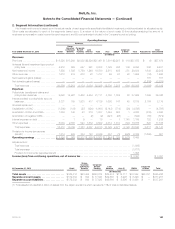

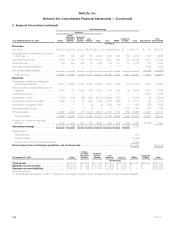

2. Segment Information

MetLife is organized into six segments, reflecting three broad geographic regions: Retail; Group, Voluntary & Worksite Benefits; Corporate Benefit

Funding; and Latin America (collectively, the “Americas”); Asia; and EMEA. In addition, the Company reports certain of its results of operations in

Corporate & Other, which includes MetLife Home Loans LLC (“MLHL”), the surviving, non-bank entity of the merger of MetLife Bank, National

Association (“MetLife Bank”) with and into MLHL (see Note 3) and other business activities.

Americas

The Americas consists of the following segments:

Retail

The Retail segment offers a broad range of protection products and services and a variety of annuities to individuals and employees of corporations

and other institutions, and is organized into two businesses: Life & Other and Annuities. Life & Other insurance products and services include variable

life, universal life, term life and whole life products. Additionally, through broker-dealer affiliates, the Company offers a full range of mutual funds and

other securities products. Life & Other products and services also include individual disability income products and personal lines property & casualty

insurance, including private passenger automobile, homeowners and personal excess liability insurance. Annuities includes a variety of variable and

fixed annuities which provide for both asset accumulation and asset distribution needs.

Group, Voluntary & Worksite Benefits

The Group, Voluntary & Worksite Benefits segment offers a broad range of protection products and services to individuals and corporations, as well

as other institutions and their respective employees, and is organized into two businesses: Group and Voluntary & Worksite. Group insurance products

and services include variable life, universal life and term life products. Group insurance products and services also include dental, group short- and

long-term disability and accidental death & dismemberment coverages. The Voluntary & Worksite business includes personal lines property & casualty

insurance, including private passenger automobile, homeowners and personal excess liability insurance offered to employees on a voluntary basis. The

Voluntary & Worksite business also includes LTC, prepaid legal plans and critical illness products.

100 MetLife, Inc.